- March 29, 2022

- Posted by: CFA Society India

- Category:Careers, ExPress

Written By

Vaishnavi Raichur

FUTURE OF INVESTMENT

ADVENT OF ESG INVESTING AND SUSTAINABLE FINANCE

Introduction

The inclusion of environmental, social and governance (ESG) factors in investment analysis is one of the most significant upcoming trends in the financial services industry. Although ESG investing has existed in the form of faith-based investing, such as Christian or Islamic funds, since the 17th century, ESG investing gained widespread momentum in the wake of climate change awareness. The signing of the Paris agreement in 2015, where the United Nations (UN) member countries agreed to limit an annual rise in temperatures to well below 2 degrees Celsius by the end of the century, led to an increase in adoption of ESG factors into investment analysis. This increased adoption, coupled with increasing regulations and efforts towards standardization of ESG reporting requirements, are expected to drive further ESG integration into investment analyses in the near future.

Expected impact of ESG investing in the future

1. ESG integration into traditional approach:

Aside from negative screening, ESG integration has been the biggest strategy through which ESG factors have been considered in investment analyses across asset classes. ESG integration has taken the form of scorecards and ratings, to determine which ESG factors are material to be considered for a particular asset class and / or company. ESG factors have also been integrated into traditional discounted cash flow (DCF) models and valuation of bonds. Further, risk assessments are performed in the form of scenario analyses and other quantitative ratios (such as the calculation of carbon pricing measures).

Currently, ESG factors are integrated into investment analyses to satisfy client mandates and to conform to reporting regulations. Increasing significance of ESG factors in enhancing financial returns and reducing risk of assets, is expected to lead to a more positive perception towards integrating ESG amongst investors and asset managers. As a result, one can expect the adoption of ESG factors to become a norm in regular investment analyses in the near future.

2. Shift to long-termism from short-termism:

Short-termism, in the context of trading, refers to the practice by investors to trade in assets on the basis of short-term momentum and price movements. In his review of equity markets in the United Kingdom (UK) conducted by Professor John Kay in 2012, he concluded that, while shorttermism may provide attractive returns to investors, it often leads to greater focus on quarterly returns, and may discourage companies from adopting research and development (R&D) investments in projects that continue for years.

However, with the advent of ESG investing, there may be a shift in perception of investors, from short-termism to long-termism. ESG factors focus essentially on long-term goals, whether it is a target to reduce carbon emissions or the progress of a particular firm with regards to improvement in working conditions of employees. Asset owners like pension funds may choose to highlight long-termism in their investment mandates, which in turn will lead asset managers to place greater importance on long-term value of assets.

3. Increased regulation and standardization:

At present, there exist a number of reporting initiatives regarding ESG factors. The Global Reporting Initiative (GRI) provides guidance for all stakeholders, including investors, for the disclosure of ESG factors. The Value Reporting Foundation (VRF) has been formed recently, with the objective of providing a comprehensive reporting framework of sustainability requirements for investors and corporates.

Apart from reporting, there have also been other initiatives for providing support and guidelines to stakeholders for ESG transparency. The most noteworthy are:

• Task Force on Climate-related Financial Disclosures (TCFD): The TCFD is an effort to operationalise the goals of the Paris Agreement for businesses. It encourages companies to disclose risks and opportunities in line with climate change across governance, strategy, risk management and metrics and targets.

• Sustainable Finance Disclosure Regulation (SFDR): In March 2021, the European Union (EU) incorporated the SFDR, to support institutional asset owners and retail clients to compare and track sustainability characteristics of investments by standardising sustainability disclosures.

The incorporation of the VRF and the SFDR are pivotal efforts towards standardisation of ESG requirements. Currently, ESG reporting is done with an alliance to one of multiple reporting initiatives and analyses are carried out according to individual discretion by asset managers. Greater standardisation will enable information surrounding ESG factors to be less fragmented and more holistic, which will in turn lead to increased transparency.

4. Increased ESG integration into private markets:

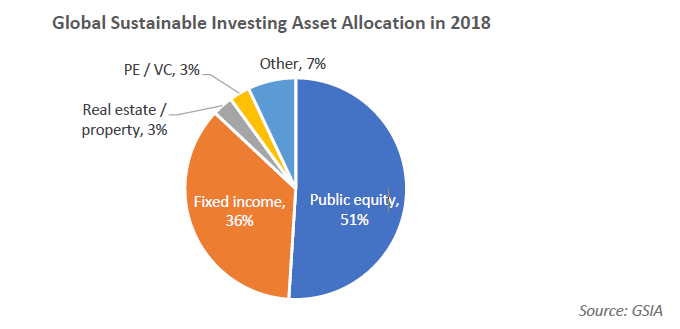

According to a review conducted by the Global Sustainable Investment Alliance (GSIA), as of 2018, public equity and fixed income comprised the largest share in sustainable investing, each contributing 51.0% and 36.0% respectively. Given the rise of ESG reporting requirements and the transition to clean energy in public companies, as well as the increase in fixed income instruments like green bonds, ESG integration in public markets has seen greater traction in

recent years.

As opposed to this, real estate and private equity / venture capital markets contributed only 3.0% each to global sustainable investing. This denotes that there is untapped opportunity in private markets for sustainable investing. With the rise in building of sustainable buildings and infrastructure across the world, and the increased adoption of ESG metrics by private equity and venture capital firms in their investment considerations, ESG investing is expected to gain more significance in private markets.

5. Increased focus of ESG in emerging markets

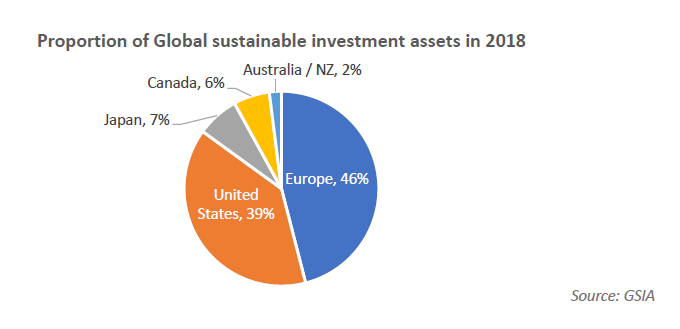

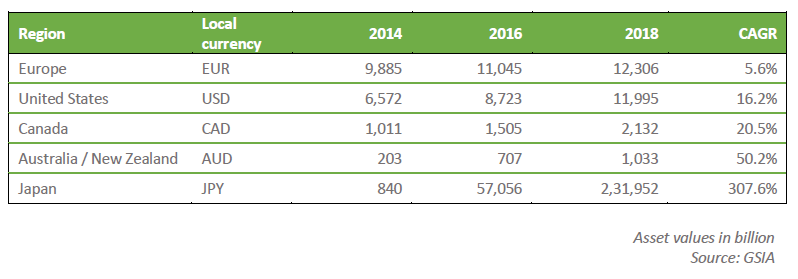

The previous decade saw a massive growth in assets under sustainable investing globally. According to the GSIA, Europe accounted for the greatest share of sustainable investing assets (at 46.0%), followed by the United States (US) at 39.0%. Developed markets witnessed significant growth in sustainable investing assets, the most notable being Australia / New Zealand and Japan, with a compound annual growth rate (CAGR) of 50.2% and 307.6% respectively, during the period 2014-18.

Emerging markets and developing countries are expected to mirror the growth in sustainable investing seen in developed countries. An organisation known as the LatinSIF was formed in 2013 for the promotion of sustainable investing in Latin American countries such as Brazil and Mexico. According to the African Investing for Impact Barometer, investments in African countries that considered ESG factors would continue to grow, with $428.3 billion in assets as on July 31, 2017.

Furthermore, India constitutes the largest green bond market amongst the emerging economies. According to research conducted by S&P Global and data collected by the Climate Bonds Initiative, India issued $6.1 billion worth of green bonds from January to November 2021, which has been the highest issuance since the launch of the country’s green bonds market in 2015.

6. Focus on net-zero investment:

The recent Conference of Parties (COP) 26 summit conducted at Glasgow saw various government pledges towards decarbonization and attaining net-zero carbon emissions by a specified period. The net-zero pledge is in line with the agenda highlighted in the Paris Agreement in COP 21, to limit the increase in global temperatures to 1.5 degrees Celsius. Various governments have adopted the net-zero challenge, with the US and the EU aiming for net-zero emissions by 2050, and China pledging to achieve carbon neutrality by 2060. Prime Minister Narendra Modi set a net-zero target of 2070 for India at COP 26, which is the first time India has set a definitive aim towards a carbon-neutral economy.

While most of the focus of COP 26 was towards government pledges, the conference also saw multiple public and private companies highlight roadmaps towards net-zero commitments. For businesses, these commitments represent opportunities for innovation as well as mitigating operational and reputational risks. A report by McKinsey offers five fundamental considerations for businesses to achieve their net-zero targets:

• Net-zero commitments are expected to become an organizational principle for businesses due to systemic changes. When a company commits to a net-zero target, it will not only affect the company itself, but will also bring about changes in its stakeholders such as suppliers, customers, investors and financial institutions.

• Even though a lot of companies have made net-zero pledges, few are yet to outline detailed plans that will turn their commitments into action. A business can differentiate itself from its peers and stay ahead of competition by making a sound and achievable plan for its net-zero commitments.

• Sufficient capital and its efficient deployment are necessary for companies to achieve net-zero targets. At the company level, management’s focus would need to be on decarbonising their holdings and to work with financial institutions with a net-zero goal themselves.

• Supply chains in companies would need a reformation. Climate change would affect raw materials causing supply shortages and price volatility. To counter these supply chain inconsistencies and reduce risk, companies would have to focus on procuring greener raw material.

• Measurement of sustainability levels and metrics as well as disclosure of information related to net-zero targets and action have now become unavoidable. Using digital systems for greater transparency can benefit companies as they can use these systems to improve their supply chains and product processes and increase efficiency. In the near future, investors would have to place greater focus on net-zero commitments outlined by companies and their progress towards achieving these commitments. Investors can identify risks and opportunities based on whether companies are able to accomplish their targets.

Conclusion

With the rise of ESG integration and adoption, as well as recent net-zero goals, it is evident that sustainable investing is expected to cause systemic changes across the global economy. The COVID- 19 pandemic has led to a surge in the perception of investors that ESG factors are significant to the global economy as a whole, and avoidance of these factors can cause major disruptions to the world’s markets and financial systems. With continued efforts towards ESG integration, it may be possible to build resilient and sustainable financial markets and economies in the long-term.

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”