- March 27, 2022

- Posted by: CFA Society India

- Category:Careers, ExPress

Jayashree Jena

Associate Director, TransAsia Private Capital Limited

Future of Investments

Advent of ESG investing and sustainable finance

ESG Investing, as the name suggests, entails identifying, assessing and incorporating Environmental, Social and Governance (ESG) factors into the process of asset allocation and investment decision.

Each letter of the ESG acronym signifies issues that have direct impact on our day to day lives although some issues are more deeply entrenched than the others.

- The ‘E’ in ESG signifies a wide array of environmental factors ranging from climate change, pressure on natural resources, deforestation, pollution, waste and loss of bio diversity.

- The ‘S’ addresses deep rooted social issues such as human rights, inequality on the ground of race, sex, religion, ethnicity or culture, working conditions, health and safety, employment and labour rights.

- The ‘G’ in ESG entails governance issues and broadly explains the process and structure by which a company is managed and overseen. Notable governance factors are shareholders rights, board independence, executive pay, audit practices, transparency and accountability.

Although ESG investing has gained prominence only in the recent decades, it is not a new concept and is as old as investing itself that dates back to centuries old. In its earliest form, ESG investing revolved around ethical or value driven investment themes in that religious groups laid out guidelines for their respective sect of followers over the types of investments they should or should not invest in. Some of the ethical or value driven investments excluded typical sin sectors, products and services such as tobacco, alcohol, gambling, pornography and arms and ammunitions etc. This early form of negative screening for investment decisions eventually led to the concept of Socially Responsible Investing or SRI that we know today.

The modern form of Socially Responsible Investing (SRI) gained momentum during the early 2000s in the back drop of widespread corporate frauds, scandals and increasing demand for inclusion of governance issues under the purview of SRI.

In a similar vein, the modern ESG Investing became more prominent in early 2000s when the then UN Secretary General Kofi Anan wrote to CEOs of significant financial institutions to take part in an initiative integrate ESG into Capital markets. The initiative produced a report entitled ‘Who Cares Wins’, which effectively coined the term ‘ESG’. This subsequently led to release of the Principles for Responsible Investment (PRI) in 2006.

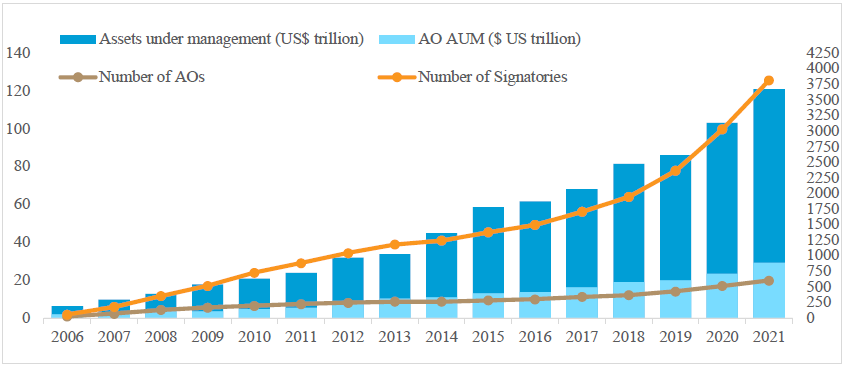

Since it’s inception since 2006, the Principles for Responsible Investment (PRI) have been widely accepted by asset owners and managers alike. The steady growth in the number of signatories to the PRI is testament of the increasing focus on ESG issues amongst asset managers globally. There are close to 3,900 asset owners / managers globally that are signatories to the PRI as of 2021, the bulk of which stem from the USA and Europe.

The following graph shows the growth in number of Asset Owners and Asset under management (AUM) that are signatories to the PRI between 2006 and 2021.

(Source: https://www.unpri.org)

Based on their investment mandate and policy directions, Investors worldwide adopt different approaches to ESG investing such as Sustainable investment, Best-in-class investment, Ethical/values-driven investment, Thematic investment. Impact investment, Green investment, Social investment and Shareholder engagement. One or more of these different investing approaches may overlap with each other, however each of these approaches has one common goal towards incorporating ESG while making investment decisions into companies and to ensure that these investee companies are either contributing substantially to one of the three ESG factors or doing no significant harm to the environmental factors and complying with minimum social and governance safeguards.

Of the three ESG factors, whilst governance factors historically have been the primary focus for the asset owners and institutional investors when selecting a company to invest in, environmental factors are increasingly getting significant prominence and momentum in the past few years with several UN led initiatives, government policies & regulations and participation by the private sector.

In the last 30 years since the Rio de Janeiro Earth Summit in 1992, the United Nations Framework Convention on Climate Change (UNFCCC) has been hosting annual Conference of the Parties (COP) meetings, where the member nations voluntarily commit to reduce their Green House Gas (GHG) emissions. COP 21 meeting in Paris in 2015 was the most significant recent milestone where member nations were urged to work towards the long term goal to keep the global temperature rise this century below 2°C above pre-industrial levels.

In the recently held COP 26 meeting in Glasgow several key commitments were made both by members nations and private sector players, some of the highlights are as follows as per report published by Council on Foreign Relations:(Source: https://www.cfr.org/in-brief/cop26-heres-what-countries-have-pledged)

- More than 130 countries pledged to halt and reverse deforestation and land degradation by 2030.

- More than one hundred countries signed the U.S. and European Union led Global Methane Pledge and agreed to collectively slash methane emissions by 30 percent by 2030.

- 23 countries including Indonesia, Vietnam, Poland, South Korea, Egypt, Spain, Nepal, Singapore, Chile and Ukraine made new commitments to phase out coal.

- Twenty-five countries and five financial institutions committed to stop public financing for most fossil fuel projects by the end of 2022.

- Asian Giants and top GHG emitters China and India pledged to achieve Net Zero emissions target by 2060 and 2070 respectively.

- More than 450 banks, insurers, pension funds, and other firms that collectively manage $130 trillion committed to use their funds to reach net zero emission by 2050.

In addition to the United Nations Framework Convention on Climate Change (UNFCCC) initiative, Some of the other UN led initiatives aimed towards addressing ESG and sustainability issues are as follows:

- United Nations Global Compact (UNGC), launched in 2000, the largest corporate sustainability initiative in the world with over 8,000 corporate signatories.

- United Nations Environment Programme Finance Initiative (UNEP FI) that includes:

– Principles for Responsible Investment (PRI)

– Principles for Sustainable Insurance (PSI)

– Principles for Responsible Banking (PRB) - UN Sustainable Development Goals (UN SDGs) that include 17 goals as follows:

(Source: https://sdgs.un.org/goals)

The ESG issues have remained in the front and centre for not only the United Nation or developed countries and governments, private sector players are also coming together to join forces to tackle these issues. Ever increasing number of asset owners, corporates and financial institutions are contributing towards ESG goals by setting their own targets for Decarbonization, Net Zero emission, ensuring sustainable supply chain processes, adopting diversity and inclusion in their work places and also through shareholders engagement and stewardship. Blackrock, world’s largest asset manager in terms of AUM is a front runner when it comes to addressing ESG issues through shareholders engagement and stewardship.

With the ground work effectively laid out and big scale commitments made towards addressing the imminent threats of climate change, it’s pertinent to note how these commitments are going to be executed in the future and whether countries and corporates will achieve their ambitious net zero targets.

As per various reports, total Investments required to achieve net zero target by 2050 is estimated to be about US$ 130 trillion, majority of this investment will be required to decarbonize the way energy is consumed today. Analysis suggests that 70% of these investments could come from private finance.

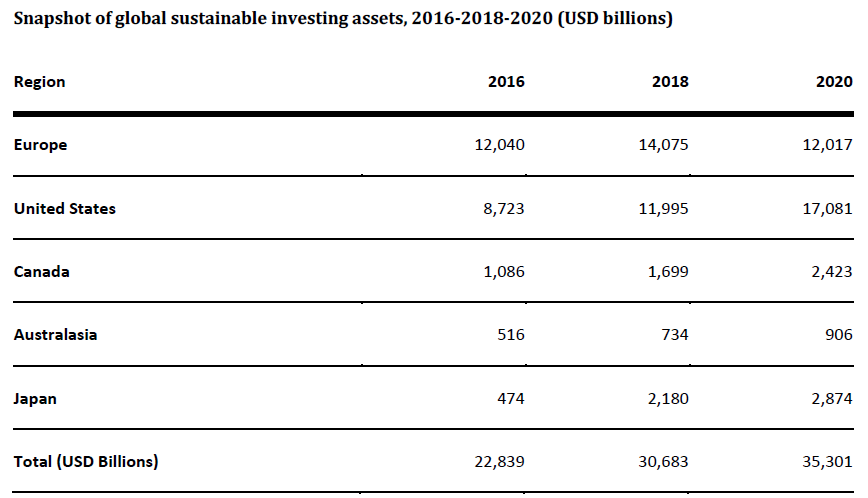

Over the last decade, a significant growth has been witnessed in green and sustainability linked financial products, including green bonds and green loans. The following graph outlines the year on year growth in global sustainable investing assets as per report published by Global Sustainable Investment Alliance (GSIA):

(Source: http://www.gsi-alliance.org/wp-content/uploads/2021/08/GSIR-20201.pdf)

As per latest report from Reuters, Sustainable finance bond issuance totalled US$859 billion in 2021 vis-à-vis US$534.3 billion in 2020 [1].

Whilst there is tremendous growth opportunity in the green investment and sustainability linked financing space, these are not devoid of challenges. Some of the key challenges facing this industry are as follows:

Ever growing threat from Greenwashing:

Greenwashing could pose a serious challenge for investors in times to come as growth and volume further accelerates in the green / sustaining investing space. Although policy frameworks such as EU Taxonomy, [2] a classification system, establishing a list of environmentally sustainable economic activities, has been designed and introduced towards avoiding issues such as green washing, such standardised frameworks are necessary on a global scale rather than specific region focused.

Lack of Standardised Data & Integration Framework:

Another challenge that the ESG investing space is riddled with is lack of standardisation on how to integrate the ESG risks into the financial modelling, valuation framework and quantitative risk analysis while deciding to invest in a Company. Lack of available data is another challenge, and this is amplified in case of smaller unlisted companies where there is no public data sources that an investor can access and analyse. Without adequate relevant data sources, it is extremely difficult to assess and quantify the ESG risk that an investee company may be potentially facing and the resultant loss to the capital investment for the investor.

Managing the transition to Net Zero:

Although the current plans to phase out coal or other form of fossil fuel is ideal, but it could prove to be extremely challenging for countries to implement this plan particularly for developing economies where the per capita energy consumption needs are increasing manifold with each passing day with growth in population and economies activities. Many countries in the recent months including large economies like India and China faced wide scale power shortage due to crunch in coal stock in thermal power plants. India recorded a power supply shortage of 1,201 million units in October 2021 — the highest in 5.5 years — due to a crunch in coal stock available with thermal plants.3 Similarly in Indonesia fearing a power blackout due to lack of coal inventory with the national power utility, the Indonesian government announced an export ban in early January 2022 which led to soaring prices of thermal coal. Current level of historic high coal prices is only a jarring reminder of our dependence on fossil fuel and how difficult the transition is going to be unless ground breaking innovations and scientific advancements are made in more efficient, reliable and stable grid scale renewable power generation and storage systems.

Evolving regulation pertaining to what constitutes “Green” Investment:

The recent proposal to include Natural Gas and Nuclear Energy to the definition of green transitional fuel as per the EU Taxonomy definitions brings this issue to the forefront. What this inclusion means is that investments in Nuclear energy can be defined as green and sustainable investment till 2045 and investments in Natural gas fired plant can be treated green investment until 2030. There is a lot of ongoing debate on this decision by the EU surrounding concerns on whether natural gas can really be considered green and whether nuclear energy can be considered sustainable given issues relating to nuclear waste management and in view of the disastrous past incidents such as the Fukushima Nuclear Disaster. In this backdrop, It’s going to be exceptionally challenging for asset managers and investors to differentiate what truly constitutes sustainable investment/ green investment.

Standardised form of available data and disclosure on Carbon foot printing:

As per the Greenhouse Gas Protocol (GHG Protocol), the direct and indirect emissions are categorised under three scopes i.e. Scope 1, Scope 2 and Scope 3. While an investee company can easily record and furnish data on their Scope 1 emissions and to some level the Scope 2 emissions which are largely inhouse and under the company’s direct control, it’s rather difficult to extend the same level of monitoring to the Scope 3 emissions which mostly stems from 3rd party sources such as purchased goods and services, procurement network and supply chain etc. In view of this, it’s a huge challenge for the asset managers to assess the accurate carbon footprint of their investee Companies while making investment decisions.

In spite of the numerous challenges, ever evolving policy and regulatory landscape, ESG investing and sustainable finance space has a tremendous potential for accelerated growth in the times to come.

With the environmental issues / climate change already gaining the necessary attention and investments, the next big wave is likely to be in the social factor of ESG.

The COVID pandemic has laid bare the ugly inequality between the ‘haves’ and the ‘have nots’, right from the statistics on vaccination rates in developed countries vis-à-vis the underdeveloped world, access to healthcare and medical support and even access to school and education during the widespread lockdown periods leading to closure of educational institutions, people from the low income communities were the worst hit and suffered the most.

There has never been a more apt time than now to mobilise resources and invest in areas that not only can generate risk adjusted financial returns but also touch lives in a profound way by creating jobs and opportunities, eliminating or reducing inequality and in turn help build a more sustainable and thriving world.

ESG / Sustainable investing is poised to play a very significant role in all these areas and act as a catalyst towards achieving the ambitious targets surrounding climate change, decarbonisation, net zero emission and help accelerate further in roads in the sustainable development goals.

————————–

Reference:

[1] https://www.reuters.com/markets/commodities/global-markets-esg-2021-12-23/

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”