- September 30, 2020

- Posted by: CFA Society India

- Category:ExPress

Written by Soham Das, CFA

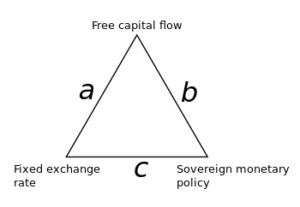

Between 1960 and 63, two economists sitting across the Atlantic Ocean formulated a theory based on a series of novel thought experiments. Marcus Fleming, sitting at the University of Edinburgh and Robert Mundell in IMF, posited that an economy has only two of the three following features: free capital flow, fixed/managed exchange rate, and the ability to decide the interest rates. Put in another way, central banks cannot have stable exchange rates and the freedom to set the interest rates while being integrated with the world economy. A nice quick 60 seconds intro here

Many a spectacular trade in financial markets has come, betting on the longevity of this theory – the most recent one being the 1992 “Breaking the Bank” trade against the Bank of England and the Mexican Peso crisis. Today Indian Central bank is faced with its own version of this trilemma, and the consequences for the Indian economy are equally disturbing.

Context

But first some background. The US Federal Reserve, in its 16th September FOMC meeting, guided the market on a near-zero interest rate over the next three years. Central bank communication and guidance serve as a tremendous source of signal in an otherwise noisy world of finance. The greater the credibility of a central bank, the more seriously market participants take its statements. As a result, the bank is able to achieve its objectives with minimum firepower. And the US Federal Reserve is the most credible central bank today.

A high amount of this assured liquidity pushes individual market participants to take higher and higher risk in order to earn yields. True to its nature, the sloshing liquidity has found its way to the high yield markets and leveraged loan sector. Now it threatens to hit our shores, with full force.

And therein lies the rub.

The Conundrum Ahead of RBI

RBI, the central bank of India, has to manage this huge wall of flows that will be coming our way (and by some reports, it has already started) while ensuring INR ‘doesn’t appreciate too much. An appreciating rupee poses a threat to the terms of the trade for Indian exporters and has the ability to throw a spanner into the growth wheel.

threat to the terms of the trade for Indian exporters and has the ability to throw a spanner into the growth wheel.

If it so chooses to stabilize the exchange rate while having free capital flows, it loses its ability to set the interest rates. Due to structural reasons, our interest rates have traditionally been higher than global average rates, keeping in view the inflation.

And herein lies the trilemma of Indian central bank. Should RBI, balance growth with inflation while having free capital flows? Or should RBI focus on having free capital and inflation, and sacrificing growth in the process?

Thinking in Three Scenarios

My read is, trying too hard to do all three will make RBI lose its credibility among market participants. That, is a serious threat. A non-credible central bank is not a central bank at all. And a non-credible RBI can end up achieving none of the objectives. Put in simpler terms – “all of the calories(inflation), and none of the great taste(growth)”

There are three major scenarios that can play out.

Scenario One, a middling possibility of Indian economy entering stagflationary period in the next 4-6 quarters.

Scenario Two, a remote possibility of growth picking up with high inflation.

The most interesting is, scenario three, that in my opinion can dampen the flow of capital while spurring in growth. If Government of India, is willing to expand its fiscal deficit, and borrow externally, by issuing sovereign masala bonds – we can build up enough capital to kick start another infrastructure creating cycle.

Prescriptions for an Investor and Asset Allocator

Monetary policy for managing inflation, fiscal to manage growth, is how economies around the world are managed. For growth to return, fiscal purse strings must loosen, and we will have to do novel things keeping in view the realities of the current world.

All this conversation of risk doesn’t hold any water, if it doesn’t translate into asset allocation.

Asset Allocation Stance

So, what are we looking at?

Inflation will pick up, with growth or without.

For an asset allocator, the prudent choice would be to allocate some capital to inflation-resistant assets, usually hard assets and precious metals. The mere mention of words “precious” and “metals” evoke the image of a certain yellow-shiny metal, but we have others as well. I will leave it to you to make the judgment and wouldn’t want this post to devolve into an investing recommendation.

If growth trickles in, then a combination of equities and inflation-resistant assets like mentioned above can offer a satisfactory return.

Investing Stance

For an Indian equity investor, inflation has the potential to disproportionately reward businesses which are asset light and/or carrying intangible assets.

Do note, these intangible assets may be on the balance sheet or hidden away from it. Investments in a brand-building can show up in balance sheet (sometimes), but investments in building “platforms”, “marketplaces” and “network effects” can disproportionately benefit from an inflationary environment.

Being asset light, they do not demand a lot of maintenance capital expenditures to maintain their competitive edge. This is good news, in an inflationary environment which demand a high degree of capital efficiency.

For Indian investors with international exposure, buying a business that has competitive advantages which compound with time is highly desirable. Those are the only advantages they can have now, as traditional advantages like “economies of scale”, “high upfront investment” have withered away.

They have been rendered ineffective due to low-interest rates in Western economies. Having exposure to currencies, like the Swiss Franc, where the central bank has been prudent has performed well in the previous crisis. My best guess is they will continue to perform going forward as well.

Concluding Words

In the 2012 Christopher Nolan flick, the Dark Knight Rises, Selina Kyle (, played by the illuminating Anne Hathaway, I’m a fan, you can say), says ominously to Bruce Wayne (Christian Bale)-

“There’s a storm coming, Mr. Wayne. You and your friends better batten down the hatches, because when it hits, you’re all going to wonder how you ever thought you could live so large and leave so little for the rest of us.”

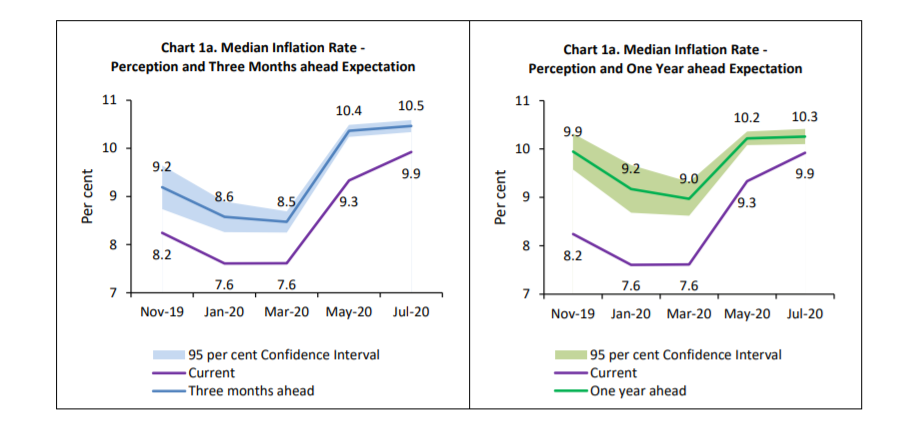

Not as dramatic, but the latest data from household inflation expectations are saying almost the same thing. Food inflation is rising and can unhinge the expectations in the coming months. Unhinged inflation expectations are sticky and can be self-fulfilling. And that’s the risk, as fiduciaries of wealth, we have to navigate around.

Figure 1: Excerpt from RBI document on Inflation Expectations Aug,2020

References

https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20200916.pdf

https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/IESH8707B70BAA32488386102D8AC4242723.PDF

https://en.wikipedia.org/wiki/Impossible_trinity

https://www.youtube.com/watch?v=oLbfAfCVG_4

About the Author

Soham is a High Yield Credit Strategist with BofAML and an advices independently on asset allocation and absolute return generation opportunities. He posts his insights on investing and Indian public companies at www.sohamdas.in

Thoughts expressed here and otherwise are his own and don’t represent his employer.

Disclaimer:

“Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”