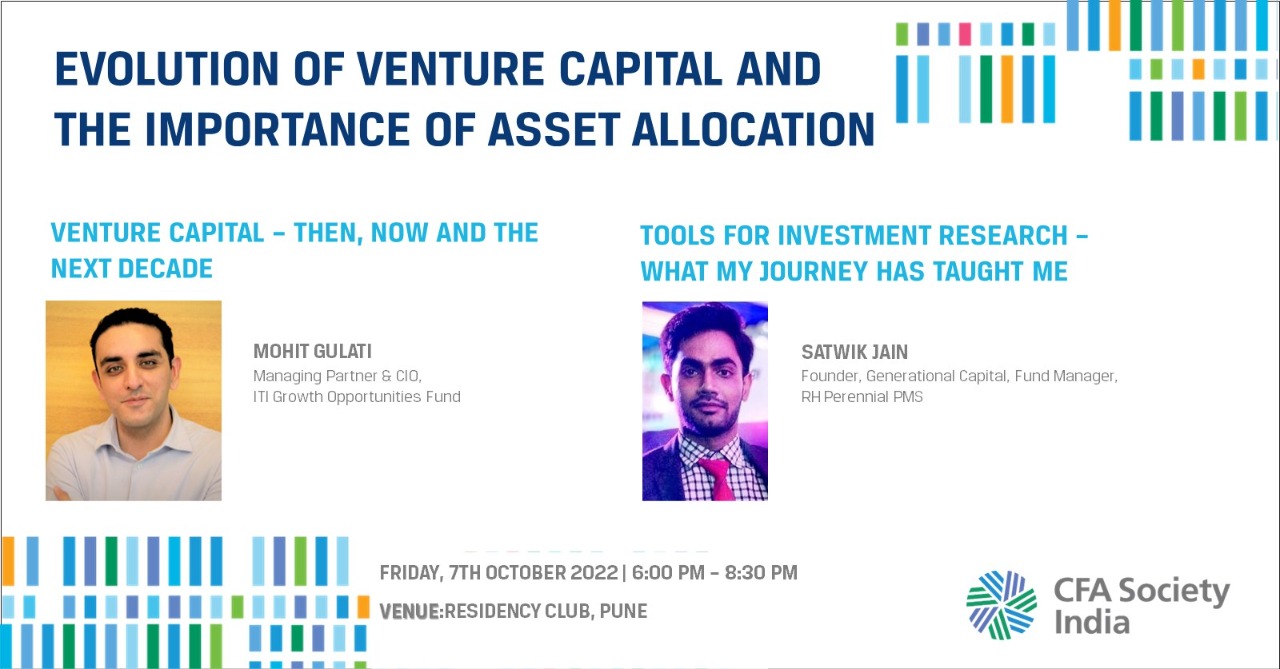

Evolution of Venture capital and the importance of Asset Allocation I Pune

- October 7, 2022

- 5:30 PM - 8:00 PM IST

- Residency Club

CFA Society India is pleased to invite you for a session with Satwik Jain, Founder – Generational Capital, Fund Manager – RH Perennial PMS and Mohit Gulati, CIO & Managing Partner – ITI Venture Capital. They will discuss the evolution of asset allocation and venture capital and what its future in India

Tools for investment research – what my journey has taught me by Satwik Jain

Venture Capital – Then, now and the next decade by Mohit Gulati

In the last decade or so, the investment scenario in India has changed drastically. While as a country we are still significantly lagging other developed countries in terms of financial vs physical assets for our savings, domestic inflows into equity markets have now come at par if not beaten foreign flows. The advancement of internet and technology has made investors much more aware about asset classes and hence have gone out to seek advice on investments beyond equity putting the spotlight on asset allocation.

A major advancement that has accelerated the growth of wealth management in the country are the number of startups. India currently boasts the third largest startup ecosystem in the world and more than 100 unicorns. It is safe to say that the last decade has been dominated by the private equity and venture capital space where billions have been invested in funding innovative ideas and budding entrepreneurs.

Join us to learn more about venture capital and tools used for investing in different asset classes.

EVENT DETAILS:

DATE: Friday, 7th October 2022 | TIME: 6:00 p.m. to 8:30 p.m. followed by dinner (registration start at 6:00 p.m.) | VENUE: Residency Club, Pune

REGISTRATION:

CFA Society India members: Free

CFA Charter Pending: INR 800 (all inclu.)

CFA Program Candidates: INR 800 (all inclu.)

Others: INR 1000 (all inclu.)

Mohit Gulati

Mohit Gulati is the CIO & Managing Partner of the AIF Cat-2 fund called ITI Growth Opportunities Fund which specialises in early-stage venture investing. He's a passionate engineer from Pune University and has a PGDM in Finance from IIT Bombay. Mohit has 13+ yrs of active experience within the Fund Management space. In his individual capacity, Mohit has led first-round deals across ECOM Express(Seris D), Grab(RIL Acquired), 1MG(Tata acquired), WigzoTech(Shiprocket acquired), HumourMe, and two dozen early-stage ventures. Within the ITI Group of 21 businesses, the technology fund under Mohit specializes in investments in Health Tech, New Age FMCG Brands, SaaS, IoT, and New Age mobility/Logistics. The 1st fund currently has 18 active investments and is in the midst of getting regulatory approvals for their larger second fund

Satwik Jain

Satwik Jain founded Generational Capital in Jan 2021 with the aim to drastically clean up the wealth management industry taking a client-first approach and having advisors who come from strong research experience. Currently, the company is a full-service multi-family office providing wealth management, investment banking, PMS, taxation, real estate and insurance advisory to individuals and families. He also manages the Right Horizons Perennial PMS coming from rich global investing experience trying to identify major wealth creation trends along with monopolistic and fast-growing capital-efficient enterprises. He is also a strategic investor in Bimaplus and a venture partner at Venture Catalysts, which is on its way to create the world’s largest integrated incubator. Prior to this Satwik started his entrepreneurship journey back in his college days where he founded fitnessholic.com, a platform that aggregated more than 150 fitness centers. Post its successful exit he joined Deloitte in their transaction advisory being part of deals exceeding an aggregate of $10 billion. He was also part of the 4-member team at Elara India Gateway fund and his last stint was as head of equity and alternatives at Client Associates , which at the time had an AUA of more than $4 billion.

Mohit Gulati

Mohit Gulati is the CIO & Managing Partner of the AIF Cat-2 fund called ITI Growth Opportunities Fund which specialises in early-stage venture investing. He's a passionate engineer from Pune University and has a PGDM in Finance from IIT Bombay. Mohit has 13+ yrs of active experience within the Fund Management space. In his individual capacity, Mohit has led first-round deals across ECOM Express(Seris D), Grab(RIL Acquired), 1MG(Tata acquired), WigzoTech(Shiprocket acquired), HumourMe, and two dozen early-stage ventures. Within the ITI Group of 21 businesses, the technology fund under Mohit specializes in investments in Health Tech, New Age FMCG Brands, SaaS, IoT, and New Age mobility/Logistics. The 1st fund currently has 18 active investments and is in the midst of getting regulatory approvals for their larger second fund

Satwik Jain

Satwik Jain founded Generational Capital in Jan 2021 with the aim to drastically clean up the wealth management industry taking a client-first approach and having advisors who come from strong research experience. Currently, the company is a full-service multi-family office providing wealth management, investment banking, PMS, taxation, real estate and insurance advisory to individuals and families. He also manages the Right Horizons Perennial PMS coming from rich global investing experience trying to identify major wealth creation trends along with monopolistic and fast-growing capital-efficient enterprises. He is also a strategic investor in Bimaplus and a venture partner at Venture Catalysts, which is on its way to create the world’s largest integrated incubator. Prior to this Satwik started his entrepreneurship journey back in his college days where he founded fitnessholic.com, a platform that aggregated more than 150 fitness centers. Post its successful exit he joined Deloitte in their transaction advisory being part of deals exceeding an aggregate of $10 billion. He was also part of the 4-member team at Elara India Gateway fund and his last stint was as head of equity and alternatives at Client Associates , which at the time had an AUA of more than $4 billion.

3 PLCFA Institute members can claim PL credit by providing their CFA Institute ID number when registering. |

Global Passport Accredited Programme Allows members of participating CFA societies to attend each other's society events at the local member price Global Passport Accredited Programme Allows members of participating CFA societies to attend each other's society events at the local member price |