- July 9, 2020

- Posted by: Shivani Chopra, CFA

- Category:ExPress

Contributed By : Labanya Prakash Jena, CFA

Creating safety nets for the poor through a contingency insurance

Why is it important?

Natural calamities, pandemics, epidemics, etc. all are times of mass distress, especially for the poor classes of the society. In India, for instance, most of those who are part of the informal labor force, those who earn through other activities, especially in rural India. Only 1 in 10 roughly belong to the formal sector. A few days of lack of activity strain their livelihood for the present and future. Natural calamities and pandemics are distinct from a typical economic contraction. This kind of event makes the private sector’s engagement in the economy almost negligible for a few days to a couple of months, due to constraints at both the supply and demand sides. The lack of participation from the private sector, destroy many informal jobs and strain the lives of the labor force working in the informal sector. The economic activities not only stop, but there is also uncertainty on when and how the economic activities shall resume creating jobs for the people depend on them. It is, in some sense, a natural lockdown. The path of recovery needs two things – relief and rebuilding.

It is noteworthy here that these households have little liquid assets in hand, they run out of cash very fast when they do not get any work in local community areas. The people who have few illiquid assets such as land, borrow money from the unorganized market at high interest to meet their day-to-day expenses by mortgaging their properties. The payment of interest and principal becomes a burden later, and sometimes, they lose the rights over their only assets. There is also a domino effect on future generations, i.e., children might leave schooling work, malnutrition, and poverty traps, and so on so forth. It is not an understatement that millions of daily wage earners with almost no savings or investment would go hungry even for one day’s leave. Therefore, it is essential to inject immediate cash into the hands into people to meet the crucial needs of the people.

How and when?

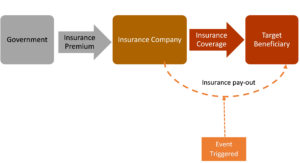

The solution is to create a safety net by structuring a contingency insurance financial mechanism – the contingent event could be a flood, cyclone, pandemic, etc. The insurance to the poorest will come through an insurance company; however, the Government will pay the premium. The mechanism will be designed in such a way that whenever the event occurs, the insurance company will immediately release payment to the beneficiary’s account. The instrument will act as an option traded in the financial market. This kind of contingent claim will have two benefits – insurance firms will be quick to respond and more efficient than government action. The in-kind benefits such as food grain transfers that may have a time lag come with risks and leakages and sometimes become a burden on the Government machinery to make those available to the needy.

We have outlined the mechanism of the scheme below:

- The Government decides the targeted beneficiary of the scheme – the Below Poverty Line (BPL) households can be the target beneficiary

- An event is decided when the contingent insurance is triggered – the event can be a cyclone, earthquake, pandemic, flood, etc.

- The Government pays regular premium to the insurance company

- If an event is triggered, the insurance company immediately transfers the money to the bank account of the targeted beneficiary

The monthly consumption of poor households can be a good reference point for the value of the safety net. The monthly expenditure of the Below Poverty Line (BPL) family was INR 3,000 per month (for 3) about a decade back. Vaguely, today it would amount to INR 5,000 per month after incorporating inflation of 5% per annum. The insurance premium for a small amount of INR 5,000 of contingent payment will be meager and will save a lot of money for the Government in the long run.

Benefits

The immediate release of cash benefits will address several problems, including food needs, malnutrition, mortgaging of property, dropping out of education. The safety net will boost both morale and risk-taking nature of people to rejoin the workforce/business. It will also reinstall faith in public choice and Government. Further, in this scheme, a life insurance scheme can be attached to the scheme. The family can get an additional payment when the natural calamity leads to the earning member’s death in the family. Many times, the entire family depends on one earning person as sudden death brings enormous financial stress in the family. An insurance benefit can protect them against this risk.

* Author’s views are personal

About the Author:

Labanya is currently working as a Manager – Climate Finance in Climate Policy Initiative’s (CPI) Delhi office; CPI is an international development and policy consulting company in climate finance. At CPI, he is engaged in research and consulting activities related to policy, regulation, and investment aspects of green financing, including renewable energy. Besides, he is also engaged in designing and analysis of new financial and business ideas at CPI’s Green Finance Lab, aiming to drive capital into the climate sector. Before CPI, he has worked with Copal Amba Research (A Moody’s Subsidiary), Emanation Partners, Skylar Capital, and Mandrill Capital Management in various capacities. Labanya is a management graduate and holds a Master’s in Economics. He is also a CFA charterholder and currently a Doctoral Scholar at XLRI, Jamshedpur.

The author would like to thank Amlan Bibhudatta for his valuable inputs in preparing this article. Amlan is a current student of Economics at Ashoka University.

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”