- April 13, 2022

- Posted by: CFA Society India

- Category:ExPress

Written By

Priyanka Dhingra

ESG Analyst, SBI Funds Management Ltd.

Paradox of Choice:

Have you ever found yourself overwhelmed in a supermarket aisle where buying a mere shampoo has suddenly felt like a humungous task because of the plethora of options available? If you feel this confusion often, you have experienced a phenomenon known as the paradox of choice. The paradox suggests that while we may feel that having many choices gives us the freedom to choose but having too many choices actually limits our freedom as we are overwhelmed by the options available.

I believe that the only thing that can help one out of this paradox is knowledge. Once armed with the right kind of knowledge about our actual needs, our confusion clears, and we narrow down our options to a smaller size where making the right choice becomes easier and the aisle at the supermarket does not seem so intimidating.

Knowledge clears confusions:

Many a times, our choices are limited by the fact that there is dearth of information, or difficulty in comprehending the available information. Let us take the increasing number of mutual fund products in the market that claim to be ESG aligned. The assets under management of ESG funds have risen multifold from INR 2,630 Cr in 2019 to INR 12,300 Cr in 2021! With such a spurt in funds catering to a particular theme, it is understandable that retail investors may feel baffled with the choices available. Let me try to address the problems of why and how of ESG Funds and the eternal question around comparability.

Why ESG?

We know that ESG funds aim at creating positive value not only for the investors, but also for the larger stakeholders and metrices of environment and society in the long-term. The difficulty is understanding why a fund, whose primary responsibility is to multiply an investor’s wealth would look at ESG parameters. This can be answered by looking at the push factors in the market. What inspires or rather forces an organization to disclose more about its products? Either it is regulations, market demand or the intention to increase transparency (and consequently demand) about its product. It is a combination of all these three within the ESG Mutual fund industry today. The number of Indian signatories to UNPRI have risen from 2 in 2018 to 28 in 2022. UNPRI expects transparency and encourages signatories to provide all the information about their responsible investment practices, methodologies, products, strategies and targets in the public domain. So, clearly market participants like the PRI have inspired investors to increase transparency and expand the ESG product basket.

The Securities and Exchange Board of India (SEBI) has become rather pro-active recently in mandating disclosures and transparency from all quarters to ease the life of investors. Whether it is in the form of mandatory Business Responsibility and Sustainability Reporting (BRSRs) expected from top 1000 listed companies by 2023, or the mandate for adoption of Stewardship Codes and Stewardship Reporting by mutual funds in 2020 and 2021 respectively, or it is enhanced ESG based disclosures mandated by ESG Funds, starting April 2022, the regulatory mandate has been a definitive push towards more transparency in the industry.

How ESG?

The second difficulty is to understand how does a fund apply ESG lens on its investments. ESG as a concept is quite subjective and mere numbers and ratios would not help explain the strategies adopted by an ESG Fund. Here, the investors must understand their own preferences clearly before deciding on a product. The first thing is to understand what you do NOT wish to have in the product. Just like you may not want a shampoo laden with chemicals like sulfates, parabens, silicones etc. which may harm your hair, similarly you have the choice to exclude certain sectors from the funds. For instance, most Indian ESG funds may exclude sectors with negative social connotations like alcohol, tobacco, gambling, and pornography with a threshold (sin stocks). Similarly, many funds would look at excluding companies with exposure in controversial weapons, animal cruelty or other emerging topics like fossil fuels. This does not mean that all ESG products have to follow an exclusion or negative screening strategy. Here, the personal preference of an investor comes into play. An investor following Shariah based investing criteria, may choose a fund which does not invest in alcohol, or a Catholic investor may look at a fund that does not invest in industries related to abortion, while another investor may not really look at exclusions at all, and would prefer funds to choose from all sectors.

The second step is to try and assess how the funds are promising to integrate ESG into their investment thesis. Taking the shampoo analogy here, it might be good for one to avoid harmful chemicals, but one may also want to know what goes into the making of the product itself. In fund parlance, some funds would integrate evaluation of ESG performance and risks in the stock selection process itself, a strategy known as ESG integration. Some other funds may look at ESG ranking or scores of constituents and select the best out of a set of companies, a strategy called best-in-class. Some others would only invest in a certain type of stocks that support a theme. Think about a shampoo which only uses herbal ingredients, similarly, a fund that only invests in say green energy companies. This strategy is called thematic investing. Yet others may look at a larger goal and look at creating a positive impact through the fund. In shampoo analogy, you may look at products from small cooperatives which sell hand-made soaps and shampoos where the money goes for their benefits. These funds align themselves to goals like Sustainable Development Goals (SDGs) or the Paris Climate Agreement and only invest in a certain type of companies that cater to the larger goals. They are called funds with sustainability objectives or impact funds. It is important for the investor to understand the process and the larger objective the process aims at achieving in order to see what product is best suited to an investor’s preference. Unless the strategies are known and understood, finding the right tune that soothes the ears would seem difficult amongst the noise of subjective information available about the funds.

The abstract of comparability:

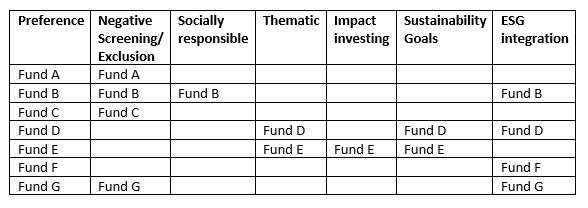

Let us look at a few imaginary funds for context. Fund A only excludes sin stocks like alcohol, tobacco, gambling and pornography. Fund B excludes all sin stocks and also fossil fuels and animal cruelty. It also checks the ESG ratings/scores of all its constituents. Fund C is a Shariah fund which invests based on Islamic principles. Fund D invests only in renewable energy companies and also checks ESG scores of underlying constituents. Fund D is also aligned to Paris Climate Agreement. Fund E is a diversity fund and funds only companies that have active diversity promoting initiatives. Fund E is an SDG Fund. Fund F only looks at ESG scores of underlying constituents. Fund G excludes sin stocks and also looks at ESG scores of all underlying constituents.

Looking at the table above, it seems difficult to understand which fund is better. So, instead of trying to compare two funds as products, one should try comparing the strategies and objectives. If one wishes to exclude the sectors with negative connotation and also integrate ESG across all the constituents, maybe Fund G would be the right choice, but that means that the universe for the fund manager would be smaller compared to the other funds. If one wishes to only integrate ESG across the constituents and does not wish to exclude any specific sector, then Fund F would be the right choice where stock selection has happened based on ESG scores, but universe is not limited by exclusions. Fund F may be rated BBB and Fund G may be rated 75. There is no direct ESG based fund comparability possible (or even required), because of the difference in inherent strategies adopted by different funds and even in various methodologies adopted for bottom up stock selection. Also, there is no correlation between the ESG rating methodologies provided by various ESG rating agencies.

In shampoo analogy yet again, you may have noted, custom products emerging in the market, where your preferences are asked in the beginning, and the products you get are customized to your needs and requirements. Think of the ESG funds in that light. It is an investor’s preference for a strategy and objective of a fund that guides one’s choice. It might so happen in the future that some sort of standardization and comparability may emerge, but it would still remain largely dictated by one’s preference.

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”

About the Author:

Priyanka is an ESG professional with 12 years of experience in sustainable finance, environment, climate change and related fields. She is currently handling ESG integration and stewardship initiatives at SBI Funds Management Limited, across all asset classes and represents the AMC on all global and domestic ESG related forums. She has previously worked on ESG ratings and AI tools to automate ESG analysis at MSCI, on environmental and climate change policy frameworks, outreach and knowledge creation at FICCI, on environmental impact assessments at Ramky Enviro Engineers and has also taught environmental studies to University Graduates in Delhi and Mumbai. She is a postgraduate in Environmental Studies from TERI School of Advanced Studies, New Delhi, and a sustainability enthusiast who contributes to various sustainable finance and ESG related institutional publications. She has recently completed the CFA Institute’s certificate course in ESG Investing.