- June 23, 2021

- Posted by: CFA Society India

- Category:Careers, ExPress

CFA Society India had organized a research note writing competition as part of its ‘Women in Finance’ initiative this year. The competition gave women charterholders and candidates a chance to showcase their research to the wider investment community, get recognized and further their careers. The entries were judged by two eminent professionals: Shireen Bhan – Managing Editor of CNBC TV18 and Farida Khambatta, one of the world’s leading emerging markets investor.

This series will showcase the three entries of the competition, starting with research note of Jyoti Nathani, CFA, the first runner up.

Key themes that will emerge and shape the Indian economy over the next 5 years

A. Financialization of India’s Savings –

a. Drivers & story: India has historically been a savers market, with investors preferring physical assets over financial and fixed deposits over equity and insurance. Sharp fall in rates, increased ease of access driven by both digital penetration and reach into B30 markets, and increased financial literacy and economic mobility are driving India’s financialization.

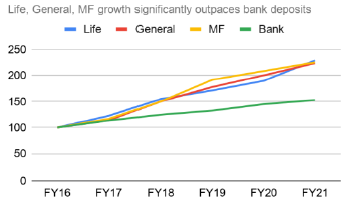

b. Evidence: Trading volumes on Indian exchanges have grown 20x over the past 20 years[1] India’s largest depository has grown users by 33% over the last year[2] Share of retail participation in the markets has grown 17pps from 37% to 54%[3]. Life insurance premiums have grown at 18%[4], General insurance premiums at 17%[5] and Mutual Fund AUM has grown at 18%[6] over the last 5 years growing significantly faster than bank deposits growing at 9%[7]. With Bank deposits still comprising ~56% of Indian financial assets[8], there is significant headroom to grow. Financial assets in themselves form less than 5% of total Indian wealth[9], materially lower than most advanced economies.

c. Key Winners: Leading mutual funds (HDFC AMC), Life insurance (HDFC Life), General Insurance (ICICI GI), depository (CDSL), transfer agents (CAMS), exchanges (NSE- yet to be listed).

B. India’s Quasi-Monopolistic Profit Pool Growth –

a. Drivers: India is a large and diverse country (making distribution a key challenge for consumer staples), a low trust society (more important in sensitive categories like banking and infant care), and often has strong regulations creating natural monopolies. These firms grow stronger through economic downcycles reaching quasi-monopolistic status.

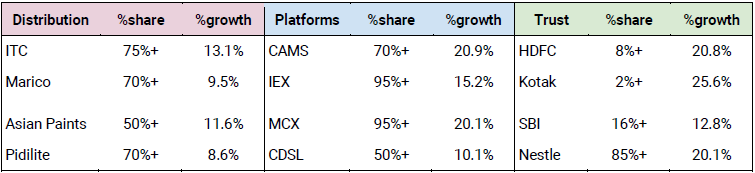

b. Evidence: Monopolies across India continue to grow profit significantly faster than the market capturing greater profit pools [10]. Three primary India specific drivers strengthen the moats help this process – Extensive and efficient distribution networks for consumer players which drive a virtuous cycle of faster turns for distributors via demand and high demand via extensive availability. [11]; Platforms with network effects operating in regulated markets become cash machines with near 100% market share [12]; Firms in sectors where trust is critical (banking, infant care) benefit via cheaper source of funds or higher pricing power that customer readily gives as a trade-off for trust.[13]. All of these moats are extremely enduring which drives strong and robust growth for these firms.

c. Key Winners: Regulated platforms (CAMS, IEX,MCX,CDSL), Distribution (ITC, Marico, Asian Paints, Pidilite) Trust (HDFC, Kotak, SBI, Nestle)

C. India’s Rural and Semi-Urban Purchasing Power –

a. Drivers: India is still predominantly rural with 70% of its population residing in rural areas. Rising purchasing power, strong policy focus on rural wealth building, increased aspiration, and increased ease of access is driving a strong multi-decadal growth in India’s hinterlands. Agriculture and allied industries, FMCG, consumer durable and banking are most well placed to benefit from this shift.

b. Evidence: Governments have historically demonstrated a strong subsidization intent with the rural economy via consistent double digit growth growth (13%-30%) in MSPs [14] and MNREGA [15]. The rural sector is also seeing support from structural reforms along increased electrification & power supply [16], disintermediation and increased industry access [17], increased digitalization [18] and increased credit and savings focus [19]. The combination of these events has led to a boost is growth of consumer discretionary spend [20], micro-credit [21] and higher staples volume growth. The structural nature of the reforms, the importance of the rural electorate driving growing budgetary outflows, and a more robust earnings pool in Indian villages gives us confidence in the longevity of these trends.

c. Key Winners: Affordable two wheelers (Hero Moto), very spread consumer staples (Dabur, HUL), and stable building materials (UltraTech, Ambuja).

D. India’s Affordable RE and Infrastructure Boom –

a. Drivers: The government has a strong focus on growing infrastructure in India. Infrastructure growth boosts both employment at the bottom of the pyramid as well as the long-term investment attractiveness of India, leading to support across the political spectrum.

b. Evidence: India’s focus on Infrastructure is made clear via its 111-lakh crore national infrastructure pipeline.[22] India’s focus on infrastructure growth is demonstrated via strong investments and execution in power production [23], power and gas transmission infrastructure [24], ports and airports, railroad doubling [25], and highway and rural road creation [26]. Infrastructure investments booms are typically accompanied by growth in allied sectors (steel, cement, building materials) as well as multiplier effects as they put money in the hands of people most likely to spend a bulk of their earnings.

c. Key Winners: Leading road and infra players (Dilip Buildcon, Ashok Buildcon, L&T), marquee allied industries (APL Apollo, Ultra Tech) and monopolist energy players (Powergrid, GAIL, NTPC).

E. India as a Global Export Hub-

a. Drivers: India has firmly cemented its places as a services export’s hub driven by its abundant supply of inexpensive, skilled, English-speaking workforce and best in class process innovation allowing it to deliver consistently at scale. The recent anti-China wave – driven by a combination of rising Chinese wages and anti-globalization sentiment has presented an opportunity for emerging markets manufacturing exporters including India, Vietnam and Bangladesh. Food processing [27], consumer electronics and cell phones [28], generic pharma strengthened by India’s recent COVID goodwill [29] and auto could be the next set of firms to benefit from India’s growth as an export hub.

b. Evidence: There has been extensive policy focus via policy linked incentives [30] to encourage manufacturing in India. India has demonstrated competitiveness via increasing market share in consumer electronics and generic pharmaceuticals. India’s position as a pharma exporter [32] has been further cemented via PPE and COVID vaccine exports to international locations. Indian two-wheeler auto has been consistently growing market share in international emerging markets. [31]

c. Key Winners: Contract Consumer Manufacturers (Dixon, Amber), Generic Pharma Manufacturers (Sun, Aurobindo, Dr Reddy), Established food processing value chains (ITC), Export Quality Auto manufacturers (Bajaj Auto, Eicher Motors).

Please access complete research note here

About the Author

Jyoti Nathani works with GSN Invest as an analyst, tracking the Indian stock market. In her previous role, she was a part of the strategic advisory team at Marsh & McLennan, one of the world’s largest brokers. Jyoti is an MBA and a CFA chaterholder. She likes to read and travel in her free time.

LinkedIn Profile: https://www.linkedin.com/in/jyoti-nathani-cfa-3135101b/

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”