- March 26, 2022

- Posted by: CFA Society India

- Category:Careers, ExPress

Payal Seth, CFA

Manager, Standard Chartered Bank

FUTURE OF INVESTMENTS

Emergence of technology and its role in shaping the future investment world

Abstract

An essay to show how emergence of technologies has shaped the future of the investment world and a vision on its impact on society along with my contribution towards the same.

Many of us have come across advertisements like “Spend two years in a lavishing sea facing Mansion without Television, Computer, Mobile phone and Internet and get $10 Million”, such ads show us how much we are dependent on technologies nowadays. Precisely, in today’s world life cannot be imagined without technologies. Perhaps, not just technologies, their innovation is leading to multitude unthinkable directions.

The world of Finance is not untouched either. Daily we are learning what kind of novel ideas are cropping up which are leading to many startups. Media is covering these advancements by updating readers in a separate section altogether. However, it is difficult to say whether Technologies are resulting into opening new horizons of Finance / Investments or vice-versa.

On the one hand, technologies have enhanced efficiencies by reducing the time consumed in operating processes, data transfer, making decisions for investments as well as communication irrespective of the distance and time zones, affecting the growth dynamics and its implications.

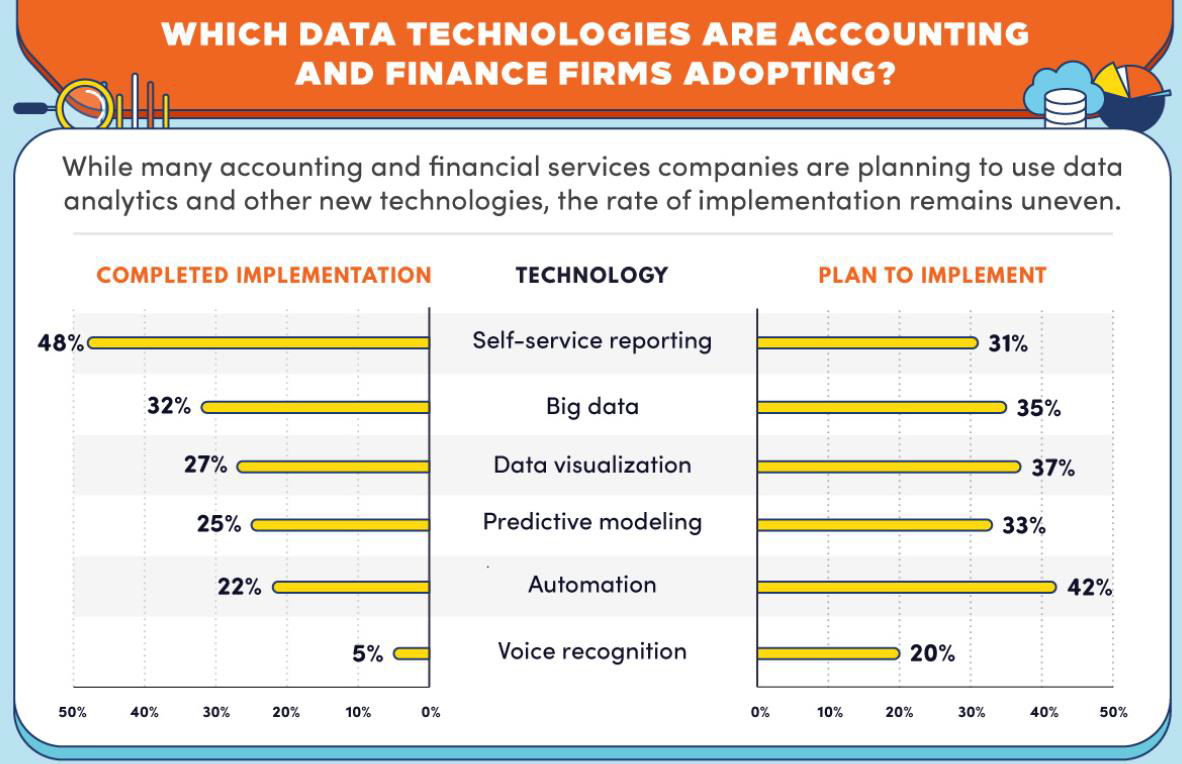

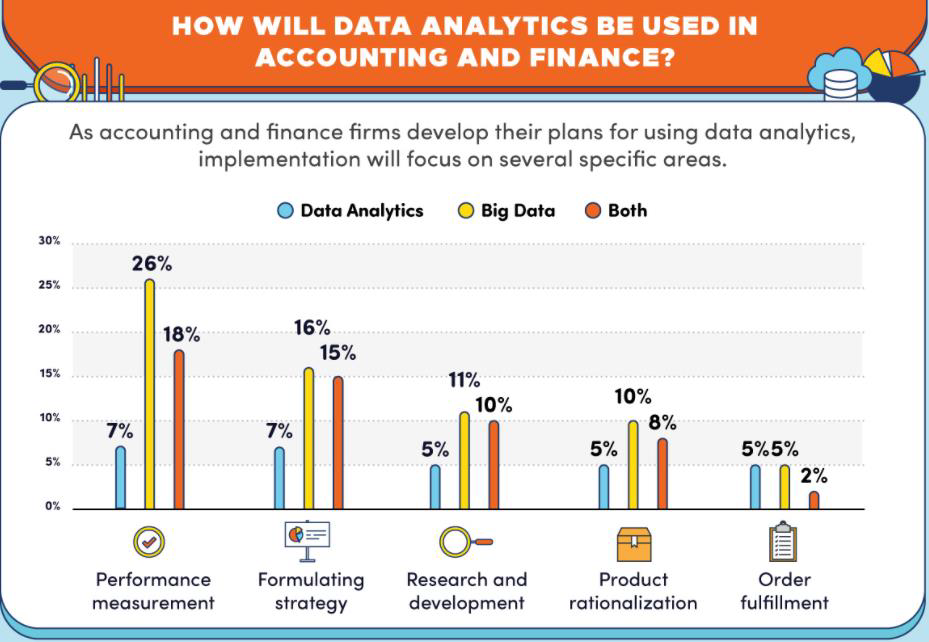

Source: Institute of Management Accountants

On the other hand, technologies have invented a whole new arena of asset classes like Crypto Assets to invest in. When emphasized about improving efficiencies or investments, the majority of people think about automation and Bitcoin. It is not only about these two, instead there is much more to highlight. To name a few:

1. Value creation by Artificial Intelligence (AI):

In the financial services industry, elements driving outperformance can be identified with machine- or code-based identifications which could sharpen the process of financial modeling across different sectors. Needless to say, what importance does financial modeling have in investments?

Further, qualitative factors like behavioral biases can be considered with the help of analytics. Also, analytics that incorporate enhanced privacy protections would foster minimal data usage, or the use of only relevant, necessary, and appropriately sanitized information, in the training of financial models.

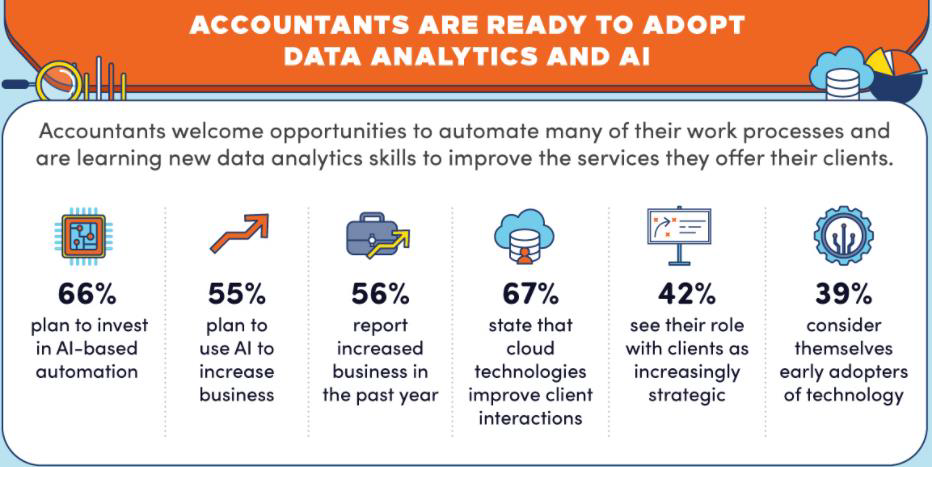

To attain greater operational efficiencies, automating manual tasks and replacement or augmentation of human decisions by advanced diagnostics are soon to be implemented by organizations. Implementation of such processes could help widening the margins.

AI applications have penetrated in all spectra of the industries operations across front, middle, and back offices. To name some, customized products, personalized user experience and analytics services, intelligent service robots and chat interfaces, market trackers, automated transactions, and robo-advisors, as well as alternative credit ratings based on qualitative data, and facial recognition authentication.

Smart processes, enhanced knowledge representation tools, and natural language processing for fraud detection are some of the applications utilized in middle-and-back-office. Last but not the least, AI apps could help prepare firms to resist intrusion onto their territory by expanding technology within firms. A research from Price Waterhouse Coopers elaborates on utilizing analytics Digital intelligence: How to make your analytics functions more efficient and cost-effective

Source: Institute of Management Accountants

2. Disruption with Blockchain:

Distributed Ledger Technology (DLT) allows the recording and sharing of data across multiple data stores. These data stores can be located in different geographies. The transactions and data are recorded, shared, and synchronized across a distributed network of participants and simultaneously allowing public witnesses, who can own their own copy of it.

The data in DTLs can be recorded and synchronized in an immutable manner by using blockchains as well as cryptographic and algorithmic methods.

Increasing, cross-chain technology, would facilitate blockchain interoperability, allowing chains established on different protocols to share and transmit data and value across tasks and industries, including payments processing and supply chain management.

In contrast to centralized ledger, which is utilized by most of the companies, distributed ledgers are harder to attack because of distributed copies. To be successful for an attack, all the copies in the ledger need to attack at the same time. Furthermore, distributed ledgers are resistant to malicious practices of a single party which in turn results in extensive transparency, removes the possibility of cooking up the financial books and eases audit trails for accountants.

Distributed ledgers also reduce operational inefficiencies, speed up the amount of time a transaction takes to complete, and are automated, and therefore function around the clock all days of the week, all of which would reduce overall costs for the entities that use them.

Technologies such as smart contracts, zero- knowledge proof, and distributed data storage and exchange, which are key to existing innovations such as digital wallets, digital assets, decentralized finance (DeFi), and non-fungible tokens (NFT), would continue to play a prominent role.

Moreover, institutional investors and funds are gradually increasing the share of digital assets in their portfolios, widening the access to financing, and utilizing the potential of blockchain and DTL to disrupt established markets. For example, decentralized finance (DeFi), a sort of blockchain- based finance that uses smart contracts to remove the need for a central intermediary, is taking wing.

DeFi based on blockchain technology is accompanying a new era of opportunity, disrupting traditional value chains and structures. As financial policies and regulations transform, DeFi is set to swell.

Please read Research Briefs for Banking Is Only The Beginning: 58 Big Industries Blockchain Could Transform

3. Liberation through Cloud computing:

Usage of cloud computing has skyrocketed through pandemic and is showing no sign of slowing down anytime soon. The shift to remote working has resulted into more businesses utilizing cloud-based technologies.

The three major forms of cloud services are public cloud, hybrid cloud, and private cloud. Public cloud is the infrastructure owned by cloud computing service providers, who sell cloud services to a wide array of organizations or the public. Hybrid cloud infrastructure is configured with two or more types of cloud (private, public) that are maintained independently, but connected by proprietary technology. Private cloud is the infrastructure built for an individual customer’s exclusive use, deployable in the company data centers.

Cloud computing discharges financial companies from non-core businesses such as IT infrastructure and data centers, while enabling access to supple storage and computing services at a reduced cost. At the same time, the cloud is procreating new formats such as open banking and banking-as-a-service, restructuring the age-old relationship between customers and financial service providers. Today, core processes like Credit Risk Management, payment transactions and customer due diligence are moving to the cloud.

Financial institutions will continue to rely on the cloud as they are onboard more graceful capabilities and launch new businesses that require high responsiveness to market and customers, and flexible ease of use. Meanwhile, the at-scale application of big data analytics will boost demand for cloud-based flexible computing, which allows computing resources to be dynamically adjusted to meet shifts in demand.

Apart from offering enhanced security with the help of encrypted data, increasing compliance with applicable accounting standards and legislative constraints, better data management and scalability; cloud-computing also improves sustainability to do a bit for climate change. Cloud technologies are more environment friendly due to its paperless nature which results in less carbon footprinting for an organization.

4. Internet of Things (IoT):

Internet of things is an advanced level of interconnectivity, which is defined as “a system of interconnected devices that communicate with each other and exchange data using the internet, without any human intervention or interaction”.

Financial services industry can be positively impacted by this technology by saving a lot of Time and money spent on gathering and transferring data.

IoT data can be gathered in real-time. This gives organizations a huge upper hand since they can swiftly update customers with relevant information and make important financial decisions. Real-time data can also benefit investment decisions since relevant data can be gathered rapidly. To elaborate, IoT would change the origin of transactional data that proceed into various accounting systems. This means that there will be a huge rush of data that will need to be absorbed into reporting systems. Majority of this data will also be furnished in real-time and will be exhibited on dashboards that aid in decision making and planning. This will open the way for more automation tools to help process and analyze the data.

IoT also helps financial institutions improve their customer experience and better detect any defrauding activity. It can mitigate risk and improve the entire security system in various ways. Such as, IoT has helped mitigate many risks connected with fraud and has helped discover and block the hacked accounts. IoT can assemble user data and analyze the activity, where it is then transmitted to the cloud, where it matches the user’s typical behavioral patterns. In case any unusual data has been observed, the user will be alerted, and the account will become temporarily disabled.

Keeping an eye on the real-time state of the market can help refine investment decision-making. IoT has the capacity and potential to make accurate business projections and track company behaviors. This puts investors at a greater advantage and is completely replacing how the financial world operates. Going forward, many angles of investment banking will be automated and more user-friendly. Moreover, IoT trading will be executed globally using bitcoin, mobile apps, and smart sensors.

Lastly, in financial industry a lot of money has been saved by utilizing Chatbots (carry out 24*7 customer services experience), Smart ATMs (Making banks more efficient and cutting down on employees) and contactless payment (making payments without being present, proved to be beneficial during pandemic).

Source: Institute of Management Accountants

Also read IoT in Banking and Financial Services Market by Solution

Besides the above-mentioned technological disruptions there are many advancements in the industry, which are difficult to identify right now and what turn investment industry would take in future after taking it into consideration.

With the ongoing pandemic, people have started working, collaborating, and connecting remotely. Even the Earning calls and Annual General Meetings were conducted virtually. With the advent of Metaverse, Company Management could think to meet in Metaverse and save time and urge to present physically.

Vision: how the future will look like, what will change and how will it impact consumers and the society.

It is a universal fact that no one can predict the future, it is like Pandora’s box. How the future would shape is difficult to put into words, because we are in transition, and it will continue. No one knows which disruption / invention would impact the financial industry in what manner and to what extent.

However, with the technologies already being implemented its is visible that time can be saved in many ways and repetitious manual tasks can be automated entirely, data / information can be stored and transferred without leakages, trends within the data can be identified easily, financial information is difficult to manipulate leading to transparent books of a company and transactions can be made with just a click while preventing hacking at the same time.

Besides saving time, the skills required by the industry are transforming. Consequences of which can be seen in the job market where highly skilled candidates are in demand who have knowledge in multiple fields. For instance, employees with good financial knowledge are required to learn coding language for automations and analytics to see trends from large amounts of data and to pull out relevant information. If they do not follow the pace of the industry, such employees could become obsolete within 2-3 years. In fact, employers nowadays are spending heavily to train employees with new technical skills so that the huge recruitments they have made in past years does not go in vain due to lack of upskilling.

On the academic side, technical and professional institutes are collaborating with firms so that the internships and vocational training they offer make more sense when graduates look out for jobs in the industry. Such scenarios would continue.

Another aspect to consider is consumerism, which has changed entirely in the past 5 years, nowadays, people have preference for online options. Ongoing pandemic has elevated this preference. Data analytics is playing a major role in defining consumer behavior, products are being sold based on the preferences of the customers. Identifying customer behavior would become more and more accurate and accordingly products and services could be offered.

Contrary to online shopping for products and services, retail and institutional clients in the financial industry prefer brokers / agents being involved while buying financial products. Though many startups have come into picture to gather data and show comparative information at one place, customers still need a word from their agent who can understand their requirements and could offer customized products. Such scenarios show consumers rely more on company representatives.

Demonetization in India in November 2016, has paved the way for many options for making transactions, resulting in many fintech firms and their products in the form of an array of mobile wallets. And the ongoing pandemic has shown a variety of ways to get work done without having physical contact with anyone.

With more disruptions, many economies are now thinking on implementing digital currency as a mode of transactions. Details on its implementation and policies to regulate the same are still areas to be explored more.

Looking at the recent media coverage like space internet, people will be more connected even from the villages where till date there is no phone connectivity. People in such deserted areas would then be able to benefit by contactless transactions and more available information. Firms would be able to think of setting up their offices in such regions, innovations in these regions could get more audiences.

Accumulating all these changes would contribute to the society and economy in many aspects. Automation and analytics could contribute to arriving at decisions where earlier a lot of time was spent in gathering and processing the data and analyzing the same.

At an individual level, people would start thinking in terms of making oneself more employable so that they can keep pace with the changing environment.

Lately, sustainable finance has made ways to the ears. Organizations could minimize their usage of equipment and could become paperless, so that they contribute a fair share towards Environmental responsibilities. Additionally, new techniques could lead to alternative sources of fuel, which is renewable and more reliable in future, reducing their carbon footprint. The Financial Industry would have more options to implement sustainable projects by financing them and including issuance of such projects funding in the form of Mutual Funds or Separately Managed Accounts.

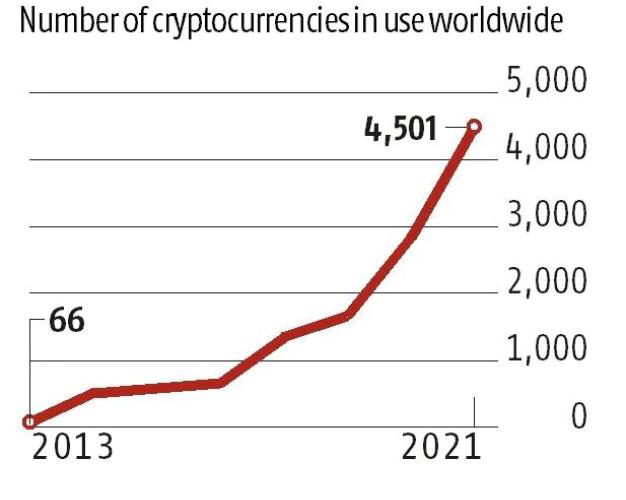

Lastly, Crypto assets has become a whole new vertical yet to be explored. With more and more information available, people are learning about these assets, how these assets work and how to invest in the same. The Governments are trying to identify pros and cons of such instruments and their impact on investors as well as on industries, its competition. Policies and regulations to tax these assets and their regulation are still a black box. Lot of analysis is required before making such investments.

Data for 2018: March; 2019: November; 2021: February

Source: Business Standard

My contribution towards shaping this future

Being an experienced CFA charter holder, I have a good understanding of the industry and its trends. I have noticed the collaboration of technologies along with the finance, what kind of decisions are being made at Management level and the same are implemented at ground level. Spending some time within the industry has given me great exposure in various verticals of finance.

The most important step towards this collaboration is contributing towards the CFA curriculum in this aspect. Until and unless people who are working in the industry do not contribute, the curriculum would not be up to date with the same pace happening in the industry.

The next step in my opinion is helping candidates in comprehension of these technological advancements within day-to-day jobs / professions. I have taken this opportunity to explain some of the advancements to my colleagues in my current as well as previous roles, which has not only helped my colleagues in correlating different aspects of technology with Financial Industry but also has helped me in thinking what kind of other disruptions could come into picture.

Further, in my current profile, I have suggested many ideas like how and where we could reduce time by automating multiple steps followed for checks and reconciliations. I was able to initiate new ideas with the development team where the processes and operational tasks were automated. My objective to do Python Certification was to seek the technical capabilities utilizing Python, which is one of the widely used programming languages.

Lastly, I am researching Crypto assets like Blockchain, Ethereum and similar platforms, as I believe investing in these platforms is more valuable than that of coins supported. Based on the functionality these platforms offer. Therefore, I believe in the near future I would be able to elaborate more on this aspect.

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”