- November 17, 2020

- Posted by: CFA Society India

- Category:BLOG, Events

Speaker: Amay Hattangadi, CFA, Managing Director, Morgan Stanley

Moderator: Ritika Mankar, CFA, Director, CFA Society India

Contributed by: Soham Das, CFA, Volunteer, CFA Society India

Sharp Investing demands sharp insights. Sharp insights in turn ask for deep experience.

So, when Amay Hattangadi presided over the Sunday session of 4th VIP conference, it promised to be an electric session. And why not? With 22 years of experience, detecting mega trends for Morgan Stanley, Hattangadi had much to share with the audience.

He generously shared some of the trends that he is seeing unfold, in South East Asia and knocking on the doors of India.

Moderating this session was Ritika Mankar, CFA, a formidable macro observer in her own right. She brought her own experience in themes to the session, and added a context for the larger audience.

He elucidated 6 trends that he sees shaping the world around us, and these were:

#6: The Rise of Retail Investors

Image Source: Robinhood

Hattangadi identifies the rise of retail “do-it-yourself” investors as a force to reckon with.

The potent cocktail of low-cost leverage, almost zero tax, zero brokerage, and fractional shares may have fuelled this trend, but the trend is powerful enough to not ignore it anymore.

He wondered aloud, why should a retail investor buy a mutual fund at all, when they are able to diversify at a much lower cost.

For some context consider these stats, culled from independent sources:

At 4.3MM trades per day, Robinhood clients make more trades than other bigger players like Charles Schwab and E-trade. Combined.

If that is not shocking enough, consider this:

Business Insider has called out the media age of Robinhood users at 31 years old, with an average account balance of $4,800. That is a flow $48billion ($4,800/account x 2 million accounts) straight away.

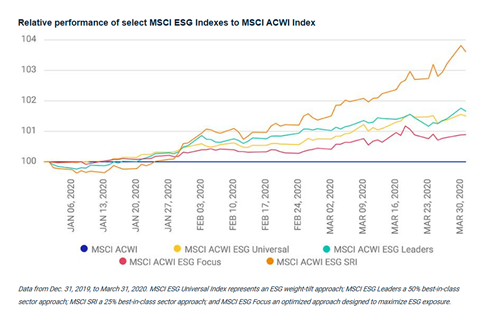

#5 The Rise of ESG Investing

Source: https://www.koreatimes.co.kr/www/biz/2020/08/175_291636.html

“We need to start to talk about money in ways that dethrone it and make it subject to human ethics and standards of love and decency.” – Joel Solomon, The Clean Money Revolution

Active flows have been negative ever since Jan 2019. Significant (asset) redemptions were made from active funds in the recent times.

But, the flows into ESG funds have only seen a ramp up in the same period.

This is the next big trend- the rise of ESG Investing. Tracing the history and contrasting it with his own experiences, he reminded us, that governance consideration were always there.

Now with environment and social together joining in, the idea of ESG has full formed in the minds of institutional investors.

In Q1’20 (CY), ESG investing indices have trumped base indices.

#4 Everything is technology

Source: https://www.bigfootcap.com/a-review-of-why-software-is-eating-the-world/

In 2011, Marc Andreessen observed, “Software is eating the world”, he was not very far off. Hattangadi, concurs.

The rise of global merchandise value in software, proves his point. This value accounted for $1.4B in 2015, posting a growth of 11%, and today it is at $6B growing at 15%.

Leisure Brands, like Nike and Adidas are transforming themselves fast into digital ready companies. Domino’s is shaping itself to be a consumer predictive analytics company which also serves pizza.

But high technology apart, China and South Korea is fast adopting technology even at a retail household level. These two countries led some of the Western ones, in e-commerce penetration by country, at 35 and 33% respectively.

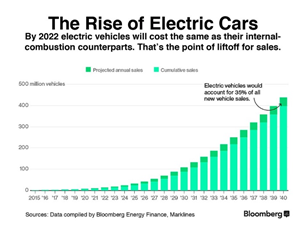

#3 The Rise of Electric Vehicles

This is the third key takeaway from the talk. The mega trend of our generation. Along with the rise in environment consciousness and triple bottom line, is the shift towards greener cars.The migration from internal combustion engine to electric vehicles has continued unabated even though oil has dropped to record lows. Indeed, the dropping oil did make Hattangadi circumspect on the longevity of the trend.

But he admits, he was pleasantly surprised as E.Vs continued to grow, while growth of conventional cars sputtered to a halt.

Pulling a dramatic chart he foresees electric vehicles pulling ahead of conventional cars sometime by 2030, while the ratio was overwhelmingly 100% in favor of the conventional ones in 2015.

Electric vehicles, comprising of battery electric vehicles and hybrid ones, are fast stealing the market share away from conventional ones and it is only bound to accelerate going further.

#2 The Rise of Cultural Export

Source: https://en.wikipedia.org/wiki/BTS

One of the most paradoxical trends elucidated in the talk was the rise of “virtual export”, in the form of cultural exports. Cultural exports like, K-Pop was a small portion of total exports made by South Korea back in 2013, exceeded by air conditioners by almost 3:1. Today cultural exports exceeds material good exports by 1.27x.

This is a surprising statistic and assumes a larger importance in the backdrop of the recent IPO of K-Pop label- Big Hit of popular K-Pop boy band, Bangtan Sonyeondan(BTS).

Such cultural exports have the ability to create highly passionate clients and the growth of subculture becomes almost viral in nature. This plays out in many ways, all advantageous for the economic prospects of such a company.

#1 The Rise of Virtual Products

Source: https://www.nintendo.co.uk/Games/Nintendo-Switch-download-software/Fortnite-1388372.html

Perhaps the most surprising trend that Hattangadi pointed out was, the stunning growth of virtual products.

What are virtual products?

Virtual products are products with no tangible existence, but exist only in the virtual environment. The ‘commerce’ done primarily via in-game, or in-app purchase, it improves the overall experience.

The explosion in the market of virtual products has created a mega trend and a new avenue of commerce.

Sample this: Between 2014 to 2019, hardware market has grown at an anemic 4% CAGR, while virtual products have exploded ~4x, compounding at 29% CAGR. Of course, such products have a large market to ride on, as the video game market is bigger than movies and music market, combined.

Growing at 20-30% year over year, the veteran observes, virtual products offer a very robust, anti-fragile trend to profit from.

The Post-Script

As the talk wrapped up, the audience had plenty of questions and Ritika Mankar chose the most insightful ones to push forward further the conversation.

“With all the structural problems around Indian business ecosystem today how can an Indian investor invest?”

Hattangadi’s response was both interesting and astute. While acknowledging the problem around investing in them, he offered that investors can very well avoid companies that can get disrupted by these trends.

“What really are the moats of the virtual products”

Hattangadi elaborated, that he broadly thinks in terms of three layers – studio model, platform-content model, and medium play. The advantages of all the three models are different.

A common theme that emerged from many of the questions was the lack of scale of Indian companies. Circling back, Mankar added – only 4% of listed space have revenue more than 100B INR. What gives?

Hattangadi is optimistic and believes the scale can come as the ecosystem matures and most importantly as it becomes organized.

The Wrap Up

Over the course of 90 minutes, Amay Hattangadi walked us through 6 trends that he is observing pan out in Asia. 6 trends, spanning from ESG investing to Fortnite skins. 6 trends, that will seem alien to anyone not familiar with them.

Ralph Waldo Emerson, poetically said, the mind, once stretched by a new idea, never returns to its original dimensions. It is now impossible for us, investors to ignore these trends as they ‘threaten’ to pan out. That, I think, is the greatest contribution of Amay Hattangadi as the Sunday morning session of 4th Value Investing Pioneer conference concluded.