- January 19, 2024

- Posted by: CFA Society India

- Category:ExPress

Written by

Mihir Shirgaonkar, CFA

AVP - Alternative Investments, Phillip Ventures IFSC Pvt. Ltd.

Member - Public Awareness Committee, CFA Society India

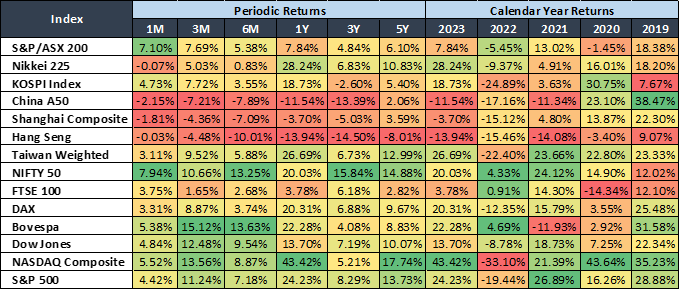

The Year Gone By | Introduction

The investment landscape in 2022 was marked by widespread pessimism among professionals and investors alike, driven by inflation prints at their highest in decades across economies and the subsequent stringent policy responses by their respective central banks. This phase of economic turmoil significantly impacted equities and various other asset classes, only casting a shadow of uncertainty over 2023. However, contrary to the gloomy forecasts, 2023 unfolded as a remarkably successful year for equities, particularly in the United States, Japan, Taiwan, Brazil, Germany, and India, among others. This turnaround highlighted not only the resilience but also the dynamic nature of global markets.

Source: Investing.com | Local Currency Returns as of December 29, 2023. Returns greater than 1 year are annualized

Although the robust performance of equity benchmarks in 2023 further reinforced the rationale for allocating to global equities, the year also saw a notable surge in interest in US dollar-denominated bonds and US treasuries among affluent Indian investors and family offices.[1] This article explores the key factors driving this growing preference for constructing USD portfolios with an increased focus on global bond investments.

Making of the Hawk | Factors at Play

The growing demand for dollar-denominated global fixed income can be attributable to a surge in treasury yields in the United States and the strengthening of the US dollar relative to other currencies. We now discuss the key factors leading up to this outcome:

Unprecedented Stimulus:

The first responses to the COVID-19 pandemic included the following actions by the US Federal Reserve[2]:

- Policy Rate: By way of unscheduled meetings in March 2020, the FOMC of the Fed slashed the federal funds rate to near zero to substantially lower the borrowing costs for households and businesses and to stimulate spending and investment when the economy would recover from the crisis.

- Stabilizing Financial Markets: The Fed purchased approximately $1.7 trillion in Treasury securities during March-June 2020 and increased the buying of mortgage-backed securities to ensure smooth functioning and liquidity in the financial markets.

- Supporting the Flow of Credit: The Fed introduced several temporary lending and funding facilities to maintain the flow of credit to businesses, households, and communities.

These substantial stimulus measures, however, were just the initial steps in a series of economic interventions by policymakers in the United States. In response to the pandemic, Congress approved stimulus bills totaling USD 5 trillion, representing an unprecedented infusion of federal funds into the US economy, the largest infusion in recorded history.[3]

Multi-decade High Inflation:

In 2021, the US experienced a sharp increase in inflation, as measured by changes in the Consumer Price Index. The annual inflation rate rose from 1.7% in February 2021 to over 5% in June 2021, peaking at about 9% in June 2022. Rising commodity prices and global supply chain disruptions coupled with a surge in energy and food prices were the dominant factors driving the rising inflation. Despite these shocks slowly receding, annual inflation continued to remain high due to tight labor markets and persistent growth in wages. This shift suggested that the rising inflation may not be transitory and would require yet another policy intervention to be brought under control.

Aggressive Monetary Tightening:

In March 2022, the US Federal Reserve hikes its policy rate by 25 basis points. Between March 2022 and July 2023, the Fed carried out a series of rate hikes taking the federal funds target range to 5.25-5.50%, the highest in 22 years. The change in the policy rate during the said period is also considered the most aggressive tightening cycle carried out in decades by the American central bank in the US. Central banks of most of the other major economies followed suit.

Thinking Beyond Equities | A Case for Dollar-based Fixed Income

Following the aggressive tightening by central banks, global equity markets experienced significant volatility throughout 2022, amid expectations of recessionary trends. The latter half of 2022 and the entirety of 2023 observed a moderation in US inflation, characterized by a consistent slowdown in core price increases. While policy rates have remained steady since July 2023, the Federal Reserve has signaled its intention to maintain rates higher for an extended period, aiming to achieve a 2% long-term inflation target. These policy measures by the Fed led to the creation of opportunities in two key asset classes: Fixed Income and Currency:

Fixed Income

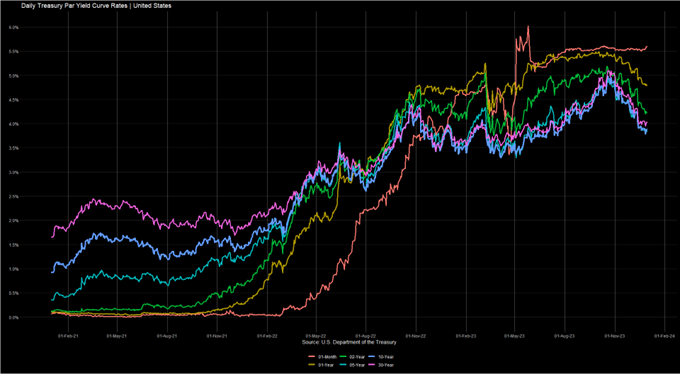

- The backdrop: As the Federal Reserve progressively raised the Federal Funds Rate in the US, treasury yields have surged steadily since early 2022. The yields on shorter-term Treasury bonds rose more rapidly when compared to those on longer-term maturities, leading to an inverted yield curve.

- The outcome: The 2-year US Treasury Bond has consistently offered a higher yield than the 10-year US Treasury Bond throughout 2023. This inversion of the yield curve has made short-term treasury bonds more attractive than their counterparts of longer maturities, particularly because the risk-free rate in the United States presently yields 5.33% in USD terms.

- The Expectation: Investors are looking at considerable gains should treasury yields start declining in line with the rate cuts that are expected to commence in 2024. A fall in yields will increase the value of bonds, causing investors to capture an upside on the value of the bond, over and above the coupon payments.

Currency

- The backdrop: The US Federal Reserve distinguished itself as a central bank that was not only faster but also more aggressive than other central banks when it came to implementing rate hikes that started in the early part of 2022.

- The Outcome: The US dollar witnessed sharp appreciation relative to the currencies of major economies, reflected in the surge in the US Dollar Index. For resident Indian investors, the depreciation of the Indian rupee against the US dollar only validated their preference for having USD-denominated assets in their portfolio.

- The Expectation: Despite the aggressive rate hikes, the US economy has witnessed strong growth on the back of robust consumer spending. On the other hand, monetary tightening by the European Central Bank has resulted in economic stagnation and a sharp decline in demand in Europe[4], making a case for monetary easing. Should other central banks start implementing rate cuts before the US Federal Reserve, the US dollar will most likely witness modest appreciation in the near term. A strengthening US dollar will result in investors ending up with a higher value of their investments in their local currency.

Thus, the anticipation of declining US treasury yields coupled with continued strength in the US dollar makes USD fixed income an asset class of choice.

Instrument of Choice | Fixed Income Funds in 2023

Amid moderating yet high inflation, the momentum of monetary tightening continued into 2023, albeit at a more measured pace. In 2023, the Federal Reserve upheld a hawkish stance, executing four additional rate hikes, each at 25 basis points. The period starting November 2023 saw yields on long and short US treasures decline as traders started anticipating rate cuts in the first half of 2024[5]. Falling yields resulted in notable gains across various Fixed Income categories. The following is the performance of a few categories of Fixed Income, each represented by a USD-denominated ETF traded on the American Exchanges[6]:

The last two months of 2023 saw a surge in optimism for Fixed Income as an asset class, propelled by a series of favorable developments. These included a continued easing in inflation rates, the enduring resilience of the economy, and a shift in the interest rate outlook for 2024 as signaled by the US Federal Reserve.

In the realm of fixed-income investments, Bond ETFs garnered significant attention, attracting USD 209 billion in 2023, representing 35% of the total net inflows across all ETF categories. A notable trend among investors was the pronounced preference for longer-duration bond portfolios, driven by expectations of substantial rate reductions in 2024. Accordingly, the intermediate-duration core bond category saw the most inflows during the year, closely followed by long-duration government funds.

Treading with Caution | Conclusion

One of the main reasons for a growing preference towards USD treasuries and bonds is the anticipation of significant rate cuts in 2024 – a scenario that may not fully materialize if the economy continues to demonstrate robustness, consumer spending remains elevated, and inflationary pressures persist. In such a case, interest rates could be maintained at higher levels for an extended period, leaving investors only with modest coupon payments for a long stretch of time. Even if more than expected rate cuts are to happen, the US dollar will likely weaken in the short term, subject to the policy actions of other central banks. This will reduce a portion of the returns made on following yields when converted into the investor’s local currency.

Given this uncertainty, investors would be better off exercising caution, balancing their optimism with a strategic awareness of potential market shifts, and ensuring their portfolios are resilient and adaptable to changing policy landscapes.

References

[1] Sood, Deepak. (Updated 2024, January 01). Bonds Sans Borders: Affluent Indian investors embrace global debt for diversification. Moneycontrol. Link

[2] Ihrig, Weinbach, and Wolla. (Updated 2020, August 12). How the Fed Has Responded to the COVID-19 Pandemic. Federal Reserve Bank of St. Louis. Link

[3] Parlapiano, Solomon, Ngo, and Cowley. (Updated 2022, March 11). Where $5 Trillion in Pandemic Stimulus Money Went. The New York Times. Link

[4] Zaidy, Hanna. (Updated 2023, October 26). ECB pauses rate hike campaign as recession in Europe looms. CNN Business. Link to Article

[5] Kinderlin, Sophie. (Updated 2023, December 01). Treasury yields decline even as Powell says rate-cut speculation is ‘premature’. CNBC. Link to Article

[6] Jackson, Ryan. (Updated 2024, January 03). ETFs Cap Off Another Year of Inflows in Style. Morningstar. Link to Article

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”

About the Author

Mihir Shirgaonkar, CFA heads the Alternative Investments division at Phillip Ventures IFSC Pvt. Ltd. and has been a part of the firm since 2021. He is a Chartered Accountant and has completed MBA-PGPX from the Indian Institute of Management Ahmedabad. He has over 8 years of asset management experience and has worked with DSP Investment Managers (erstwhile DSP BlackRock) and HDFC AMC in his previous roles. In his career so far, he has handled multiple areas which span portfolio management, market making, valuations, fund administration, and project management. His other interests include philosophy, reading, photography, trekking, coding, cooking, and travelling.