- April 18, 2024

- Posted by: CFA Society India

- Category:ExPress

Mihir Shirgaonkar, CFA

AVP – Alternative Investments, Phillip Ventures IFSC Pvt. Ltd.

Member – Public Awareness Committee, CFA Society India

A Potential Supercycle | Introduction

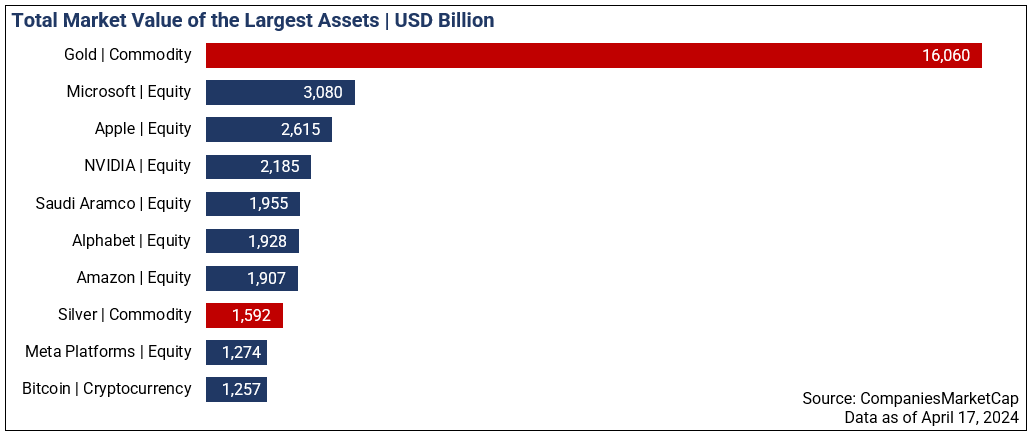

Gold is currently the largest asset by total market value. At over USD 16 trillion, the yellow metal is valued at more than five times the most valued public company Microsoft. At the time of writing this piece – and likely as readers peruse this article – gold is trading near its all-time high. Silver also finds a place in the list of the ten largest assets by value. On the other hand, base metals have had a noticeable run on exchanges globally, with Copper being the most prominent of them, which trades above USD 9,000 per tonne on the London Metals Exchange. The growing focus on metals has ignited discussions among investors and advisors about whether the recent rally indicates the start of a commodity supercycle. Certain metals seem poised to benefit from trends evolving in this decade. Consequently, investment professionals thoroughly contemplate the role of metals far beyond a tactical play in the overall portfolio construction. In this article, we will delve into the short-term trends that have placed metals at the forefront of deliberations, as well as the long-term considerations for evaluating metals as a strategic asset allocation.

Short-Term Trends | Metals in the Pandemic Years and Beyond

At the onset of the current decade, metal prices plummeted sharply due to widespread panic triggered by COVID-19 across asset classes. However, as initial fears subsided and markets began to stabilize, there was a dramatic and sustained surge in metal prices. The rally in metals continued till March 2022 amid monetary stimulus and ultra-accommodative policies employed by central banks globally. Here are some of the short-term trends observed in metals:

- The Pandemic and the Initial Recovery: In May 2021, metal prices had seen an increase of 72% overall over their pre-pandemic levels. In inflation-adjusted terms, this rally led to metals reaching a nine-year high with industrial metals such as copper, iron ore, and nickel leading the pack. On one hand, manufacturing recovered faster than services, particularly in China. On the other hand, supply-side pressures had already built up as a result of pandemic-led disruptions that included congestion at major ports, quarantine restrictions, challenges in staffing shipping crews, and a rebound in fuel prices, all adding to the cost of metals.[1] Soaring demand for metals and their constrained supply continued fuelling the rally into the initial months of 2022.

- Monetary Tightening by Major Central Banks: In March 2022, the US Federal Reserve initiated what would eventually become one of the fastest and the most aggressive monetary tightening exercises in decades. Historically, metals and the US dollar have largely exhibited an inverse relationship. The appreciation of the US dollar amid successive rate hikes exerted downward pressure on metal prices, which saw declines during the period of tightening exercise.

- A Potential Weakening of the US Dollar: In its March 2024 FOMC meeting, the US Federal Reserve suggested potential interest rate cuts later in the year while acknowledging a downward trend in inflation. An anticipated weakening of the US dollar amid the projected easing of the monetary policy has contributed to strong gains in gold and other metals in recent months.

Long-Term Considerations | Exploring Metals as a Strategic Asset Allocation

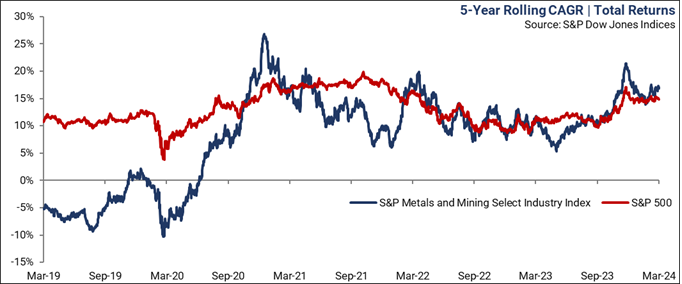

Financial markets have witnessed not only strong gains in the prices of metals but also superior returns on equities of companies operating in the business of metals and mining. An investment theme otherwise considered value-destroying has delivered returns comparable to the S&P 500 over a longer time frame. This global trend in the metals and mining space is visible in Indian equities as well, with the NIFTY Metal index outperforming the broader equity markets in recent times.

The following are some considerations that make the case for metals as a potential strategic allocation:

- Role of Metals in Energy Transition: During the 2023 United Nations Climate Change Conference (COP28), the United Nations Secretary-General António Guterres announced plans to establish the Panel on Critical Energy Transition that will be tasked to ensure a sustainable transition to renewable energy. He also added that the demand for metals such as copper, lithium, and cobalt is set to increase fourfold by 2030, stressing the need for nations to commit to tripling their renewables capacity by 2030.[2] According to author Guillaume Pitron, supporting the shift of our energy model will require extracting more minerals over the next 30 years than mankind has extracted in the last 70,000 years.[3]

- Gold as a Safe Haven Asset: There are concerns about the stability of the national debt in the United States which currently stands above USD 34 trillion. These concerns have propelled the ‘debt debasement’ trade wherein investors seek protection against a potential weakening of the US dollar. Gold remains the safe haven asset of choice for investors seeking diversification away from the US dollar. Central banks globally have been significantly adding to their reserves of gold. According to the World Gold Council, China increased its gold by most in 2023 by adding 224.88 tonnes.

- Likely Transition to an Inflationary World: There have been deliberations about the current decade being characterized by inflation not seen in the preceding decade. Large-scale fiscal stimulus, such as government spending on infrastructure, social programs, and other public services, can result in a demand-supply mismatch. Fluctuations in the prices of energy sources, particularly oil and gas, also have a significant impact on inflation. A combination of these factors can potentially drive more allocations toward gold and other metals as investors seek a hedge against inflation.

Resources:

[1] Stuermer and Valckx. (Updated 2021, June 8). Four Factors Behind the Metals Price Rally. International Monetary Fund.

Link to Article: https://www.imf.org/en/Blogs/Articles/2021/06/08/four-factors-behind-the-metals-price-rally

[2] Quiñones, Laura. (Updated December 02, 2023). COP28: Extraction of minerals needed for green energy must be ‘sustainable and just’, says Guterres. UN News.

Link to Article: https://news.un.org/en/story/2023/12/1144267

[3] Mai-Xuan. (Updated 2023, October 23). 3 critical metals that are essential for the energy transition and whose demand is set to soar by 2030. Alcimed.

Link to Article: https://www.alcimed.com/en/insights/critical-metals-energy-transition/

Conclusion

The role of metals in supporting the next leg of global growth highlights their relevance in present as well as future market scenarios. Metals as well as businesses operating across the metals value chain have not only rebounded sharply from initial pandemic-induced drops but have also been propelled by factors ranging from shifts in economic regimes to the critical roles they play in energy transition. The evolving global landscape, thus, underscores the relevance of metals in present as well as future market scenarios.

About the Author

Mihir Shirgaonkar, CFA heads the Alternative Investments division at Phillip Ventures IFSC Pvt. Ltd. and has been a part of the firm since 2021. He is a Chartered Accountant and has completed MBA-PGPX from the Indian Institute of Management Ahmedabad. He has over 8 years of asset management experience and has worked with DSP Investment Managers (erstwhile DSP BlackRock) and HDFC AMC in his previous roles. In his career so far, he has handled multiple areas which span portfolio management, market making, valuations, fund administration, and project management. His other interests include philosophy, reading, photography, trekking, coding, cooking, and travelling.

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”