- May 7, 2020

- Posted by: CFA Society India

- Category:BLOG, Events

Speaker: Nitin Bhasin -Head of Research, Ambit Capital

Moderator: Shreenivas Kunte, CFA, CIPM – Director of Continuing Education and Advocacy, CFA Institute

Contributed By: Srividhya Venkatesan, CFA, Public Awareness Committee of CFA Society India

India has witnessed several domestic companies getting listed on the bourses and growing to become strong global brands today. Some of these companies like Infosys, TCS, HDFC Bank, etc. have become long time return generators and wealth creators for its shareholders.

Through this webinar, the speaker has covered certain important aspects of how to evaluate an issuer company and valuing its IPO so that investors can make an informed investment decision.

Indian IPO Market Overview

“An IPO is like a negotiated transaction – the seller chooses when to come to public – and it’s unlikely to be a time that’s favorable to you” – Warren Buffett

Traditionally,the bull market witnesses a lot of IPOs hitting the market. In India too, the period of rising market (e.g. FY 03-08 and FY 14-18) saw a significant rise in the number of IPOs hitting the market and they dropped drastically during the bearish period (e.g. FY 09-13).

The chart below reflects the IPOs journey in India (timeline series of IPOs from FY 2003 to FY 2019)

In FY 03-08, the number of IPOs along with the markets was booming, and large caps (at that time ~INR 10,000 Cr market capitalization) dominated the IPO market. This was followed by a dull period (FY 12-16) and by FY 18 there was a spike in IPOs again, as the market bounced back but with much larger sized IPOs. As can be seen from the above chart, IPOs also go through market cycles.

Unlike the US, India doesn’t have many loss-making IPOs or tech IPOs getting listed. Most of the companies getting listed in India, have assets on their balance sheet and a historical track record of earnings, which makes its IPO valuation much easier.

Performance of Issuer Companies – IPO Returns

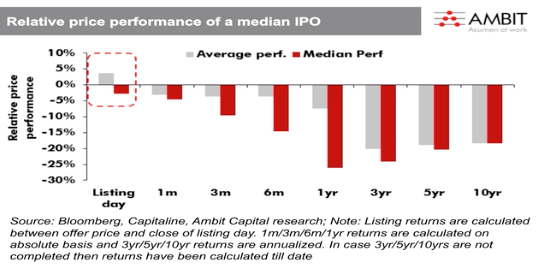

Everywhere in the world, the IPO returns possibly look very similar.

As can be seen in the chart above;the average returns generated are positive only on the listing day. Over time, returns from the IPOs decrease, indicating a significant overpricing of these IPOs.There have been several IPOs that have given supernormal gains on listing, but these are few and far between.

Hence, the quality of IPOs that comes for listing, plays a very important role in generating a long time stock returns and wealth creation.

Quality of IPO

- RoCE of companies, in the year of IPO listing, is one of the best metric to evaluate the quality of the Issuer Company

- As can be seen in the pie chart, closer to 55-60% of the Issuer Companies, had a RoCE of more than 15% (32%+26%)

- This means some very good quality IPOs were launched in the Indian stock market unlike the other parts of the world like the US or China

- The second metric for evaluating an Issuer Company, is its growth prospect

- Many of these Issuer Companies project to grow larger over 10-15 years

- If we check the vintage of the Nifty Index, we would notice that almost 2/3rd of the constituents were listed more than 15 years ago

- Indicating that it typically takes a long time for a company to grow large enough to become part of the Nifty Index

- When investing in an IPO, this growth aspect should be evaluated properly

IPO Returns – Examples

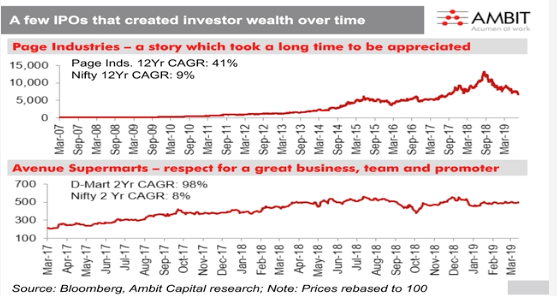

(a) Examples of IPO that generated returns

Generated Investor Wealth

Page Industries: Initially listed as a textile company. It started getting valued as an innerwear brand almost 7 yrs post listing. Even after correction, around Sept’18, the 12 yr CAGR (till Mar’19) was 41%

Avenue Supermarket:Generated very high returns and has been a consistent performer

Long Term Investments

TCS :Took time for leadership to be appreciated. Has been a consistent performer in the last 10 years (2009-19)

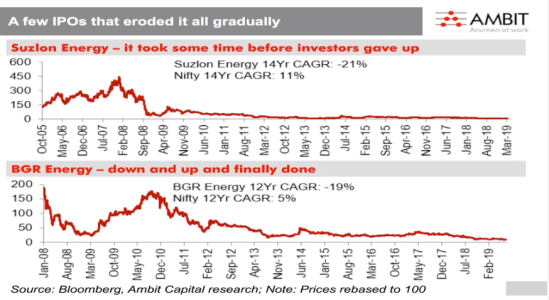

(b) Example of IPOs that eroded value

Looking at the IPO returns chart and the above examples of some of the recent IPOs, it brings us to the key question of how an Individual Investor should diligence an Issuer Company and check its IPO pricing.

How should an Issuer Company be evaluated?

- Diligently read the draft prospectus, its corporate website, management interviews and any published financials

- Assess attractiveness or lack thereof vis-à-vis industry peers

- Assess KMP (Key Managerial Personnel), team and promoter family – understanding people running the business

- Use financials of industry/peer, to make a judgment call and estimate how the company would evolve since forward-looking estimates are not publicly available

- Valuing company using DCF for the next 10 years and pricing the near-term valuation using relative valuation

Some Important factors to keep in mind while reading a Draft Prospectus

- DRHP is a very informative document that offers a lot of details about the company

- Key aspects to be checked include risk factors (both imaginable and non-imaginable), legal issues about the company-KMP (Key Managerial Personnel) -Board, related party transactions, business performance over last 3 years, industry analysis and relative peers, the reason for going public and use of proceeds, any further dilution proposed (further Offer-for-sale), etc.

- These points act as filters while evaluating the Issuer company

Key Filters for evaluating the company

(a) Accounting and Corporate Governance

- Access the key accounting ratios used in the industry – with a focus on cash flows and funding for expansion

- Assess corporate governance – managerial remuneration, auditor quality, capital allocation through cycles, board composition (over the last couple of years), disclosures and simplicity/complexity of group structure

(b) Company and Management

- Understanding genesis of company and evolution

- Family and professional management team involved, employee retention policies and ESOPs

(c) Primary Data Checks

- Search for information on company and management on the internet – networks like LinkedIn, product surveys, etc.

- Face-to-face channel meetings, ex-employees, industry conferences, suppliers, customers and competitors

- We should be aware of bias and look at a reasonable sample size

(d) Assess competitive advantages and the sustainability thereof

- Use John Kay’s Innovation, Brand, Architecture and Strategic Assets (IBAS) framework to analyze the firm’s competitive advantage

- Innovation is the most tenuous source of a competitive advantage

- Brand or reputation gets built over decades and hence is a very powerful source of competitive advantage and can become a strategic asset

- Architecture involves understanding a firm’s distinctive style, ethos, and relationships with suppliers and distributors

- Strategic assets include natural monopolies, intellectual property, licenses, etc.

Valuation and Pricing of an IPO

Business Valuation and IPO Pricing are not the same

(a) Valuation of the Business:

- Estimate operating cash flows, growth rates and risks

- Can the company use its competitive advantage to lengthen its competitive advantage period or enter adjacencies?

- Don’t lose track of reinvestment rates to grow an asset, working capital or intangible needs can impact free cash flow and RoCE

- Equity-raise and de-leveraging from IPO to be incorporated in valuations

(b) IPO Pricing

- Mostly done on a relative basis by establishing similarities/dissimilarities around scale, market leadership, opportunity, management and near-term earnings growth

- Frequently used multiples are P/E, P/B and EV/EBITDA; these need to be adjusted for idiosyncrasies

- Comparable from same industry may be missing domestically; the global universe and companies similar on business characteristics available domestically

Key Takeaways

When making an investment decision, the quality of the management and the business is very important.

Investment in an IPO should not be purely based on the backing of a Private Equity investor, large and long anchor list or high over-subscription (specifically on the last day). When investing in IPOs, it’s very important to do proper diligence on the Issuer Company and its management from sources like Draft Prospectus, management interviews, internet coverage, etc. Pricing should be checked and compared with peers based on similarities/dissimilarities and accordingly an informed investment decision should be made.

Watch webinar at : https://cfainstitute.org/research/multimedia/2019/practitioners-insights-valuing-ipos