- April 22, 2020

- Posted by: Shivani Chopra, CFA

- Category:BLOG, Events

Speaker : Nimisha Pandit, CFA, Associate Director and Head of Equity Research at Multi-Act Trade & Investments Pvt. Ltd

Moderator: Anil Ghelani, CFA, Vice Chairman, CFA Society India (IAIP) and Senior Vice President, DSP Mutual Fund

Contributed By : Shivani Chopra, CFA

Webinar notes-

Valuation Methods-

- Conventions of valuation (Market based)

- Historical valuation- Use of company’s past price multiples

- Relative valuation – Can be used when historical valuation is not available or relevant. Also, when market participants want to assess the relative expensiveness or cheapness of a company as compared to its peers

- Normative valuation (Absolute)

- Discounted Cash Flow (DCF) – Used to estimate company’s true intrinsic value.

- Net assets valuation – Methods like Replacement cost of assets (RCA), Book value (BV), NAV, etc. are used

- Which method to choose during distressed times- Use normative /absolute valuation methods:

- In a trend market either bull or bear market, the historical prices/multiples reflect the current or recent sentiment. So, as long as the market continues to hold that sentiment, historical valuation might be right but once the attitude of investors changes, the historical reference point also changes. The market sentiment has indeed changed post the outbreak of Covid-19, hence its prudent to employ absolute valuation models

Valuation Tools- One size doesn’t fit all

- Valuation methodology of a company should be chosen given the unique dynamics of that firm. Focus on quality of a company and nature of business-

- Pay close attention to quality of earnings, cash flows, strong or weak balance sheet, sustainable company advantage, barriers to entry, etc.

- Check if the company can survive during economic downturn

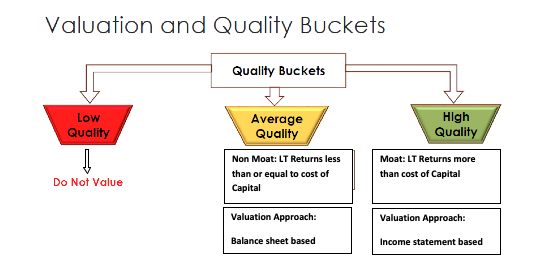

Classification of companies based on three quality buckets

Companies can be classified as low quality, average quality or high quality.

- Bucket #1 (Low quality) – Companies suspected to have engaged in accounting manipulations or having untrustworthy management. Red flags could be lack of Free Cash Flows(FCF), poor returns, excessive leverage, suspicious related party transactions and complex structures like lot of subsidiaries, cross holdings, etc. Read more about the quality of earnings – (a) Book titled “Financial Shenanigans” by Howard M. Schilit or (b) Blogs available on CFA institute website and Multi-Act website

All other companies can be placed in remaining two buckets depending upon sustainable competitive advantage like “Economic moat”

- How to determine if a company has an economic moat or not- seek an answer to the below:

- “Can a competent and well financed entity enter into this business and compete effectively with the existing players ?”. If the answer is “yes”, then it is a non moat business else it is a moat business

- Read more about this topic by going through, (a) Warren Buffet’s letters to shareholders, (b) Pat Dorsey’s “The Little Book That Builds Wealth” or (c) Blogs available on Multi-Act website

- Bucket #2 (Average quality) – Place all non-moat businesses here. They will generate long-term returns less than or equal to cost of capital.

- Bucket #3 (High quality) – Place all moat businesses here. They will generate long-term returns more than the cost of capital

Valuation and Quality Buckets

The idea behind classifying companies in these buckets is to identify the valuation methods appropriate for each set of companies. One should avoid low quality companies and hence there is no need to conduct a valuation exercise. Use asset based methods to value average quality businesses and income statement based methods to value high quality firms

- Bucket #1 – Stay away from such companies. If the quality of earnings is poor, no amount of margin of safety is sufficient enough to protect yourself from permanent loss of capital. A case example of Gitanjali Gems was presented. Using a net net valuation method (an approach advocated by Benjamin Graham), we get a value of INR 305 as of 2013. Net net value is computed by deducting all liabilities from current assets and provides a floor value to the equity of the company (since fixed assets and other long term assets are not even considered). At that time, market value of Gitanjali Gems reflected a 25% discount to net net and after one month fell to 75% discount.

- Bucket #2 – It’s prudent to value non-moat firms based on the assets which they employ. Valuation methods such as Historical P/B, P/ Net net, Adjusted PB, Replacement cost of assets (RCA), Net asset value (NAV), Asset based valuation (ABA), etc

- Bucket #3 – For high quality businesses, earnings will add value to shareholders, so we should use income statement based valuation methods like DCF, historical multiples such as P/E, P/S, EV/EBIT, etc.

- Valuation tools- Rather than using fancy elaborative valuation models, one can focus more on quality of business and company dynamics. Also, the principle of mean reversion is used which assumes that a company’s historical performance is a good indicator of its future performance. In other words, future will mirror company’s long term average historical performance

- The same mean reversion principle is used while deciding cost of capital and a constant discount rate is used over a market cycle. Also, a country wise cost of capital is used. E.g. for India, a 14% nominal rate and a 8% real rate of cost of equity is assumed

Asset Based Normative Valuation methods

- Net- net: As discussed before, formula is Current assets – (All ST + LT liabilities). Be extra cautious if a company is available at a discount to its net net value. Probably, the market knows something which you may not. Look through all line items of current assets carefully- Account receivables may be of low quality or inventories may be obsolete

- Book value:

- Tangible Book value (TBV)= Net wortth- Intangibles

- For Banks and NBFCs , we can employ a bearish view by adjusting the formula as Adjusted Book Value = TBV- ( Gross NPAs – Provision for NPAs).In uncertain times, even the assets under the watch list can be deducted

- Justified P/B multiple = Normalized ROCE vs Cost of Debt. E.g.

Co A: Avg ROCE = 11%, Cost of Debt = 11%, Justified P/B = 1x

Co B: Avg ROCE = 9%, Cost of Debt = 11%, Justified P/B = 0.8x (A lower P/B multiple since Avg ROCE< Cost of Debt)

- Replacement cost of assets (RCA): This method can be used where capacities of plant & machinery of companies in a sector is standard. Below are the key steps-

- Check existing capacity either in annual report or any other source

- Get data of latest capital expenditure by companies in the industry

- Estimate replacement cost of company’s capacity

CASE STUDY of a sugar company was presented- The firm has a plant with cane crushing capacity of 76,500 tons per day and industry capex data indicates a cost of INR 450,000 per ton. This converts into a value of INR 34,425 million. Using this replacement cost of the primary asset – sugar, we can get total enterprise value (TEV) and equity value. In this instance, the RCA method gives INR 165 as against a book value of INR 66. However, during stressed times, one should be conservative and consider the book value of INR 66 and RCA value of INR 165 can be more appropriate in an optimistic market as some other entity might buy this company rather than setting its own. During normal times, one can also consider market multiples based EV/RCA valuation. Using this approach, we get a range of INR 78 to INR 156 (-1SD to + 1SD)

Earnings Based Absolute Valuation

DCF technique–

- CASE STUDY of an adhesive company having an economic moat was presented. For key points and assumptions, refer to the data below-

- Focus should be on organic growth while building projections

- Use of real growth rate and real discount rate

- DCF model yields a value of INR 455

- During normal times, a valuation based on P/DCF can also be considered which gives a range of INR 342 to INR 862 (-1SD to + 1SD). But during distressed times, a naïve DCF approach will work best

- Stress test of DCF value can be performed as well. Considering today’s situation, impact on near time earnings (loss of revenue and supply side constraints) and long term business (change in business practices, impact on competitors and government regulations) should be analyzed

- The subject company has a defensive business and hence even during a volatile market situation, the overall impact of stress test will not be that severe. As a worst case scenario consider zero FCF generation for the next one year (e.g. for 2021FY due to Covid-19 outbreak) and run the model to check the result. You will notice that the value doesn’t fall significantly. So when the long term growth story of a company is intact, DCF value will just show a minor drop.

- It’s worth noting that in this case example, ~75% of the value is coming from the terminal value and one may question the effectiveness of the model. In such cases, we can probe the quality of terminal value by using 3TV approach

3TV Approach

Depending upon the valuation drivers of a business, we can have three tranches:

- Tranche 1 (Asset value): Tranche 1 is the value of the tangible assets( or the value of the regular assets of the company)

- Tranche 2 (No growth value): Tranche 2 is the value of current earning power (or franchise value from current competitive advantage )

- Tranche 3 (Total value): Tranche 3 is the value of growth (or ability to protect and grow firm’s competitive advantage)

Going back to our Adhesives company example, Tranche 1 is INR 58, Tranche 2 is INR 109 and Tranche 3 is INR 455 (DCF value). The moot question now is whether you feel comfortable paying a premium of ~ INR 346(Tranche 3- Tranche 2) for sustainable growth value and invest accordingly.

Link to complete video – https://www.youtube.com/watch?v=Z7gwCchA3ts&t=3151s

Link to session presentation- https://www.cfasociety.org/india/Presentations/Valuation%20in%20Stressed%20Times%2031st%20March%20by%20Nimisha%20Pandit.pdf