- January 18, 2024

- Posted by: CFA Society India

- Category:ExPress

Written by

Kislay Upadhyay, CFA

Founder & Fund Manager

FidelFolio Investments

Understanding Rule-Based Investing

Rule-based equity investing is using a framework for investment management that has clear guidelines on stock selection, entry, exit, and allocation (position-sizing). It relies on predefined rules and algorithms to make investment decisions, eliminating emotional biases and creating a systematic and disciplined investment process. However, it is not new. Most of us have heard of some form of rule-based investing or trading. In fact, many of us are confused with numerous terms around this concept viz. quant, rule-based investing, algorithmic trading, factor-based investing etc.

In this article,

- We look at different types of rule-based investing, their evolution over time, strengths and limitations.

- We introduce the modern and most powerful form of rule-based investing – MAGIC (Multiple AI-ML Generated Investment-Rules Combined)

- We look at various screening and backtesting tools available that contribute to democratising rule-based-investing.

Evolution of Rule-Based ‘Trading’

Rule-based trading originated through quantitative models in the mid-to-late 20th century, though some of the key models and theories appeared even earlier. Early rule-based systems focused on simple technical indicators and moving averages. In the latter part of the 20th century, the popularity of rule-based investing grew as institutional investors and hedge funds began adopting algorithmic trading systems. Computer technology enabled financial analysts to process large datasets and backtest trading strategies efficiently. Later, High Frequency Traders (HFTs) used algorithms to do multiple trades within seconds. These systems were designed to exploit market inefficiencies, execute trades at optimal prices, and manage risk systematically. Despite occasional setbacks, such as the infamous “flash crash” of 2010, rule-based trading continued to evolve among traders. However, mainstream active investing, which relied on fundamental analysis, didn’t / couldn’t benefit from advancement in rule-based trading, which is based on technical analysis.

Rule-Based approach for Passive & Factor-Based ‘Investing’

Rule-based / quant approach was easily applied to passive investing. This reduced tracking error and improved cost-efficiency. Later, semi-passive concepts like factor-based (smart-beta) gained traction. First factor-based model was developed by Stephen Ross in 1976, and later by Fama-French in 1993. Factor-based strategies use rules to construct portfolios that deviate from traditional market indices. These rules are based on factors like volatility, value, momentum, or quality. Factor-based investing has become a bridge between active and passive investing, providing a rules-based approach to deviate from index, with the potential for outperformance.

However, even a factor-based approach couldn’t add benefit to mainstream active investing.

- It is a semi-passive approach, not a substitute for active investing or meaningful outperformace

- Low transparency or lack of clear economic rationale

- High portfolio turnover

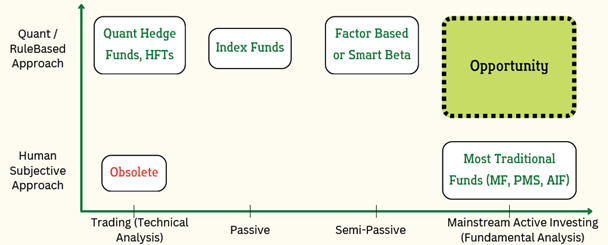

Exhibit 1 shows that application of rule-based / quantitative methods had remained restricted to trading, passive or semi-passive factor-based investing until recently. Mainstream fundamental investing, where bulk of money is invested, still remained deprived of the benefits of rule-based approach.

Exhibit1: Trading, and Passive & Active Investing using Quant

Rule-based approach for Mainstream Fundamental ‘Investing’

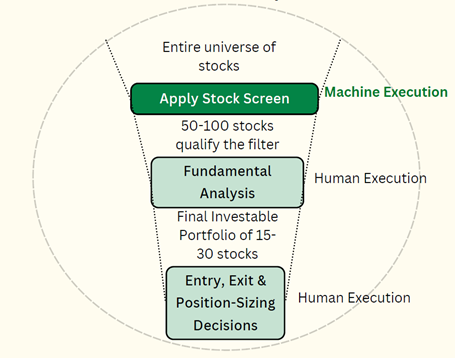

While application of rule-based methods evolved for trading, and passive & semi-passive investing, a parallel development occurred in mainstream active investing. For ages, rule-based approaches for investing involved stock screens, a method that used predefined criteria to filter stocks. The idea was to narrow down the universe of stocks based on fundamental factors, such as earnings, valuation ratios, and financial health. These screens provided investors with a systematic way to identify potential investment opportunities. Exhibit 2 shows how stock screens were used in the investment decision making process. E.g. from an universe of ~5000 stocks, 50-100 stocks qualify the filter / screen. Thereafter, fundamental analysis and other qualitative studies are conducted on the stocks to narrow down to the final investable portfolio. Here, human subjectivity plays a very large role in the process of stock selection. Other portfolio management decisions like entry, exit and allocation (position sizing) are also largely dependent on human subjectivity.

Exhibit 2: Investment Process using Stock Screen

From Stock-Screens to Complete Investment-Rules

There was a severe limitation with stock screens.

- The output of these screens was just a list of stocks without a clear framework for action

- There was no way to know if the screen was any good i.e. if the stocks recommended in the past had given good returns

- It was not possible to backtest these stock screens, as there were no guidelines on entry, exit or position sizing

- Investment process depended too much on human subjectivity – final stock-selection, other portfolio management decisions (entry, exit etc)

Additionally, with development of behavioural finance, inherent human biases and consequent suboptimal decisions became popularly known. Nobel laureate Daniel Kanheman’s Nobel prize winning work on mistakes in investment and finance by humans made it clear that the less the role of human subjectivity in the investment process, the better will be the decision. It became commonly accepted that the biggest reason for underperformance of investment is behavioural biases, followed by human errors and limitation to study wider breadth of investment opportunities.

Also, advancement in computer technology made vast data processing and rigorous backtesting across various market conditions possible. All this led to stock screens taking the shape of complete investment rules. These rules:

- Included predefined rules to select the final portfolio stocks, not just a narrow list of stocks

- Had clear rules on entry, exit and position sizing

- Could be backtested to estimate expected return, risk, performance across various market conditions

- Different rules could be developed for desired risk levels and investment horizons

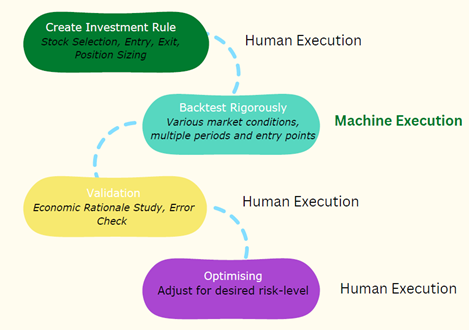

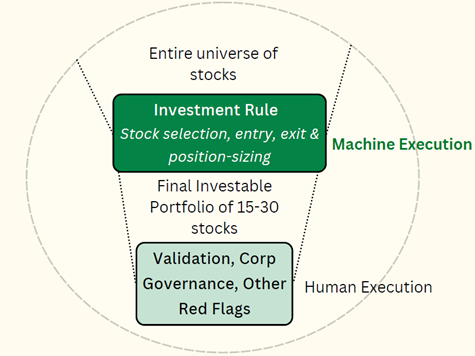

With investment rules, the role of humans in the investment process is completely transformed. Exhibit 3a & 3b illustrate the same. Exhibit 3a shows the first step, which includes the human role in devising the investment rule. This includes creating, backtesting and optimising it for desired risk- profile. Then, in exhibit 3b, the investment rule is applied to the entire universe of stocks, which gives out a final investable portfolio of stocks. Final step includes validation and red flag checks.

Exhibit 3a: Creating, backtesting and optimizing an investment-rule

Exhibit 3b: Investment Process using Rule-Based Approach

Application of complete investment rules for investment management is gaining popularity. For the first time in human history, investors have a method which provides ALL of below for mainstream fundamental investing:

- Objective investment process with low human subjectivity

- Backtesting over various market conditions and expected return, risk etc

- Low Human biases & errors

- Can assess vast opportunity set within minutes

- Transparent economic rationale

Popular Investment-Rules

Let us look at a few popular investment rules that are based on common fundamental ratios.

- Magic Formula: Developed by Joel Greenblatt. It uses Return on Capital Employed (EBIT / Capital Employed) and Earnings Yield (EBIT / Enterprise Value) to identify attractive investment opportunities. Backtested Annual Return: 19.9% from June 1999 to Aug 2014.

- Coffee Can Rule: The concept was originally introduced by Robert Kirby, in 1984, which means buying quality stocks and holding for long-term. Later, in 2017, we used an objective rule based on Return on Capital Employed (ROCE) and Net Sales Growth to implement this in portfolio management. Backtested Annual Return: 24% from 1999 to 2017.

- FidelFolio Rule 13-14-24-20-8-11-C: This rule is developed by FidelFolio’s AI investment-rule generator in 2022. It states to invest in all companies that have delivered 20% Return on Equity (ROE) and 8% OperatingProfit Growth in at least 11 of the last 13 years. Backtested Annual Return: 21% with 13% standard deviation (risk) from 1999 to 2021.

*Backtesting returns are taken from public sources for Magic Formula and from ‘Coffee Can’ book for Coffee Can Rule, and calculated by FideFolio for FidelFolio Rule 13-14-24-20-8-11-C

Best practices with Rule-Based Investing

- The rules governing investments should align with fundamental economic principles. It is essential to critically assess whether the rules are grounded in economic logic and applicable across various market conditions. This facilitates effective risk management, and application at scale.

- Backtesting should give an unbiased picture of the investment rule. Backtesting period, investment horizon, rebalancing frequency etc. should be commensurate with practical application of the rule. Data used for backtesting should be of high quality and integrity.

- Portfolio turnover is an important metric. High portfolio turnover can eat into actual returns in the form of impact and transaction cost. This might not be factored in backtesting. At large scale, this can lead to the rule being completely ineffective to outright value destroyer.

- Human investment team needs to validate results of the investment rules, including conducting sanity checks, economic rationale check, qualitative analysis etc.

Democratising Rule-Based Investing

Creating and backtesting investing rules is a difficult and time consuming process. Few institutional players have the resources to do it, and that too with severe limitations. There is no backtester tool available for the rest of the investors. So, the next revolution in the investment research process would be the availability of a backtesting tool. Democratising this access will be a ground-breaking step in the investment research process in the world.

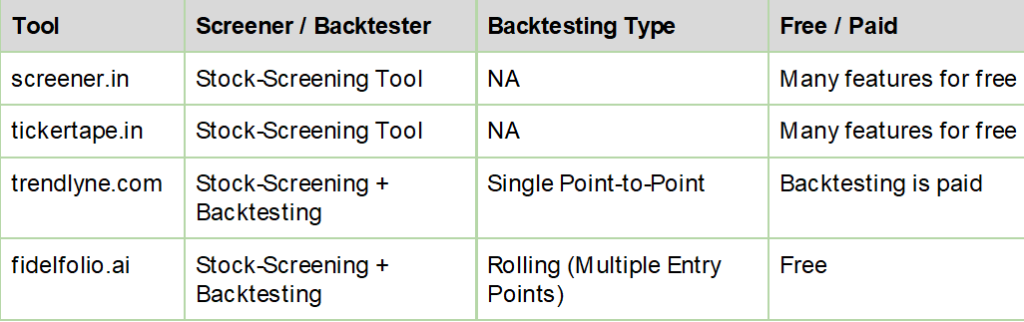

There are a few tools already available to the retail investor that can provide help with rule-based-investing. Exhibit 4 lists a few tools with focus on Indian markets:

Exhibit 4: Indian-market-focused online tools to help in rule-based investing

MAGIC (Multiple AI Generated Investment Rule Combined): Future of Rule-Based Investing

Single investment rules like Magic Formula, Coffee Can Rule, FidelFolio Rule 13-14-24-20-8-11-C provide an unprecedented detailed, objective, transparent system for portfolio management. However, practical usage still faces a few challenges:

- In several financial years, only a few stocks qualify the rule. Thus, constructing a diversified portfolio every year becomes difficult.

- Single investment-rules have noise. Though the performance at portfolio level has been backtested, single bad stocks can qualify the filtering criteria and pose reputational risk to fund managers. Thus, human validation becomes a very important step.

Countering these last challenges, comes the method of MAGIC (Multiple AI-ML Generated Investment-Rules Combined)

What is the MAGIC method?

Instead of using a single investment rule, multiple investment-rules are combined to form a complete strategy. These investment rules can be generated by AI-ML algorithms trained to create investment-rules. Top rules (with highest sharpe ratio), for each level of risk (standard deviation) are selected. Each rule is rigorously backtested. Then, from thousands of rules created by the ML algorithm, a few hundreds are finally used.

Then, these top rules of the desired risk level are combined. For e.g 25 most common stocks in the chosen rules make it to each year’s portfolio. This forms the final strategy using the MAGIC method.

We believe that the future of investing, and particularly rule-based investing, is…

MAGIC – Multiple AI-ML Generated Investment-Rule Combined

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”

About the Author

Kislay Upadhyay, CFA is the founder of FidelFolio Investments. He has over a decade of investing experience. He has worked across fund management, investment banking & investment analysis roles at Synergy Consulting, Ambit Capital, Abakkus Asset Managers, NSE. Working with investment veterans in small teams gave him an early exposure to industry defining work. Consequently, he has been a core member of the investment team that pioneered rule-based ‘investment’ in India. He has been in the core team that developed ‘Coffee Can’ investment strategy and wrote the national bestseller investment book: ‘Coffee Can Investing – The Low Risk Road to Stupendous Wealth’ (2018). He also co-authored an acclaimed report: ‘The Big Call – Bubble in Quality’ (2019). Kislay holds a CFA Charter, MBA from IIM Lucknow, BE from VTU, and ‘Artificial Intelligence in Financial Markets’ certification by NSE Academy.