- April 8, 2019

- Posted by: Shivani Chopra, CFA

- Category:BLOG, Events

Contributed By : Sidhant Daga

The Kolkata Chapter of the CFA society hosted Mr. Rajashekar Iyer on the 5th of April, 2019.Mr. Rajashekar Iyer, has been recently featured as one of the super-investors in the book titled “Masterclass with Super Investors” where he has discussed about his journey in the stock markets

EVENT HIGHLIGHTS

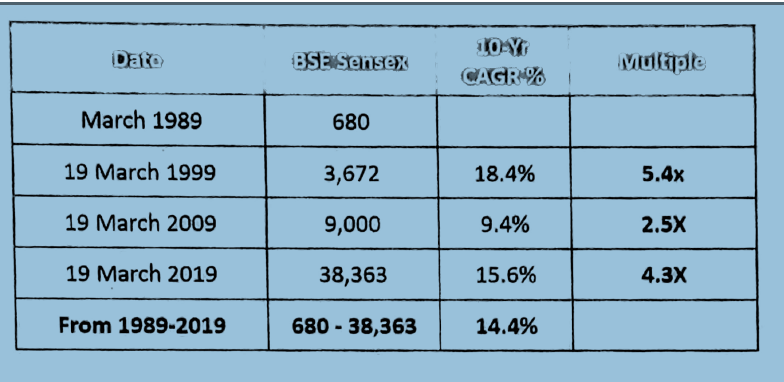

- Explaining on how equity class performs as an asset class, Mr. Iyer mentioned that over the past 30 years,if you take different 10 year periods, you’ll get average returns as measured by the index of ~ 13.5%(before dividends and taxes)

- If one takes a 10 year period and makes around 14-15% CAGR, one will make a 2-3x of his initial investment at the end of the period, and over 30 years it will be ~ 30-40x of your initial investment.

- Mr. Iyer mentioned about how only a small amount of savings went into the equities till 1990, it went up a little in the Harshad Mehta boom period, it came down and has again risen, but is still overall low.

- The three components which make the equity return are : Market,Stock Selection and Market Timing.

- One can make higher returns by proper stock selection and better market timing.

Mr. Iyer shared historical data for the market return profile (BSE Sensex) for the last 30 years.

- One can do defensive investing by buying and holding a well diversified portfolio of leading stocks bought at regular intervals. One can also invest in index ETFs.Defensive investing helps a defensive investor to achieve overall market returns, but extreme discipline is required to carry out the same.

- Mr. Iyer explained how cash calls are sometimes more imp than stock selection as in good times even bad companies rise and how cash calls help in generating higher returns.

- The speaker gave an example of how one must hold on to a stock till its rising and upward pyramid his trades once his trade gets in favor. He told of how he entered MRF and sold it early with only 100% returns , if he would have held on, he could have earned much more.

- The speaker stressed on how one must be in the markets most of the time but not all of the time. Cash calls are imp. to enhance returns. Historically one had to only do 5 cash calls in the last 27 years. Markets are bullish most of the times.

- Mr. Iyer showed how one could have earned a return of ~ 43% if one would have timed his cash calls correctly and had remained invested only in the bull runs since 1988.

- In every bull run, the leaders are different. For eg. – In 1998-2000 it were the IT stocks that made money, in 2003-2008 it was infra and power that made money. Identifying the leaders is imp. to generate high returns.

- One must not sell a stock just after one’s investment thesis has played out, but still hold it till the stock price is rising to generate maximum returns from that particular stock. One must keep trailing the SL as the price of the stock moves higher.

- The 3 triggers which cause bull markets to end are- over valuations, economic slowdowns and increasing interest rates. Any one of the 3 can trigger the start of a bear market.

- Stock selection is far more imp. at the top of the markets than at market bottoms.

- Proper stock picking requires immense amount of time and discipline.

- Extra returns via proper stock picking creates a huge difference in the long run. An ‘x’ amount of investment would be 56x with a 14% cagr after 30 years , whereas, it would be 237 x with a 20% cagr and 2620x with a 30% cagr in the same time period.

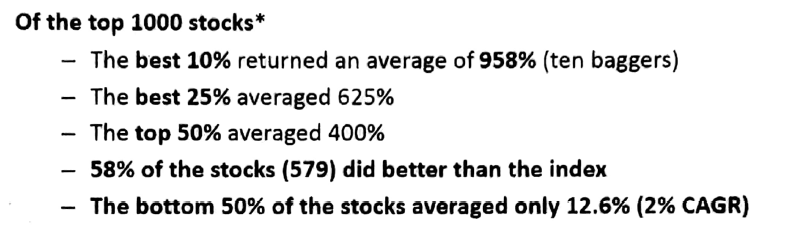

Mr. Iyer showed the astonishing variance between top performing stocks and worst performing stocks-

Above data is based on market cap in 2014, returns are from 20th March 2014 – present.

- Position sizing is very imp.

- Mr. Iyer mentioned how patience is very important, one must only follow a style which suits them, one must buy or sell only based on own conviction and not on borrowed conviction

- The speaker told one should try finding patterns in past multibaggers and use it to find probable multibaggers of the future.

- Sometimes under researched companies outperform over researched companies.

- One should pick a business with good economics, good ROEs, increasing sales, scalable business model, good quality management.

- One should judge a management by looking at management’s strategic thinking approach, execution capabilities and integrity.

- One must spend enormous amount of time in improving their investment skills.

PANEL DISCUSSION

Q1) What is your criteria to select companies?

A1) I look at past performance, if it’s good , then why? , is the good performance sustainable? For example, Relaxo has increased its sales multiple times in the past few years, they have not diluted their equity, margins and realisation per unit has improved due to better product mix.It seems it is likely to continue. The suppliers of the co. gave positive reviews, there is scalability in the business.Thus we can see the past performance is good and seems to be sustainable.

Q2) How do you identify inflexion points in a co.?

A2) Sometimes it’s via accident. One can sometimes observe inflexion points by correlating current affairs with companies which are going to benefit from the same , for eg. I did in a photographic film co. after Govt. announced it is mandatory for everyone to have a photo id.

Q3)How much time do you invest in selecting a co.?

A3)It’s around 1-2 weeks. The faster you reject bad companies the more time you get to spend on good companies.

Q4) Do you do further research after completing your initial research?

A4) Yes. For example, In Relaxo I contacted the suppliers. I also contacted a shareholder who has been holding a stake in the company for the past 10 years.

Q5)Has there been instances where you had a positive view for a company but it changed to negative?

A5) Yes. I regret of not buying Havells based on negative comments of one of my friend. One must form judgement only by himself and not get influenced by someone else’s judgement.

Q6) How to build a position in a stock?

A6) One should do upward pyramiding and must have immense discipline with respect to stop loss.

Q7) Your views on career in a sell side or a buy side?

A7) Sell side is more of a tracking job as a certain sector or industry is allotted, one gets a fixed pay and sell side also helps in understanding a proper analysis framework. In buyside, the risk is higher as one has to choose what to research and what not to and where to invest.

Q8) How to overcome Behavioral issues?

A8)One must have processes to overcome these issues. For example have a gameplan before entering a stock as to what will be my stop loss, what is the % of my capital I’m willing to invest and lose in a particular share.

Q9)Where do you see the Sensex by 2025?

A9) At Least 100% up from now.

Q10) Should one follow contra investing?

A10) One should not contra invest just for the sake of it, being against the trend without a proper evidence is a pretty bad idea. If one has facts on one’s side, then only one should enter contra bets.

Q11)What are the red flags one must see before investing into a company?

A11) One must avoid companies with low ROE, promoter integrity issues and companies where there is a lot of lending to sister companies.

Q12) Do you invest in PSUs?

A12) Generally no as I don’t know about the quality of the management.

BOOK RECOMMENDATIONS

- Anatomy of Bear Markets

- Winning on Wall Street

- How to Make Money in Stocks: A Winning System in Good Times and Bad

It’s a very useful article about Value Investing ideas, Financial investment, Business,Real Estate Money Management. and also very informative .Thank you and keep sharing.