- May 28, 2020

- Posted by: CFA Society India

- Category:ExPress

Contributed By: Labanya Prakash Jena, CFA

The financial sector is exposed to climate change risk

Climate change is threatening economic growth, food production, livelihood, and the financial system. In the “Report on Trend and Progress of Banking in India,” Reserve Bank of India (RBI) acknowledged that climate change risks could adversely affect the stability of the financial system. As climate change risk is recognized as a systemic risk to financial stability and potentially affect the performance of the portfolio exposed significantly to carbon emitting and polluting sectors, there is an urgent need to change portfolio allocation.

Climate change risk is going to adversely affect more to long term institutional investors like insurance companies and pension funds compared to short/medium term investors since both liability duration of these investors and realization of climate change are long. Climate change risk is more problematic for the insurance company since their liability is linked to the adverse impact of climate change. An increase in the frequency of natural disasters such as floods and storms increases the insurance claims and, consequently,growing liability for insurance companies. For example, total global losses due to weather catastrophes were $340 bn in 2017 due to weather catastrophes, out of which $138 bn were insured losses[1].Indian banks and investors have an exposure of $1.4 tn[2] to sectors that are prone to climate change risk – both physical and transition risks. In this scenario, the Government is expected to come out with policy regulation favorable to carbon mitigating economic activities and penalizing carbon-emitting businesses. Hence, the expected change in policy and regulation warrants the rebalancing of the banks and institutional investors’ portfolios and calls for a shift in their asset allocation in favor of green businesses.

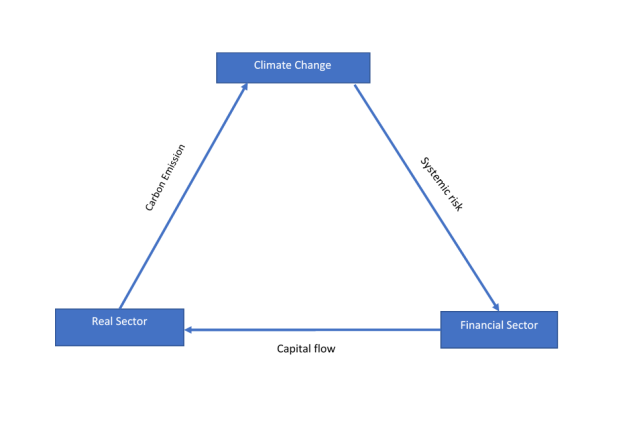

Interrelationships between the financial sector, real sector, and climate change

Source: Author’s Analysis

Does India’s stock market react to climate change risk?

Source: BSE Database

Note: The S&P BSE Greenex is designed to measure the performance of the top 25 “green” companies in terms of greenhouse gas (GHG) emissions, market cap, and liquidity.

The above chart suggests that the “green” index has underperformed that the market index (BSE Sensex) over 2010-2019. The “green” index lagged the market, particularly after 2017, when India has come out with several measures to decarbonize the economy and made a commitment at the Paris Agreement to reduce carbon emission intensity of GDP by 33%-35%. Logically, the green companies should have performed better than the market since the Government is expected to deploy policy and regulatory measures to incentivize “green” companies and penalize the carbon-emitting companies. However, the above chart indicates that the Indian stock market has not captured environmental risks yet. The market efficiency theory suggests that market participants incorporate all the information in capital allocation, which reflected in the market price. However, sometimes market participants don’t have enough useful information to decide or do not know how to interpret available information. In the long term, the market will be more efficient as the companies start disclosing more information on climate risk and opportunity (either forced by regulator or investors or other stakeholders). Besides, market participants will be paying more attention as the impact of climate change become more visible and learn ways to interpret this material, climate change risk and opportunity, information.

Our primary research with institutional investors indicates that Insurance, pension, and mutual funds not focused on environmental risk. The financial market regulators such as PFRDA, IRDA, and SEBI have not paid attention yet on climate change risk in their regulatory guidelines. PFRDA and IRDA can make climate change risk assessment of portfolio as a fiduciary responsibility of fund managers, which can force them to incorporate this imminent risk in their investment decision making. SEBI can recognize climate change risk and opportunity as material information, and make regulation on compulsory disclosure of climate change risk disclosure of listed companies, which can help investors in making an informed decision on securities and sector selection. It is noteworthy here that oversight of climate change risk exposes the financial sector to systemic climate change risk.

The way forward for: Need to allocate capital to mitigate climate change risk

Since the carbon-intensive sectors are currently facing both physical and transition risk, consequently eroding the profitability of these sectors and companies who are exposed to these risks. Hence, the investors should identify companies who are proactive in taking the right steps in mitigating these risks. Besides, the investors should look at investment opportunities in the sectors, which are climate-friendly, such as clean energy, energy-efficient, and clean transportation,to mitigate climate change risk.

Sources:

[1] https://www.munichre.com/content/dam/assets/munichre/content-pieces/documents/pdf/302-09092_en.pdf

[2] http://www.emergingmarketsdialogue.org/wp-content/uploads/2018/04/Study-Natural-Capital-Risk-Exposure-of-the-Financial-Sector-in-India.pdf

About the Author:

Labanya is currently working as a Manager – Climate Finance in Climate Policy Initiative’s (CPI) Delhi office; CPI is an international development and policy consulting company in climate finance. At CPI, he is engaged in research and consulting activities related to policy, regulation, and investment aspects of green financing, including renewable energy. Besides, he is also engaged in designing and analysis of new financial and business ideas at CPI’s Green Finance Lab, aiming to drive capital into the climate sector.Before CPI, he has worked with Copal Amba Research (A Moody’s Subsidiary), Emanation Partners, Skylar Capital, and Mandrill Capital Management in various capacities.

Labanya is a management graduate and holds a Master’s in Economics. He is also a CFA Charterholder and currently a Doctoral Scholar at XLRI, Jamshedpur.