- July 17, 2023

- Posted by: CFA Society India

- Category:ExPress

Sandeep Gupta, CFA, CIPM

Founder & CIO Lucretius Fund

Director Elect - CFA Society India

Change is the only constant. (Heraclitus)

It is the nature of things to change. The biggest driver of change in our times is technology. The finance and investment industry is also not immune to this. Whenever an innovation starts getting mainstream, there is ample opportunity for bad actors to exploit the naivety and non-sophistication of existing stakeholders. The fiduciary duty to ensure compliance with the applicable laws, regulations, standards, etc. can make industry professionals averse to change. However, fiduciaries also have a duty to seek better risk-adjusted outcomes for their beneficiaries. Thus, they need to ensure that they have sufficient information, knowledge, and expertise to make informed and rational decisions. For this they need to keep abreast with technological advancements and the innovation impact it may have.

The world of Finance has seen various innovations over the ages. The invention of metal coinage, the development of paper money, the emergence of banking and fractional reserve lending, the emergence of joint stock trading companies followed by capital markets, etc. were some innovations of the past. In addition to the benefits they unlocked, each came with their own fair share of shenanigans. For example, Joint stock companies facilitated better trade through features like limited liability, transferability, divisibility and diversification, access to capital, etc. But it also led to agency problems, monopoly domination, market volatility, and speculative bubbles. The innovations required stakeholders to catch up fast and introduce requisite regulations and best practices to ensure stability.

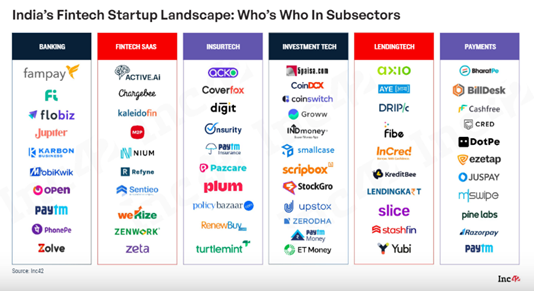

The reason for the above longish preamble is that many recent innovations are yet to emerge fully from the requisite regulatory and stabilization phase. New-age technology companies in investment and finance industries are using innovative technologies such as blockchain, AI, cloud, IoT, etc. to offer new or improved solutions for financial services. Some of the innovations are briefly enumerated below. While some of these are well understood by the existing stakeholders, many others are still evolving. These technologies have been adopted by existing players to improve their efficiencies. They have also led to the creation of a multitude of Fintech’s across categories like Banking, Insurance, Investments & Wealth, Lending, Payments, Financial Software Services and many others.

In Banking, we have neo banks like Jupiter, Zsolve etc. who are challenging existing banks. All existing banks now have their own digital App’s. In Insurance we have players like Acko and Digit who are harnessing technology for better underwriting. They are able to offer better insurance prices and services to less risky segments of their markets due to their ability to access big data and get intelligent inputs from it. Further aggregators like Policy Bazaar etc. are harnessing technology to improve distribution. In wealth & investments, digital brokers like Zerodha and Groww are able to provide stock broking services at much cheaper commissions than the banks and growing their customer base rapidly. Additionally innovative Fintech’s like Smallcase & Scripbox are making investments in Financial products by retail investors easy and direct. The list of innovations is endless. All the entrenched players are also fast adopting technologies to ensure that they stay relevant. Some of the key Fintech Categories and prominent FinTech’s in India are as below:

Some additional key concepts to grasp while discussing the Impact of new technologies on the Finance and Investment Industry are Digital Money, Blockchain, Web3, Metaverse, AI, Machine Learning, Robo-Advisors, Alternative Data, Natural language processing (NLP), Cloud Computing etc. Each of these are a complete subject matter in themselves but will give a short gist here.

Alternative data refers to non-traditional sources of data that can provide valuable insights into market trends, consumer behavior, company performance and risk factors. Alternative data can include social media posts, satellite images, web traffic, geolocation data, sentiment analysis, credit card transactions and more. Alternative data can help investors gain an edge over their competitors, identify new opportunities and generate alpha.

Alternative data refers to non-traditional sources of data that can provide valuable insights into market trends, consumer behavior, company performance and risk factors. Alternative data can include social media posts, satellite images, web traffic, geolocation data, sentiment analysis, credit card transactions and more. Alternative data can help investors gain an edge over their competitors, identify new opportunities and generate alpha.

AI and machine learning are used to analyze large amounts of data, generate insights, automate processes, optimize portfolios, enhance customer experience and reduce risks. Natural language processing (NLP) is a branch of AI that enables machines to understand, process and generate natural language. NLP can be used to extract information from unstructured text, such as news articles, research reports, earnings transcripts, social media posts and more. NLP can also be used to generate natural language summaries, reports, recommendations and alerts for investors. NLP can help investors save time, improve efficiency, enhance communication and make better decisions.

Robotic process automation (RPA): This is a technology that automates repetitive and rule-based tasks by using software robots or bots, improving efficiency, accuracy and compliance. Robo-advisors are digital platforms that provide automated, personalized and low-cost investment advice based on algorithms and data. Robo-advisors can help investors with asset allocation, portfolio rebalancing, tax optimization, goal setting and tracking, risk management and financial planning.

Robotic process automation (RPA): This is a technology that automates repetitive and rule-based tasks by using software robots or bots, improving efficiency, accuracy and compliance. Robo-advisors are digital platforms that provide automated, personalized and low-cost investment advice based on algorithms and data. Robo-advisors can help investors with asset allocation, portfolio rebalancing, tax optimization, goal setting and tracking, risk management and financial planning.

Cloud computing allows finance companies to access, store and process data and applications on remote servers, reducing costs, increasing scalability, improving security and enabling innovation. Open APIs are interfaces that allow different applications and systems to communicate and share data, enabling interoperability, collaboration and integration among finance companies and other stakeholders. The Reserve Bank of India (RBI) launched the account aggregator framework, a financial data-sharing system to ease the accessibility of financial data, and which will empower individuals with control over their personal financial data.

Internet of Things (IoT): This is a network of connected devices that can collect, transmit and act on data, creating new ways of generating and accessing data, such as sensors, wearables and smart devices.

Internet of Things (IoT): This is a network of connected devices that can collect, transmit and act on data, creating new ways of generating and accessing data, such as sensors, wearables and smart devices.

Blockchain: This is a distributed ledger technology that records transactions in a secure, transparent and immutable way, enabling new methods of transferring value and data, such as cryptocurrencies, smart contracts and decentralized applications. Augmented reality (AR) and virtual reality (VR): These are technologies that create immersive and interactive experiences by overlaying digital content on the physical world or creating simulated environments, enhancing customer engagement, education and entertainment.

Web3 is used to describe the next generation of the internet, which is based on decentralized, peer-to-peer, and trustless protocols that enable users to own and control their own data, identity, and assets. Metaverse is the term used to describe a collective virtual shared space that is created by the convergence of physical, augmented, and virtual reality. The metaverse is enabled by Web3 technologies such as blockchain, cryptocurrency, NFTs, VR/AR, etc. Web3 and metaverse present new avenues for investment and value creation. For example, investors can participate in decentralized finance (DeFi) platforms that offer various financial services without intermediaries; they can also invest in NFTs that represent unique digital or physical assets.

Digital money is an innovation that is now mostly well-understood. Digital money is any form of money that exists only in electronic form, such as bank deposits, credit cards, online payments etc. Digital money emerged in the late 20th to early 21st century CE, following the development of information and communication technologies that enabled the transfer and storage of data electronically. Digital money was a major innovation because it increased the speed and convenience of transactions, reduced transaction costs and intermediaries, and increased financial inclusion and innovation. A new form of digital money viz. cryptocurrencies also emerged which challenged the role of central authorities. Some governments including India have come out with their own versions of it.

Digital money is an innovation that is now mostly well-understood. Digital money is any form of money that exists only in electronic form, such as bank deposits, credit cards, online payments etc. Digital money emerged in the late 20th to early 21st century CE, following the development of information and communication technologies that enabled the transfer and storage of data electronically. Digital money was a major innovation because it increased the speed and convenience of transactions, reduced transaction costs and intermediaries, and increased financial inclusion and innovation. A new form of digital money viz. cryptocurrencies also emerged which challenged the role of central authorities. Some governments including India have come out with their own versions of it.

Readers are encouraged to go deeper into the technologies and ideate on how they can be harnessed in different aspects of the finance & investment world.

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”