- December 18, 2020

- Posted by: CFA Society India

- Category:BLOG, Events

Webinar was conducted by CFA Institute and Fitch Ratings

Speakers:

- Mary Leung, CFA, Head, Advocacy Asia-Pacific, CFA Institute

- Carmen Nuzzo, Head of Fixed Income, Principles for Responsible Investment (PRI)

- Venn Saltirov, Portfolio Manager, BlackRock

- Mervyn Tang, CFA, Global Head of Fitch Ratings, ESG Research

Contributed By: Jolly Balva, CFA, Member, Public Awareness Committee, CFA Society India

PRI (Principles for Responsible Investing) is an investor led movement that is committed to drive sustainable investing. There are over 3000 signatories that include asset managers and credit rating agencies.

In 2015, Paris agreement was signed and the need to transition to a low carbon economy has been acknowledged. Many countries in APAC like Japan, S. Korea, New Zealand and in Europe amongst others have pledged to have zero emissions by 2050, and China by 2060. Regulatory changes are happening at a fast pace across Europe. These regulations can have important implications in terms of restricting the investable universe. Asset managers are increasingly providing product offerings in ESG, with strategies that target net zero emissions. There is effort to measure carbon footprints of portfolios. Although nascent, KPIs and governance aspects have started getting included in legal documents to make the commitments more powerful.

There are certain drivers behind the rise of interest in fixed income investors, however, there are certain barriers as well.

Drivers:

a). Risk management and the need to consider it holistically including ESG factors

b). Demand from clients

c). Role of fiduciary duty is now widening in definition to include the impact of ESG factors in the environment and society, apart from profits.

Barriers:

a). Limited understanding of how the factors affect bond valuations

b). Lack of comparable data

c). Lack of company culture

d). Limited market and academic research

PRI has worked to nurture the Investor – CRA dialogue. They worked on the following aspects, amongst others:

1). Ironing out the Investor – CRA disconnect on:

- Materiality : which ESG factors affect an issuer’s risk of default

- Visibility : what is a reasonable time horizon to consider

- Approach : the challenge of a ‘built-in’ approach and of building organizational capacity

- Transparency : need for better communication and consistent language

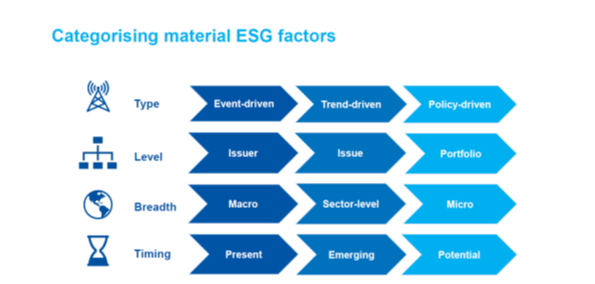

2). Categorizing Material ESG factors:

Source: PRI

3). Choosing Credit Relevant Time Horizons:

Assessing ESG risks and credit-relevant time horizons:

- Visibility: How discernible are ESG risks?

- Probability: How likely are ESG risks to be materialized?

- Timing: How likely are ESG risks to reoccur?

- Severity: What is the impact of ESG factors on a bond issuer’s creditworthiness?

Integration in Credit Risk Assessment

For Sovereign Issuers: there are two type of factors that need to be considered in assessing exposure to climate change related risk. a) Physical climate risk : Is the issuing country vulnerable to weather events like hurricane, flooding, droughts et al b) Transitional climate risk : whether the sovereign has committed to a net zero emission goal by 2050 or so. If yes, how does it plan to fund the cost, viz higher revenues by raising taxes or by deficit financing.

For Corporate Issuers: There are ESG scores and assessments (ratings) available that profile issuers and these can also be incorporated separately. Not all factors will impact credit rating. Fitch ratings look at the issuers’ credit profile and analyse the impact of ESG issues. Factors that can have a considerable impact on rating :

- Governance, which has been considered since a long time

- Climate change related factors – Carbon emissions and regulations: Carbon emissions and intensity affect a wide number of issues in ratings. Regulations could make certain assets to be unviable and thus affect asset valuation. The demand in products could decrease and thus affect profitability. Banks might pull away from financing high carbon intensive industries. There could be no impact sometimes if an entity remains unaffected in financing with sovereign guarantees in place for instance, despite faring badly on ESG parameters.

- Events – biodiversity/weather events

Implications on Valuation

With the world increasingly coming together to reduce global carbon emissions and governments taking a strong stand, the scale of impact could be massive. Japan, S. Korea and China hugely depend on fossil fuels for production. An adoption of decarbonization will require energy management policies to meet energy demand and can bring about changes across sectors. Switching to electric vehicles will require infrastructure building. Wind and solar grids will increase the demand of batteries and lithium and cobalt.

Perspective and Trends in Asset Management

Asset managers have started considering risk holistically. Blackrock considers ESG factors into risk management for traditional as well as sustainable portfolios.

Although the risks may not be same across industries, governance remains common. Focus on the ‘G’ factor, especially in Emerging markets is paramount. They refrained from investing in certain high yield issues in china, owing to lack of transparency.

Companies’ social license to operate is becoming increasingly important in every single geography.

They overweight sectors in EM that fare better on social welfare, public utilities like gas suppliers or those that provide sewage water treatment and underweight sectors that score low on them. Though the information on the ‘S’ aspect of ESG is currently less covered by third party providers and is scarce.

There is a broad consensus rising on the need to resolve the environment related issues. Companies that are well placed to transition to a low carbon economy will be well positioned. From a risk management perspective, one would rather want to position portfolios ahead of those trends.

Climate change will reshape the financial world. From a portfolio management perspective, Blackrock believes that sustainability integrated portfolios are expected to provide better risk adjusted returns. Extreme weather events and potential policy actions are well within the medium or long term horizon of every single investment. In 10 years the world needs to have peaked in strong emissions and is expected to have strong measures in place to reduce them. 30 years is when the world as a whole needs to reach net zero emissions. There is mispriced risk in the market and has an impact on valuations. There is also going to be a large scale reallocation towards sustainability.

Link to complete webinar: https://www.arx.cfa/en/research/2020/11/soc301120-webinar-esg-integration-fixed-income-2