- October 16, 2023

- Posted by: CFA Society India

- Category:ExPress

Manish Gvalani, CFA

Member, Public Awareness Committee,

CFA Society India

I recently watched ’Antman and the Wasp – Quantumania’ and it was a fun movie to watch. No one does a better job than Disney + Marvel of showcasing the multitude of possibilities in the metaverse, and this one was a pure entertainer. It had a good mix of imagination, technology, bravado, and thrills. I can’t wait for the next seasons of Loki & Hawkeye on Disney+.

But that’s a world of superheroes, a realm of fantasy that you and I like to visit from time to time. Every hero in there has its own superpowers, Hulk being my favorite, especially when Edward Norton enacted the role.

While I was immersed in this world of extraordinary capabilities, I started wondering about the superpowers that we possess, as humans. Is it Success? Is it a life of Virtues? Is it a Growth mindset?

If these were indeed superpowers enjoyed by few elites, then you wouldn’t ever hear stories of adversities coming from this privileged class. But that’s not the case, as bookstores and the internet are filled with stories of failures, bankruptcies, and embarrassments coming from quarters you would have least expected from.

Success –

Vanderbilts were once the richest family on earth but over time, their wealth has been squandered away by the following generations. Raymond Group’s ex-Chairman Mr. Vijaypat Singhania recently released his only Autobiography wherein he admits that his mistake was to give everything his son wished for, eventually to be ousted from the board by his own son.

Virtues –

Some companies and organizations have taken the virtue of green energy to extremes, causing a nuisance to citizens and hindering the robustness of their own country’s energy security. Sunrise Campaign, Save Old Growth, and Just Stop Oil are a few of the activist groups that have sent volunteers to glue themselves to roads, paintings, or goalposts.

I get it that disruption gains more attention than pleas and requests, but I doubt that the disruptors have any sense of the fundamental backstories to energy politics – does their country have enough sources of their own or are they dependent on hostile nations for energy? is it possible that these campaigns are supported by oil heirs who might be restricting supply to keep making bigger gains from their oil fortunes? are they being brainwashed by Russian bots that could be making them believe that they are fighting for a just cause and saving the world?

Growth Mindset –

Byjus founder Raveendran has lost the backing of his marquee investors and is embroiled in many lawsuits across the globe. Theranos founder Elizabeth Holmes is serving an 11-year sentence for her fraudulent blood testing business that lied and misrepresented with no regard for the consequences. 95% of speculators lose money in F&O trades and 80% + fund managers fail to beat the index performance.

These are examples of overconfidence bias and optimism bias that creep in when you are oozing with a growth mindset and aiming for the skies. It is an essential ingredient for being a founder or a leader, but a lot of damage also gets done by snake oil salesmen who parade their visionary messages with great oratory skills.

The reason I say that none of these are superpowers is because they cannot protect you from the adversities that life will throw at you. They could give you a better arsenal of tools and resources to deal with unfortunate events, but they cannot fully secure you from it.

Nothing can secure you 100% from the blows of fate, but is there a superpower that could soften the impact, leaving you wiser and stronger to forge ahead? Is there a superpower that could help you to keep calm in the midst of stressful scenarios? How do you think rationally when many forces are competing to make you into a scapegoat or a victim? How do you guard yourself against landmines and booby traps?

And that’s where Human Psychology comes in. On the face of it, sounds like a concept to be taught to students pursuing Psychology Majors or maybe to salespeople in a Profit-driven organization. But at its core, it’s the study of how the mind works in response to external stimuli i.e. others and situations.

Let’s look at a few examples to highlight how you (actually) make decisions compared to how you think you make decisions –

The tall building in the picture on the left side is Eden House in Dubai and I was shown a 3 BHK in this building at a particular rent, let’s consider that 100. Post this visit, I was shown another apartment next to Zabeel Park, and that was priced at 80. Both were beautiful houses but my budget was 55 and hence I had to reject them. I was then shown the 3 BHK in the current building (Blue Tower) which was priced at 65, and I was given 3 days to decide.

Guess what did I do? I booked it in 2 days and rationalized that those good apartments, with beautiful views, were costing upwards of 80 and I got a deal at 65 in the same locality, so it’s a no-brainer. It didn’t take me any time to make up my mind, and I was happy making this decision. “I got a steal of a deal. Yippee”

On second thoughts, what actually happened was that I completely threw away the budget I had i.e. 55. It had no role to play in my decision-making, though it felt that it would be critical to my decision. But it wasn’t because my anchoring bias had locked the rates in my mind i.e. 100 & 80. Anything below seemed a good price to get in, and I did.

What if I was shown houses starting at 40 or 50 first, and then shown this apartment priced at 65, do you think I would have taken it? I doubt it as I certainly would have struggled to pay up in my mind. But paying down was a no-brainer. I am happy with my decision to move in here, but I am also cognizant of the anchoring bias that played on me.

“Anchoring bias is a cognitive bias that causes us to rely too heavily on the first piece of information we are given about a topic. When we are setting plans or making estimates about something, we interpret newer information from the reference point of our anchor, instead of seeing it objectively.” – Decision Lab website

Just look at the 2 images above and you have to consider one of them for a job opportunity or a Fiverr freelance job. Which one would you go for?

Your rational mind may need a few more profile details to go through, but the irrational part of your mind, the instinctive part, or maybe the emotional part of your mind may have already tilted the decision in favor of the one dressed to kill.

Think about the first few seconds when you saw these images. What was your mind doing on auto mode? Wasn’t it already choosing, even before you were thinking of the job at hand?

The picture (on left) above includes Mr. Parag Agrawal, ex-CEO of Twitter and the youngest ever CEO of S&P 500 companies. As for the gentleman on the right, he is Mr. Jan Marsalek, ex-COO of Wirecard, and now a fugitive wanted by the German police, listed on Europol’s list of Europe’s most wanted fugitives, and Interpol also has issued a Red Notice against him.

If you were honest about the choice you made in the first few seconds, then you succumbed to the ‘Liking / Disliking Bias’. How easy it is for us to fall into a trap, with no realization of this being a trap of sorts?

“Under the influence of liking or disliking bias, we tend to fill gaps in our knowledge by building our conclusions on assumptions, which are based on very little evidence.” – fs.blog

Just in case you think that you are very rational, then let’s look at your last week itself. Which habit are you trying to get rid of but couldn’t? Which conversation you needed to have but you didn’t yet? Which payment or purchase was to be completed but is pending still? Which agenda on your to-do list has survived for more than 7 days on that list? Which impulse decision did you make this week in spite of having decided to be strong-willed?

If you were completely rational, you would be operating like a machine. But you ain’t Robocop and hence you will have to live with your human elements, and instinctive decision making is a big part of it. You also are constrained on time and hence can’t optimize every decision of yours. Hence sometimes you go with your gut, and the gut can be tricked big time. Just as I did above.

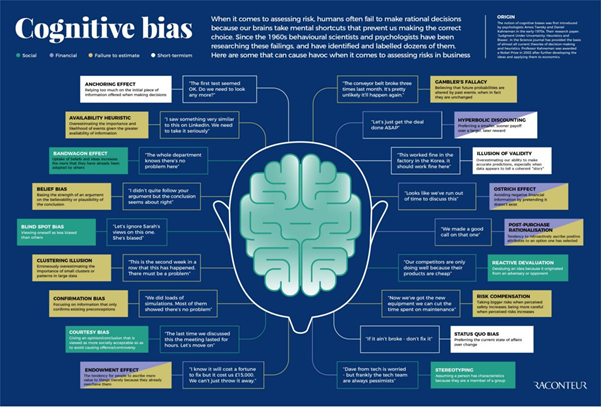

The picture above shows just a few of the cognitive (psychological) biases that we as humans are afflicted with. If you were to explore Wikipedia for this topic, you might be introduced to at least 180 biases that are impregnated in your human DNA. There ain’t any way to run away from them, just as one of the Spiderman movies is titled ‘No Way Home’. Hence the only way left to tackle this predicament is ‘Self Awareness’; not the individual identity, but the self i.e. the mind and it’s quirks.

The examples I shared above are either personal or related to current events. But organizations/cults /institutions/fraudsters/deceitful sorts are aware of the quirks of the mind and hence they are in nonstop action mode to lay a honey trap for you. A few recent examples are provided herein –

- Sam Bankman-Fried became the largest donor and won the vote of confidence from Washington officials, only to wind up being convicted for the biggest fraud in the history of corporate America

- Wirecard won the confidence of German officials who refused to see or believe that there was something wrong with the biggest online company listed in Germany. Eventually, FT broke the news that the company had fudged its balance sheet to the tune of USD 2 bio

- Crypto firms like Squid Games Crypto capitalized on the blind belief of crypto enthusiasts and made a run USD 3.38 million

- So many F&O Traders have been found sharing screenshots of fake P&L statements on Twitter to seduce gullible retail investors who are hoping for a lottery of sorts by believing some random stranger online

At the heart of all these frauds/shenanigans is the knowledge of human fallibility and a method to exploit that weakness. You may not be surrounded by Elizabeth Holmes or Squid Games Crypto developers, but you are certainly surrounded by people with the same desired incentives i.e. money, power, and fame. Few of them would be wise, rational, and virtuous. But that’s just a few. Most have an incentive bias to make you buy something, do something, or trade something.

What you have to understand is that everyone is driven by their own biases i.e. emotional and cognitive. And it’s these biases, that make them see the world in a certain manner. And unless you are not cognizant of that, you are on a sure-shot path to confusion, frustration, rage, or regret caused by others’ actions.

“Knowledge is Power. But the knowledge of psychology is the purest form of that power.” – Scot Adams

And if you are keen to get started on this path of decoding human psychology, then Charlie Munger’s Youtube video with 25+ Human Misjudgements is the first step into this maze of human biases. Just in case you prefer the transcript of this speech, then it can be found on fs.blog post on the same topic.

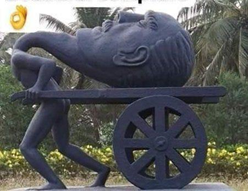

You may have been moving around too long with your head swelled up, trying to understand why people behave the way they do, and also why you behave the way you do sometimes. It can get pretty difficult to move around with these biases, without even knowing that you are carrying a truckload of these in your 3-pound brain too.

Hence I invite you to explore this intriguing rabbit hole of human psychology. You will only thank me for having introduced you to this metaverse (it’s the most trending word online today, so why not use it too 😃), where all the human thinking happens, before you see it play out via the words spoken or actions taken.

I would let Scott Adams sum up the article in his eloquent style – “Every psychological trap on this list can be used to manipulate you, if there’s something on the list that you are not familiar with, you’re vulnerable to deception. In some cases, you’re missing opportunities to make your product and yourself more attractive to others. Hence it’s a good idea to make psychology your lifelong study. Over time it starts to feel like a superpower that allows you to understand things that confuse and confound those around you.”

Do I say more?

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”

About the Author

Manish Gvalani is a CFA charterholder and Masters in Finance from KJ Somaiya. He has worked in Portfolio Advisory roles across many international banks eg. SCB, Citi, and BNP Paribas. Currently he is working with Dubai’s biggest bank, Emirates NBD. He is passionate about Snooker, dabbles in bio-hacking and is a voracious reader. His favourite books are “Letters from a Stoic” by Seneca and “Snowball” by Alice Schroeder. He has a weekly newsletter called “Psychology of Investing” wherein he covers topics related to behavioural finance, long term compounding and longevity. Weblink for the same is https://manishgvalani.substack.com He lives with his wife, and parents in Dubai.