- January 13, 2021

- Posted by: CFA Society India

- Category:ExPress

Written by Labanya Prakash Jena, CFA

Why Indian investors should be more worried about climate change than others, and what should they do about it?

Climate Change risk is threatening economic growth, food production, and livelihood

The top four out of 5 risks the World is facing today are related to climate change – both in terms of impact and likelihood (WEF, 2020). The global attitudes survey also listed climate change as the top global threat (Pew Research Center, 2018). Climate change is not only a threat to the society and real economy but a systemic risk to financial stability and could lead to a massive decline in the value of financial investment assets. As per various estimates, the cumulative damages from climate change could reach US$ 8 trillion per year by 2050 (EIU, 2019) and much more in a lost opportunity.

India’s economy is more exposed to climate change risk than most of the countries.

India is ranked as the fifth most vulnerable country to the effects of climate change, suggesting a high risk to both human and economic losses (Germanwatch, 2020). Moreover, India is also least prepared to mitigate climate change risks or adapt to climate change. The World Bank estimates that by 2050, climate change could reduce the country’s GDP by 2.8% and put 600 million people at risk due to extreme floods, wildfires, and heatwaves (World Bank, 2018). The Reserve Bank of India has pointed out that India’s agriculture sector is mainly exposed to climate change risk. For example, McKinsey estimates that 27 percentage points increase in the likelihood of more than 10% yield declines for four major crops (rice, corn, soy, and wheat) by 2050 for India. However, rising heat and humidity and an increase in the frequency of storms and floods are also affecting other sectors such as housing, transportation, forestry, fisheries, tourism, construction, manufacturing, and hospitality. According to German Watch, India’s economic loss due to climate change was $37 billion (~0.36% of GDP) in 2018, the impact felt in multiple sectors including housing, infrastructure, construction, agriculture, and animal husbandry. For example, McKinsey projects that India could lose 30% of annual daylight hours by 2050 in extreme heat exposed areas, which is more than a 40% percent increase from today. It is noteworthy that heat-exposed work produces about 50% of GDP and contributes to 30% of GDP growth in India.

India’s financial market may not be responding to climate change now; it will be sooner or later – the sooner, the better

The climate change risk is not only restricted to the real economy but could potentially threaten the stability of the financial system through quick value erosion of financial assets (EIU, 2019). The historical and current relationship between climate change and the financial system is weak (Patrick Bolton, 2020). However, there were cautionary notices on the significant financial risks emanating from climate change and has become more evident in recent years with mounting business losses due to an increase in occurrence and intensity of extreme weather incidences such as storms, floods, and droughts (NGFS, 2019). In the “Report on Trend and Progress of Banking in India,” RBI acknowledged that climate change risks could adversely affect the stability of the financial system.

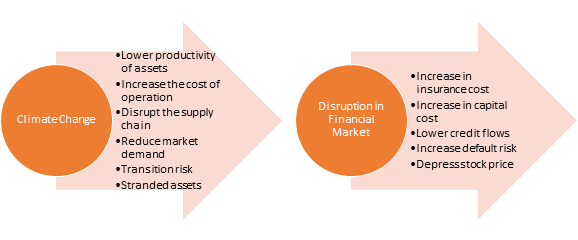

Climate change risks would adversely affect the productivity of assets, increase the cost of operation, disrupt the supply chain, and reduce the market demand for carbon-emitting or polluting businesses. Similarly, the cost of insurance would be higher as the probability of asset losses increases due to a rise in the recurrence rate and intensity of extreme weather events. The increase in insurance cost will result in a considerable value of uninsured assets; consequently, less credit flows into those businesses. These disruptions would increase the default risk of existing fixed-income financial investments (loans and bonds) and depress stock prices.

“Impact of Climate Change on Financial Market”

Investors who have a short- or medium-term investment horizon have a false belief that climate change would not affect them since they would exit by the time climate change materially affects the financial market. It is noteworthy that the impact of climate change on the financial market could be felt sooner than expected, and the stock market could react immediately. In the United States and Europe, investors ignored the risk of climate change just a few years back, but suddenly they became more cautious on this risk than ever.

How should investors respond to mitigate this imminent risk?

This imminent risk warrants necessary and urgent actions before the risk hits the economy and, consequently, the financial market. Since the current impact is small, the financial market is ignoring it. Ironically, the financial market reacts more quickly and vigorously to any risk than the real economy. However, ignoring this imminent risk for a long time could cause a Minsky moment in the financial market. There are various ways investors can respond to this risk. In this article, I have divided it into four parts: 1: investment Strategy; 2:Engage with corporates to develop strategies to address these challenges; 3: Engage with policymakers and regulators to effective policies and regulations; 4: Build knowledge and capacity

1. Investment strategy

A). Negative Listing

The simplest way is negativing listing – Avoid investing in sectors (e.g., oil, gas, and coal) that are more likely to be affected by climate change risk. However, not all companies will likely to be affected by climate change by the same proportion. Some companies in these sectors are also rapidly changing their businesses – transitioning from heavily carbon-emitting to less carbon-emitting. For example, a fossil fuel energy company is transitioning towards a renewable energy company rapidly. Investors, particularly large investors, could lose a large pie of investment opportunity if they deploy negative listing. Only, small size investors can afford to deploy this investment strategy.

B). Tilting portfolio in favor of climate-friendly sectors

The investors can tilt their portfolio in favor of climate-friendly stocks that are likely to benefit from climate change and diversify from climate-unfriendly stocks. It will be easier for retail investors to quickly change their asset allocation due to their smaller size; large investors can gradually offload their positions from climate-unfriendly stocks.

Passive investors can create carbon-neutral and or less-carbon-intensive rule-based portfolios, matching their respective benchmarks or specific requirements. These portfolios match with the conditions of passive management strategy and capitalize on the investment opportunities that arise from the transition to a low-carbon economy. Moreover, these portfolios can hedge against climate change risk.

The core-Satellite investment approach is another way to reallocate the portfolio. The investors can continue its existing (core) portfolio; however, investors can create a small (satellite) portfolio only allocated in climate-friendly sectors. The satellite portfolio can offer growth prospects, diversification benefits, and a natural hedge against climate change risk.

C). Integrate climate change risk and opportunity in-stock selection

Investors can integrate climate change risk and opportunities in the investment decision-making process. The investors can evaluate both the negative and positive impacts of climate change on companies’ financial and operating performance and, consequently, their valuation. The investors can integrate these risks and opportunities in the company’s projected revenue, expenses, CAPEX, book value, and capital cost and adjusts all these elements in valuation.

2. Constant engagement with corporates

Controlling the future (climate change) risks will be critical to make the business survive in the long term and leverage the opportunities that arise out of climate change.

The top management of corporates is not proactive enough to take actions to make the business climate-resilient. The benefits of these actions would be realized in the medium to long term, which could be beyond the management’s term in the same company. Hence, they do not have enough incentives to make these decisions; on the contrary, taking actions on climate change could increase the cost in the short-term. This kind of unwarranted state must prompt investors to be more pro-active on climate change.

The investors can engage with corporates to support and encourage them to transition the businesses less-carbon intensive and less pollutive even at the expense of lower profit in the short-term. The first step should be improving corporate governance and disclosure related to climate change. While corporate governance can direct the management to take action on climate change, better disclosure can allow investors to assess the real riskiness of their investments. There are other ways to exert pressure on corporates to act upon climate change, including raising questions about climate change in the Annual General Meeting (AGM), bringing climate-related resolutions and voting on them, and demand for setting carbon-emission targets.

Aligning the compensation structure with the climate change risk-mitigation plans is another way to force the top management to take immediate actions on this imminent risk. The board can set long-term and short-term target of reducing GHG emissions per unit of revenue by a certain percentage from the base year. The bondholders can play an active role in the corporate’s risk management strategy concerning climate change by incorporating covenants related to climate risk in the bond contract. The covenants could be maintaining minimum climate change rating, maximum GHG emission per unit of debt, and restriction on acquisition of or investment in a GHG-intensive and polluting business, and avoiding climate litigation.

3. Engage with policymakers and regulators to design effective climate policies and regulations

There is enough evidence of corporates and investors playing an active designing public policy and regulation. The investors can engage with policymakers (Government) to design effective policy measures to mitigate climate change risk. The investors, particularly institutional investors, can urge the Securities regulator, Securities & Exchange Board of India (SEBI), to act upon disclosure of climate change risk and opportunities in financial reporting. It is noteworthy here that climate change is already recognized as a material risk. Besides, the investors can urge other financial regulators such as Pension Fund Regulatory and Development Authority (PFRDA), Insurance Regulatory and Development Authority (IRDA), and Reserve Bank of India (RBI) to incorporate climate change in their regulatory prescriptions to their respective regulated institutions. Forming a collaboration would be an ideal way to engage with the government and regulators to take these necessary actions.

4. Build knowledge and capacity in climate change finance and investment.

The investment management industry does not have the human resource capacity to correctly incorporate climate change in investment decision-making. The industry should encourage industry professionals to gain specific knowledge and expertise in climate change to assess climate change risk and unearth investment opportunities emanated from climate change. The industry can also create climate change specialists who can support the investment team members constructing climate-proof portfolios and changing portfolio allocation considering climate change. The specialists, equipped with a knowledge base in business and climate science technologies and policy knowledge and skillsets, can better assess climate change’s impact on financial assets.

The Indian investors must act quickly (for their own interests) on climate change – one of the complex and urgent challenges to humanity- to make the economy and financial system resilient against climate change.

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”