- April 14, 2020

- Posted by: Shivani Chopra, CFA

- Category:BLOG, Events

Speaker: Mr Navneet Munot, CFA,CIO – SBI Mutual Fund

Moderator: Mr Abhishek Loonker, CFA, Director – Ascent Capital

Contributed By: CA Nishit Vyas, Senior Analyst – Deutsche Bank

These are extra-ordinary times and to quote Lenin ‘There are decades when nothing happens and then there are days when decades happen’- these are those days. While we were thinking of conquering Moon and Mars, we didn’t realise that a small virus will jeopardize not only the financial markets but also humanity at large. In the last few days, billions of people have been locked down, approximately USD 15 trillion of wealth has evaporated from the stock markets in the last 1 month, oil saw its biggest ever single day fall, several EM’s are down 40%, credit markets are frozen, volatility has zoomed and even today, we do not know what lies ahead. In the last week alone, India lost approximately USD 12 bn of forex reserves, the largest weekly drop since the Global financial crises. Volatility was at historical lows just a few weeks back, but now volatility for most asset classes is at a multi/all-time high.

Is this a black / grey or a white swan event?

- Surely not a white swan event.A pandemic of such magnitude is unprecedented where 190 countries are impacted at the same time.

- The Olympics have been postponed (which were last cancelled in 1944 due to World War II).

- This is one of those unknown unknowns – we do not know that we do not know (ie: How long will this last, what is the cure, what is its financial impact, when will we return to normalcy).

- Post Ebola, many individuals including Bill Gates had warned about the risk from such health catastrophes, but we seem to have paid little attention to it.

- So going forward, a lot more attention needs to go to the healthcare sector

A research paper’s interesting finding:

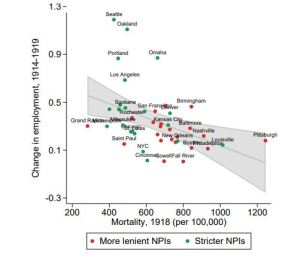

An interesting research paper published by SSRN shows an interesting phenomenon that happened during the 1918 Flu Pandemic in the US.

It said that cities which adopted a lockdown earlier and for longer not only had lower mortality but also grew faster in the medium term. However, it must be noted that today the economies are a lot more interdependent and interconnected, the stages of economic development may vary for countries and the world is much different than it was in 1918.

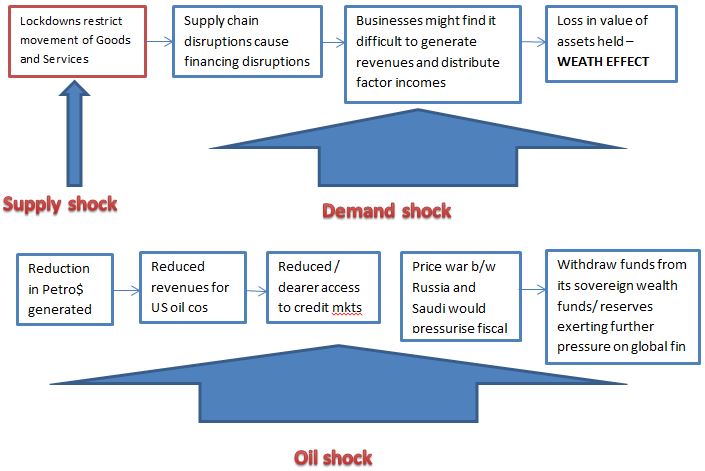

The supply, demand and oil shock

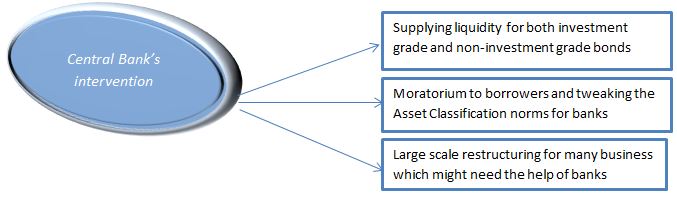

Central Banks have ensured “YogakshemamVahamyaham” ie: I shall ensure the safety and well-being of my devotees

- For the past few years the Central banks have helped address geo-political risks, credit risks, excess volatility and helped boost a slowing economy

- The central banks have lowered interest rates, sold put options and printed money to address the economic problems. As a result, it has encouraged risk seeking behavior and increasing leverage across markets

- Investments that are made on the basis of machine programs and algo-trading invest in these markets due to its apparent lower VAR (due to artificial lower volatility). The behavioral bias of herd mentality further accentuated this problem

- Now due to this crisis, the Central Banks are again following the template and cutting interest rates. The US Fed has thus far:

-

- Cut interest rates by 150 bps, now at near 0

- Bought back treasuries, corporate bonds, ABS, Cp’s, Money Market MF’s

We are all Keynesian’s now: The fiscal must step up

- The US is to provide a fiscal stimulus of nearly USD 2 Tn ie: ~10% of GDP

- Countries are giving wage subsidies, guaranteeing loans, giving tax waivers, making direct cash transfers and Universal basic income might finally be a reality for many countries

- The short term cost of a fiscal stimulus is near zero but in the long term, the costs might increase due to higher interest rate and inflation.

India and the way forward:

- Limited fiscal space but enough headroom for monetary stimulus

- Certain regulatory, judicial and administrative reforms should be implemented to help out certain sectors like real estate, telecom, auto and airlines. Eg: creating a crude oil reserve from our vast forex reserves (~USD 360 Bn), gold monetisation scheme etc.

- A 1 USD fall in crude leads to USD 1.30 Bn saving for the country but this figure is a bit mis-representative. The benefit gets spread across the government, corporates and the consumers. Lower crude also implies lower remittances from countries exporting crude (due to lower petrodollar proceeds)

- Looking at all of this, it seems India’s economic growth which was expected to rebound in the coming quarters, is now deferred (and we might have a U shaped recovery)

History doesn’t repeat itself:

- In 1942, Dow Jones actually bottomed out, before the World War got over (1945) and before the Hiroshima-Nagasaki attacks (1945).

- In the past 30 years, we have witnessed the coalition governments, Asian crisis (1997), Pokhran nuclear tests leading to sanctions(1998), the attacks of 9/11(2001), global financial crisis (2008) and the oil crash (2016)– but in this time period, Sensex has risen from 400 to 40000 and it is difficult to keep sanity in these times.

- In these times we need to be cognizant of the illusion of control bias (due to easy availability of information on internet), the loss aversion bias, the recency bias, the bandwagon effect and the confirmation bias.

Conclusion:

- These are extraordinarily challenging times but I have faith in human ingenuity

- A few centuries ago Mathus said that with the rate of population increase, the world will run out of food – but today, we produce more food than what the world can consume

- Since the crisis has engulfed the whole world, it is likely that a lot more investment will go in healthcare going forward in form of medications and vaccines

- The Marshal plan (post the WW 2 in 1948), and India’s LPG reforms (post the BoP crisis in 1991)are evidences that we have weathered such storms in the past and shall do the same again

- History says that the new sanitary/ sewage systems were built in London and Mumbai after plague hit these cities

- To all the friends at CFA Society, we may note that Isaac Newton developed calculus at home when Cambridge University was closed due to plague

List of recommended books to read wrt investing in these times:

- Manias, Panics and Crashes – A history of financial crises.

- Lords of Finance.

- Jared diamond guns germs and steel.

- The cost of capitalism.

- Fact-full-ness.

- Against the Gods: The Remarkable Story of Risk.

- The day the bubble burst.

- Ascent of money.

- This Time Is Different: Eight Centuries of Financial Folly

- When genius failed.

Webinar link: https://www.youtube.com/watch?v=R-AuzgL44PM