- February 1, 2021

- Posted by: CFA Society India

- Category:BLOG, Careers, Events

Speaker: Rajendra Kalur, CFA, Founder of TrustPlutus Wealth Managers (India) Private Limited and TrustPlutus Family Office & Investment Advisers (India) Private Limited

Moderator: Shreenivas Kunte, CFA, CIPM, Director, Professional Learning and Advocacy, CFA Institute

Contributed by: Monika Duggal, CFA, Member, Public Awareness Committee, CFA Society India

The wealth management industry in India is at a tipping point. The twin drivers of financialization and formalisation are providing enough tail winds for it to grow by leaps and bounds. What is even more encouraging is the growing demand for competent manpower in this space.

FACTORS CAUSING DISRUPTIONS IN WEALTH MANAGEMENT (WM)

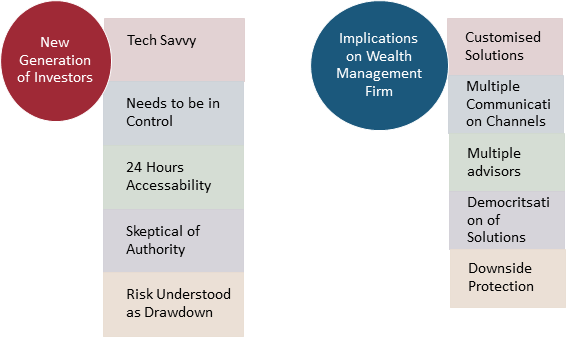

The WM industry is in the midst of significant change: a new generation of investors, whose expectations and preferences have been shaped by new technologies and by their living through the last financial crisis, have brought new standards to the industry in terms of how advice and investment products are being delivered.

There are 10 disruptive trends in Wealth Management as noted by Deloittes, 2015:

Challenges in case of New Generation Investor and its Implications on Wealth Management Industry

RISE OF MACHINES: COMPLEXITY OF ADVICE

The range of solutions required by client is getting diverse as well as increasingly complex. Machine can provide simplistic solutions and distribution platforms efficiently and effectively, but at time of complex requirement of advice and explanation of solutions to the client intervention of Human interface.

Pure play Management firms are ridging their Business models and starting introducing human advisors. As there is upward movement in Value chain and increase in affluent investors more personal touch and hence pure play machine models are giving way to Human interface.

Hence more financial professionals are required in wealth management industry to deal with client biases, emotional behavior for regeneration of right alpha.

USE OF TECHNOLOGY IN WEALTH MANAGEMENT- BIG DATA AND ADVANCED ANALYTICS (ARTIFICIAL INTELLIEGENCE)

1). Client Advice including Identifying the right relationship manager based on the social, emotional, risk appetite and psychometric fit of the client.

2). Client Acquisition

3). Client Sales

4). Biz Performance Management

ANSWER TO THE QUESTION “WHAT THE WEALTH MANAGEMENT FIRM IS LEADING TO?”

The role of relationship manager for client retention is moving to holistic Goal Based Solutions.

Relationship manager is required to

1). Move from Products to solutions – Clients are aware of the products in the market, relationship manager needs to understand the needs and goals of clients and provide solutions.

2). Identifying the Client Goals – The RM can achieve this goal by engaging deep conversation with clients, for which softer skills are extremely required in wealth management industry.

3). Moving from Financial planning to life planning – Big opportunity or challenge for wealth manager is to understand social ability, understand emotions and control the clients behaviour apart from financial ability of client.

4). From Volatility as Risk to Draw Downs – Since there are large movements in the market, the price of securities may drop down to 40% – 50% which can have huge impact on the portfolio, especially if the portfolio is leveraged. So, it is crucial to earn return on the wealth of the client after giving protection to the client.

Due to uniqueness of wealth management industry the human interface is critical, hence the manager is required to be knowledgeable about the subject as well as need to have good command on soft skills, to seek out the required information from the client to plan his portfolio for achieving his goals.

DEMOCRATIZATION OF INVESTMENT SPLUTIONS

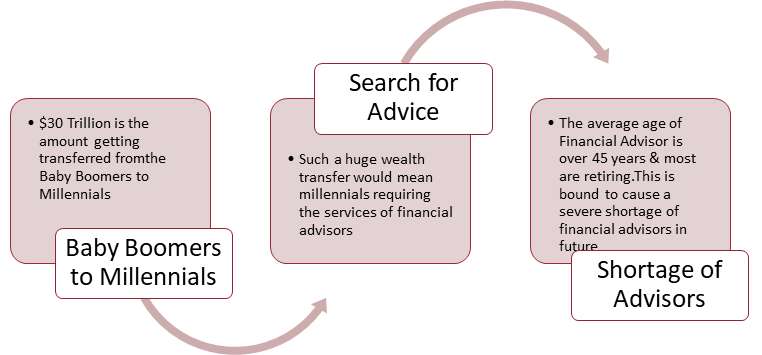

CHALLENGES OF WEALTH TRANSFER – HUGE ADVICE GAP

Source: WWR, Cap Gemini, 2016

This is the study of ageing countries like USA, Europe and Japan

- In India, the beginners in wealth space there are first generation millennial looking for the right financial advisors and hence big opportunity for CFA Charterholders and CFP’s.

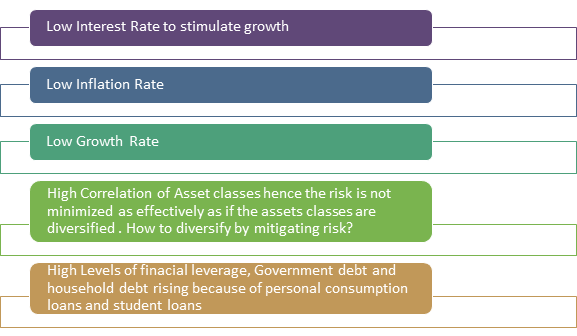

Macro Environment Report – Understanding the challenges of macroeconomic environment after 2008 crisis to optimise the returns is crucial. The various components are:

INCREASED REGULATORY & COMPLIANCES COSTS – The firm has to be equipped with strong and robust compliance which in turn ensures the sustainability, healthy competition in industry, build investor confidence, better consumer protection and mitigation of conflict of interest

NEW BUSINESS MODELS & INTENSITY OF COMPETITION

Key competitive trends include:

- Convergence of brokerage and private banking models to serve affluent clients with a broad range of advisory, investment, banking and lending capabilities.

- Large, diversified banks emphasize cross-selling of wealth and banking services to their client base and continue to coordinate their various WM business models and brands, treating them as distinct channels rather than distinct businesses, further blurring distinctions between WM businesses.

- Continued fragmentation of financial advisory with Independent Registered Investment Advisors (RIAs) continuing to gain market share.

- Established asset managers have entered the retail arena, competing directly with entrenched discount brokerage providers.

- Competition for mass affluent clients has increased with banks and discount brokerage firms targeting this segment. Robo advice capabilities will likely enable the distribution arms of insurance companies and asset managers to provide advice to the same clients and increasingly compete with other WM firms.

- Digitally enabled start-ups are capitalizing on a high rate of innovation in the industry.

WEALTH MANAGEMTN INDUSTRY OUTLOOK IN INDIA

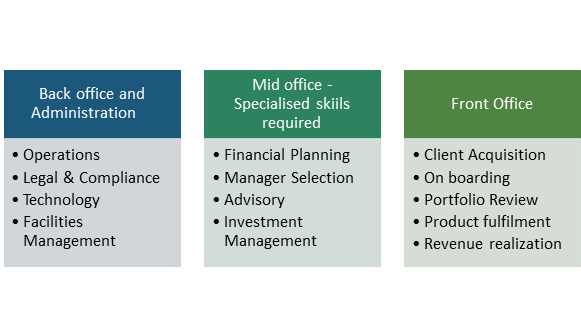

CAREERS IN WEALTH MANAGEMENT – ROLES, SKILLS, QUALIFICATIONS AND DELIVERY

Wealth management value chain consists of three distinct parts:

There is a lot of change in model of evolution of advice in wealth management industry. Investors in old days used to go to stock broker, there was no regulation and no investor protection. With span of time the investor moved to insurance key man or independent financial advisor where the main focus was to offer products based on commission or products pushed during bubbles not the beneficial interest of investor. Currently the intelligent investor and evolution of financial market, regulations and technology, the investor looks for professional financial planner. To protect the interest of the investors, there are SEBI Regulations for Investor Advice, 2013.

HOW DOES THE ADVISOR ADDS VALUE TO THE PLAN

As per the “THE EVOLUTION OF EVIDENCE BASED PLANNING: SAM INSTONE,” the major role (70%) of advisor is to ensure the client sticks to the plan, executing and effective monitoring of the plan to achieve the goal.

Other roles of advisor are:

Creating a Plan & making it relevant 20%

Taxation & Compliance 9%

Fund Selection & Rebalancing-1%

Market Predictions 0%

Hence the role of wealth management is to have a strategic approach rather than tactical approach for effective performance of duties.

Hence the scope of services in wealth management industry is as follows:

1). Financial Planning, Estate Planning, Taxation

2). Manager Selection

3). Product Due diligence

4). Investment Advisory

5). Portfolio Review & Tracking

6). Client Acquisition & Relationship Management

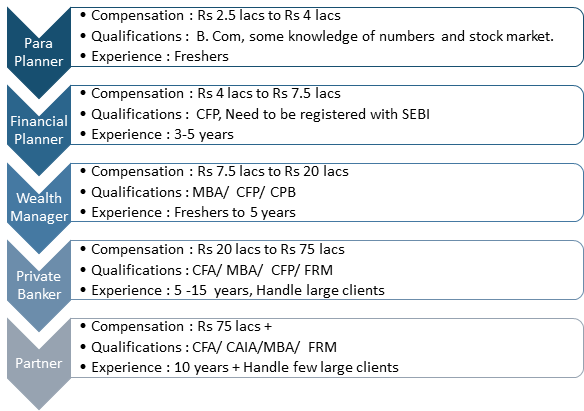

ROLE, QUALIFICATIONS AND COMPENSATION – FROM BOTTOM TO TOP

Recently there is a splurge in requirement of professionals who are competent and have great understanding of client requirement. CFA Level 1 or Level 2 candidates with good taxation knowledge can start as Financial Planner by either registering their own firm or join advisory firms/ Banks.

Link to webinar: https://www.cfainstitute.org/en/research/multimedia/2019/career-insights-wealth- management-industry