- November 24, 2014

- Posted by:

- Category:BLOG, Book Reviews, Mumbai, Speaker Events

No Comments

Contributed by: Ishwar Chidambaram, CFA

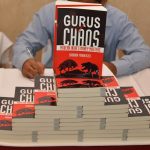

IAIP organized a book launch event in Mumbai on Friday, November 22; wherein the author & speaker Saurabh Mukherjea, CFA, shared his experience as well as key themes in his book “Gurus of Chaos: Modern India’s Money Masters”. Following are the highlights:

- Indian Economy: India is currently a $2 Trillion economy, with annual capital flows (including savings) of $650 Billion. Nearly $450 Billion of this amount flows into Gold and Real Estate, which are non-productive investments. India’s share of global FII flows is only 0.5%, which is rather low. India has the highest Cost of Capital in the world (outside of sub-Saharan Africa), which is in the range of 15% to 18%. This has historically been a deterrent to free flow of capital.

- Indian Funds: The largest equity fund in India has an AUM of only $9 Billion, which is extremely small by global standards. Around $15 Billion flows into the Indian stock markets annually.

- Clarity of Thought: All leading fund managers cultivated independence of thought. They retained their sanity and eschewed greed and fear. He cited the example of Maruti Suzuki, from which a leading FII investor profited by going long in August 2007, at the height of panic driven selling on the counter.

- Cognitive Biases: As per Daniel Kahneman, the human brain operates in two modes: (1) System 1 which is impulsive and instinctive, responsible for Fight or Flight, Greed and Fear, etc. (2) System 2 which is more evolved and composed. Fund managers need to consciously ignore the Reflex brain and actively harness the Reflective brain to maintain their calmness, sanity and clarity of judgment at all times.

- Top Sectors: Aspirational consumption will fuel India’s growth story. The Home Improvement sectors, covering Paint, Cement, Plywood, Electricals, Tiles, etc. will benefit the most from this growth. More than 120 Million Indian households have no roofs. Even if only 2% of these get access to roofs, one can expect at least 25% growth for these sectors. Similar situation exists for other basic amenities like power, water, sanitation, etc. Removal of infrastructural bottlenecks will be a key pivot point for India’s transition into the ranks of the developed nations.

- Prospective Bubbles: The next bubble is likely to from the Manufactured Goods Export sector. This is a largely knowledge intensive sector, which is India’s strength. This sector has benefited from the Indian Rupee (INR) depreciating nearly 80% against Chinese currency (CNY) over the past 8 years. Valuations of firms in this sector are expected to go through the roof, leading to a bubble in stock prices.

- Tangible qualities for becoming a successful fund manager: Right at the start, it is important to find either a Guru/Mentor or a Firm, preferably both. The author’s mentor was John Kay, while the legendary fund manager Sanjoy Bhattacharyya had Pradeep Shah as his guru. The formative years of one’s career (from age 22 to 30 years) and the firm’s environment are critical. It is important to maintain a “long-term greedy” attitude to succeed.

- Research Methodology: The author uses a wide range of publicly available resources to source information on companies. These include the firm’s customers, competitors, suppliers, head hunters, recruiters etc. For e.g., he turned bearish on Infosys in January 2007, long before everyone else, based on reports from head hunters in NY and London that Infosys was being out-recruited by TCS, HCL Tech and Cognizant.

- Promoter Holdings: India is the least liquid market among the world’s top 15 economies. Many listed MNC firms will delist if they are asked to reduce promoter holding. This will have an impact on sentiment. Buying of shares by the promoters is a significant leading indicator of stock outperformance over the short term.

- Global Markets: China will devalue its currency to boost its slowing economy and regain export competitiveness. The exact price impact of such a move on commodity markets is still unclear. If commodity prices rise, it will be negative for commodity importers like India, while a fall in commodity prices will be bullish. Any Chinese devaluation will be followed with similar actions by developed markets like Europe and US, triggering a global currency war in the effort to stay competitive.

- Humility: Clarity of thought can only come from humility. Humility is the most essential quality which is positively correlated with successful investing. It is common to all the great fund managers. It has two consequences: It leads to more conservatism and higher risk aversion, which are most vital for successful investors. Secondly, it acts as a spur for greater efforts and thoroughness in research. As per the author, the “sweetest irony” is that the super achievers are the most humble and nicest human beings.

– IC