- March 8, 2022

- Posted by: CFA Society India

- Category:BLOG, Events

Speaker: Lauren C. Templeton, Founder & President, Templeton and Phillips Capital Management, LLC

Moderator: Sunil Singhania, CFA, Founder, Abakkus Asset Management, LLP

Contributed By: Shruti Agarwal, Mutual Fund Analyst, Value Research

“Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.” An investment manager and niece of the great Sir John Templeton, Lauren started the session by sharing some of her uncle’s quotes with whom she has spent majority of her career, studying his investment philosophy. John Templeton pioneered global investing, but his practice of bargain hunting and contrarian methods propelled his excess returns. In this session, Lauren Templeton shared the timeless principles that guided decades of market-beating returns and the investing philosophy at her firm Templeton and Phillips Capital Management, LLC.

Investment Process

Lauren highlighted the three key aspects of how investing the Templeton way look like:

- Focus on value: This is based on Sir John’s approach towards bargain hunting, which is led by quantitative reasoning. If a statistical bargain is uncovered, it is followed by valuation and fundamental analysis to measure the intrinsic value of the firm. And then a comparison is carried out between their estimated value and the market’s estimate seen through the share price.

- Contrarian views are rational outcomes: Lauren pointed out that their most successful investments over her entire career were the result of buying companies that were temporarily out of favor or when the entire stock market was out of favour. The only way a stock can become a bargain is due to a lack of buyers. Though it sounds common sense but it’s hard sometimes to apply that common sense.

- Trouble is opportunity: Lauren keeps a sign at her desk that reads ‘Trouble is Opportunity’ which she says is their mantra. The best bargains appear during periods of market duress and pessimism. The golden opportunity is when the entire market goes on sell. And during these times, even high-quality growth firms can be purchased at a bargain.

Speaking of the much-debated topic in today’s context – Growth vs Value investing, Lauren shed some words of wisdom. She said, “We’ve heard a lot over the years that value is dead, you need to invest in growth, value is outdated, value is constantly underperforming growth. And I would argue it depends. I mean, are we talking about a low PE strategy? Are we talking about buying companies that have a high free cash flow yield? There are a variety of metrics you can look at to determine value.”

She also pointed out that Sir John constantly adapted the metrics he used in the stock market and also shared one of his quotes to articulate this point – “Never adopt permanently any type of asset or selection method. Try to stay flexible, open minded and skeptical. Long-term top results are achieved only by changing from popular to unpopular, the types of securities you favor and your method of selection.”

Stock selection

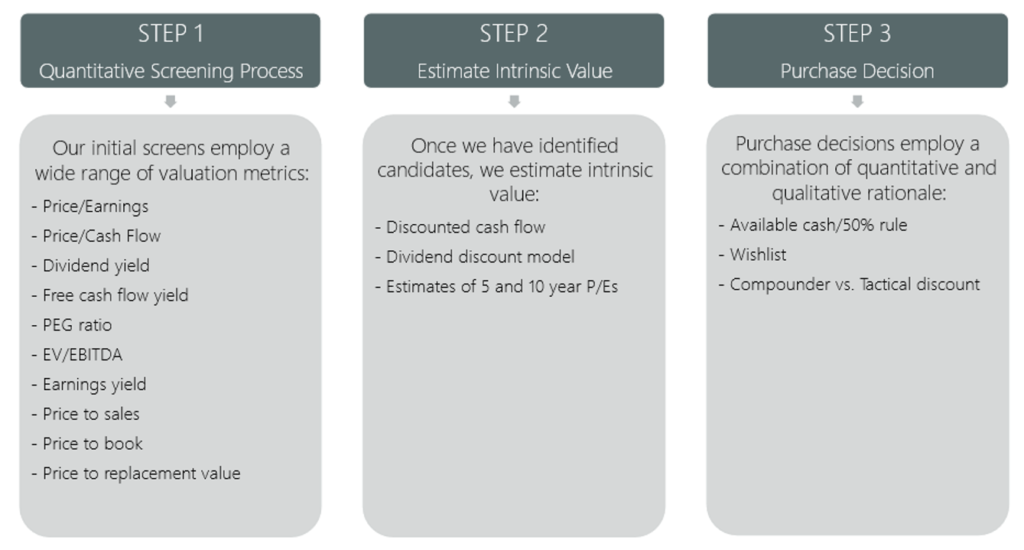

Lauren then talked about the three key steps that are followed at her firm for stock selection. Securities are first ranked based on some valuation metrics. The ones that run past this quantitative screening process are then subjected to additional analysis. And then lastly, it is followed up with some fundamental analysis, perhaps some discussions with the company’s competitors, understanding the industry landscape a little more etc. So, the purchase decision is a combination of quantitative and qualitative rationale.

Explaining the available cash/50% rule as a part of the purchase decision process, Lauren said “The best time to sell a security is when you find something that is 50% better. So, do you have any available cash in the portfolio? Can you find something that is a better bargain?”

“And we also maintain a wish list of securities in our office”, Lauren added. Wishlist securities are quality businesses that are not attractively priced. “We have two different types of securities in our portfolio – compounders versus tactical discounts.” A compounder is going to stay in the portfolio for a long time. These are quality businesses that typically have been picked up during moments of maximum pessimism, they do not go on sale very often. On the other hand, a tactical discount is something that is going to close quite quickly. For instance, investments in Mexican airport operators post the swine flu crisis.

Alpha generation

As per Lauren, there are three sources of Alpha – Better Information, Better Process and Better Behaviour. The first is very difficult to apply post regulation, full disclosure, and can be illegal. “That’s not really the area that we plan, although we like to have quality information.”, remarked Lauren. Quant managers fall into the second category where they try to build a bit better and faster algorithm to game the market. But the most simple and consistent way among all is to have better behavior. “Our company plays in this space; we think that we’ve trained ourselves to have better behavior. And value investing is very compatible with that.”

Average equity investor earns less returns than an index

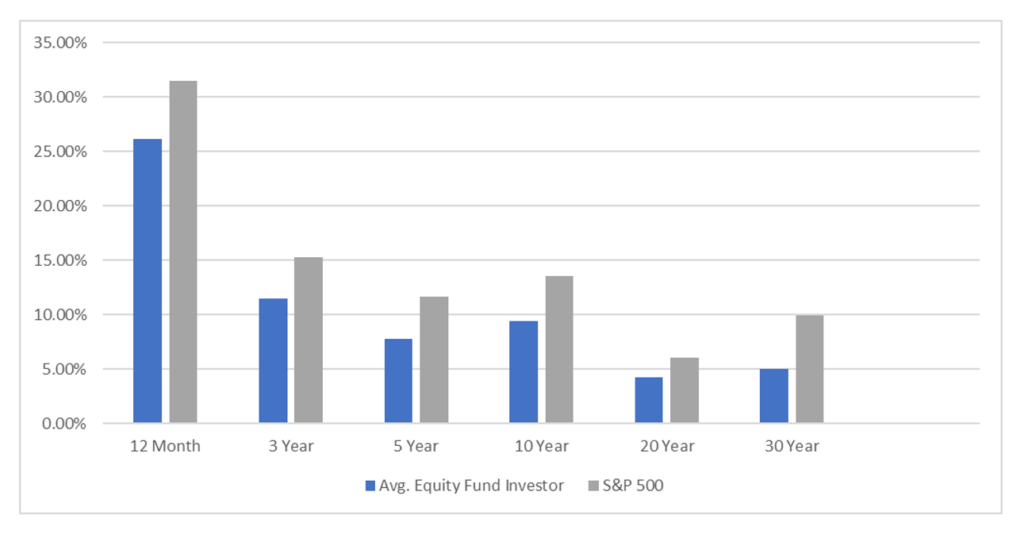

Talking about the irrational behaviour of equity investors, Lauren explained how humans are not perfectly rational wealth maximizers. This is contrary to a term used in academics called ‘Homo Economicus’ which is used to describe man as a perfectly rational wealth maximizer. She shared a chart from DALBAR showing the average equity fund investor vs S&P 500 index.

Be it in the short term or the long term, the average equity fund investor underperforms index. There are similar studies showing data of investors versus other asset classes. In conclusion, an average investor underperforms all asset classes across all time periods. This is possible because people buy when the market is high in value and sell when market is down. As an investor one can hire the best manager in the world but if you can’t control your own behavior, you may not have good returns.

“Market evidence suggests we spend one-third of our life in a bear market. So, you should prepare for them in advance, these are your golden opportunities to compound capital at a higher rate of return than the next guy. And it’s all about your perspective. Research shows that stock prices are 14 times more volatile than their underlying fundamentals.”, said Lauren.

Implications for investors in a post Covid world

Addressing investors’ concerns about the current market scenario, Lauren said she finds this market very analogous to the ‘.com bubble’ of the late 90s. But she thinks this time the scenario is even worse. With monetary and fiscal stimulus there is an incredible amount of leverage in the system. But she also remarked that one should not be afraid of the markets. There’s not any way to time the markets and markets can often stay irrational for a lot longer than the average person expects.

She further added that it’s a bifurcated market, both in the US and India. “Not all securities have participated equally in the rebound off the lows from the pandemic.” Also, it is not a wise investment decision to buy stocks at absurd valuations. Lauren shared an extract from the interview of Scott McNealy, co-founder of Sun Microsystems, who gave an interview to Bloomberg magazine in 2002, reflecting on his company’s valuation in the .com bubble –

“At 10 times revenue, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes I have zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is illegal. And that assumes with zero research and development for the next 10 years, I can maintain the current revenue run rate. Now having done that, would any of you like to buy my stock at 10 times revenue? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?”

So, one needs to be really selective right now. Valuation always matters. It always matters what you pay for an asset. To further emphasize the importance of valuation, Lauren took example of Microsoft. She said Microsoft has truly been a .com success story coming out of the late 1990s, revolutionising technology. It came decades back but has still maintained its desktop software prowess ever since with a formidable 77% market share. “However, despite its fundamental success, you should note that investors that bought shares of Microsoft at the height of the .com, bubble in 1999 had to wait 17 years for a return. And in hindsight, it’s pretty easy to see that back in 1998, Microsoft’s price to sales ratio of 21.9 times and its PE of 61 times had already accounted for almost two decades of success that would follow.”

In her closing remarks Lauren also asked investors to stay away from reacting. “So many investors these days are watching the financial media, they’re reading, they’re reacting. If you’re reacting as an investor, that is not a healthy place to be. That’s not a rational state of mind. Read the information, think about it, absorb it, but don’t react as an investor.”